10/12 Recap

CPI came in hotter than expected and we got all the same macro panic we’ve had for months now. I’m still in the camp the 2% target of the fed is not achievable, they’re in panic knowing that they have to raise their target, but won’t do it yet because of the dire consequences to the bond market if they do. Breadth was pretty terrible so far with nothing but big tech doing much. This is what I’ve been alluding to for a while now. With rates where they are, the reality is most companies in our market are just mediocre. There isn’t much to say. The defensive names in the XLP have all been smashed, the utilities in the XLU have been crushed, healthcare names have been crushed. At the end of the day equities are all correlated to yields. Yields go up, valuations go down. It’s pretty simple, but under the hood, as yields go up, most companies in our market are just not displaying growth worthy of investment relative to what risk free assets are paying. That is part of my thesis on why I think the market and most equities do nothing for a long time. Very few companies are actually growing revenues and earnings nicely outside of megacap tech ex Apple.

The SPY is still below the 50 and 100 day above, but over the 8 ema which in the short term is a bullish trend. Things look ok now, all the inflation datapoints are out, inflation is bad, and yet nothing horrible has happened. We just rolled over hard after the bond auction that just occurred in the last 15 minutes. Moreover, tomorrow we have all the big financials reporting. Let’s wait and see what warnings they give and what provisions they set aside for losses. Make no mistake about it, this market is terrible right now, breadth is horrid and a handful of companies are pretty much carrying the whole thing.

With that out of the way, we got some great news regarding the consumer today which has been a constant point of potential fear amongst analysts as Amazon said they had a record Q4 Prime Day event. I think what we’re seeing is a bit of a divergence forming where the middle class and up consumers are doing well and the consumers below that are not. All those fears about student loan repayments starting, maxed out credit cards, etc all turned out to be a giant nothing because as usual the main consumers in our economy, are doing ok for the most part. On the otherhand almost every retailer focusing on the consumers below that threshold is seeing a pullback of sorts and Amazon just continues chugging along as it’s never really been the place for the lowest prices, but more of a place for convenience and speed. Speaking of speed, they mentioned this in their note today,

that is just remarkable and those last mile logistics that they can offer at scale and nobody else can are what will lead to domination of other industries like Pharmacy in the near future along with continued share gains in the retail business of which they’re still a mere 3% of global retail sales believe it or not.

Trends

1 Week

2 Week

1 Month

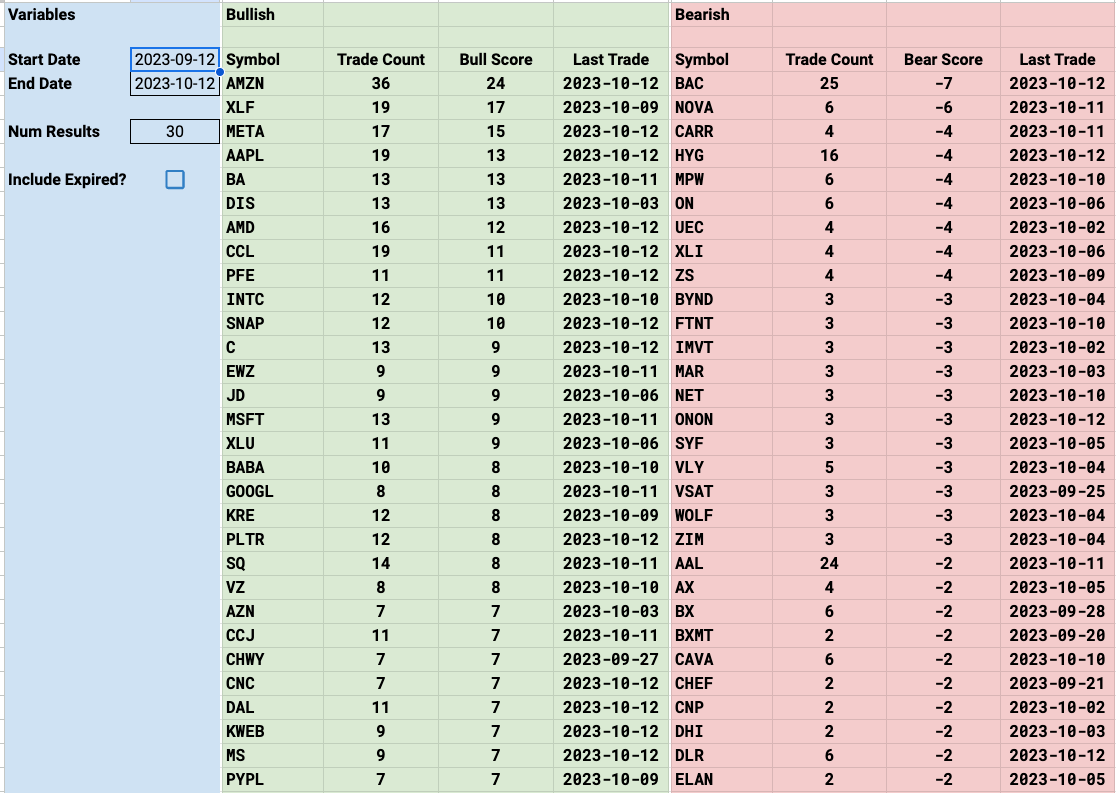

Today’s Unusual Options Activity