10/11 Recap

PPI came in very hot today at 2.7%, well above estimates. Tomorrow we have CPI but the bottom line is, inflation is not under control, and all we’ve have heard recently about how it is dead is just not true. This is going to cause rates to stay elevated for longer than anticipated which is not optimal for the bulk of market participants and companies. Tomorrow we also should have consumer data from Amazon as well regarding their 2 day Prime Day event that wraps up tonight. So expect some more very volatile moves tomorrow after this plethora of data gets dropped.

The SPY took a breather today but is still comfortably over the 8 and 21 ema. Other than big tech, the rest of the market didn’t do much. Google and Meta led the way again as the XLC names continue to carry the torch for now. All the megacaps but Tesla were green today even as the /ES struggled.

Oil was hit but rebounded off lows back over $84/barrel. This is still a substantial move lower down over 10% in the last 10 sessions.

Treasuries also have pulled back with the TNX down nearly 10% in 4 sessions from 48.87 to just below 46 which has fueled this little run we’ve seen in equities. A continued move lower here looks like likely with breaking below the 8 ema and momentum flipping negative. We will have to see how CPI comes in tomorrow.

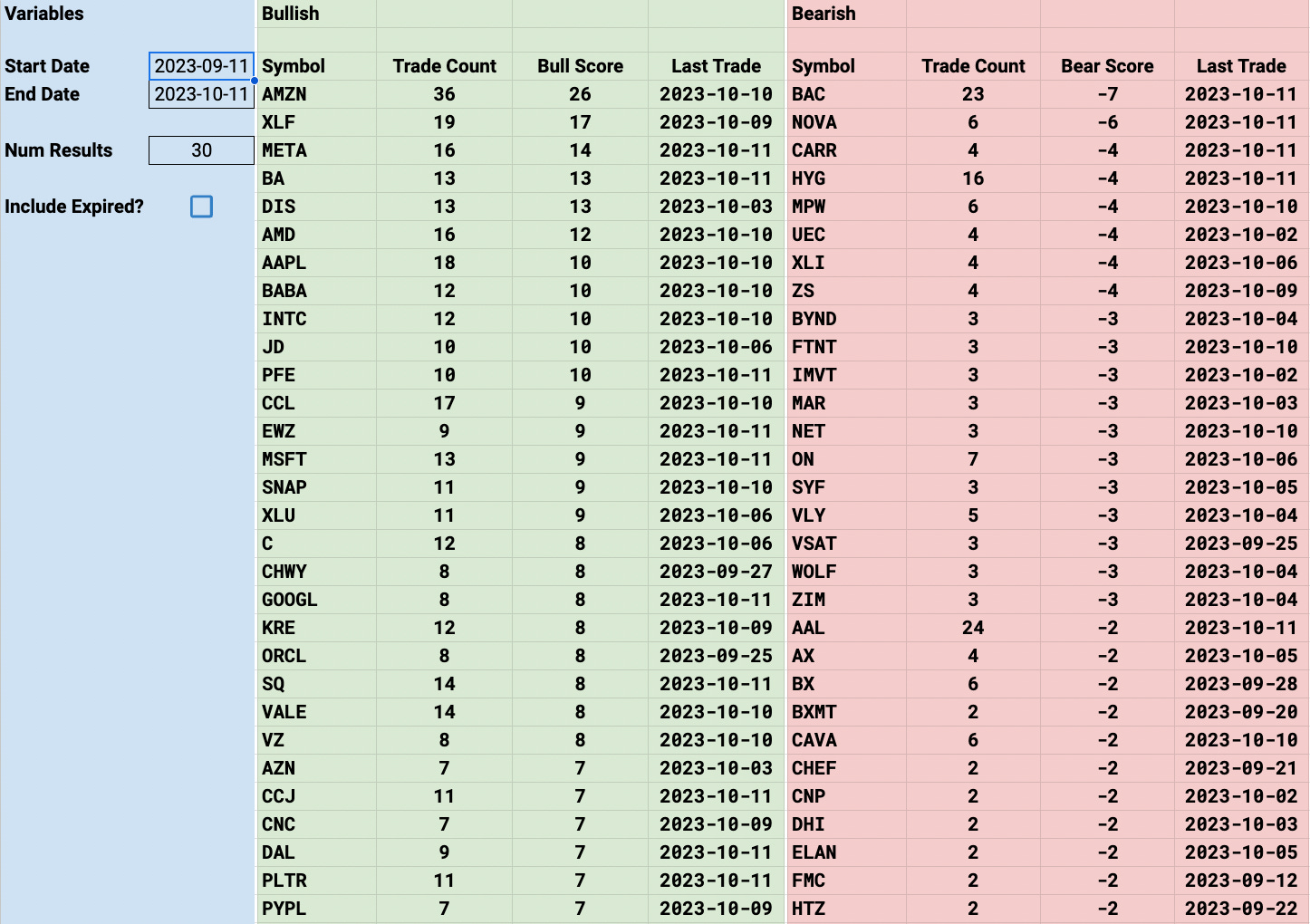

Trends

BA has been very strong this week and it nearly touched $200 this morning, its been the top trend this week. FTNT is near the top of the bearish trends this week and its down another 2.5% today. There were weekly put buys on it each of the past 2 sessions and 3 in 4 days that have paid off nicely today with the move to 57.20 now. As I always tell you pay extra attention to any short term call/put buying you see in these recaps, they seemingly workout at a higher clip.

1 Week

2 Week

1 Month

Today’s Unusual Options Flow