10/13 Recap

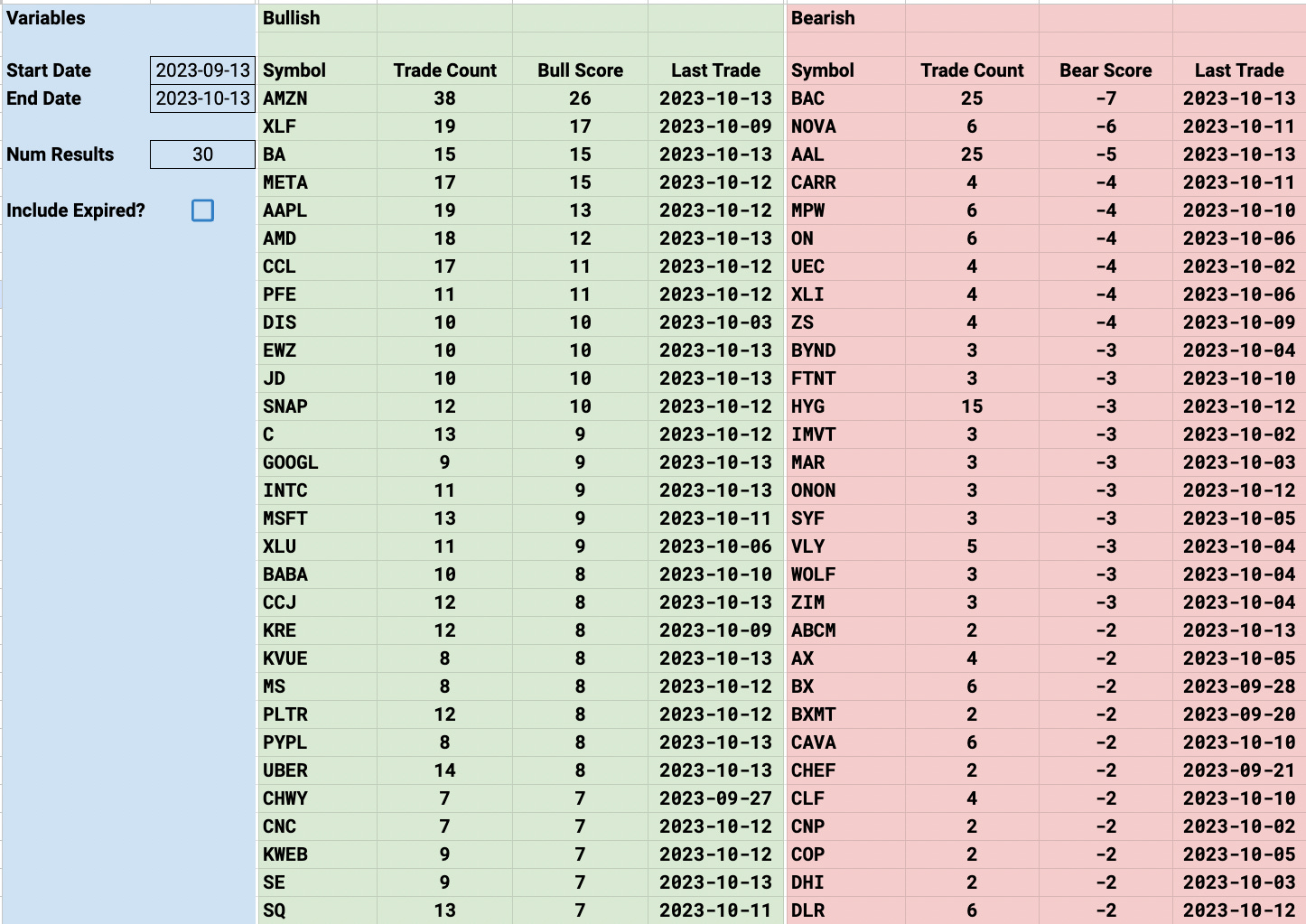

We had some chaotic moves today with the VIX spiking nearly 20% as panic set in before the weekend. We have Israel potentially having a ground invasion tonight/tomorrow and who knows what that escalates to. We also have the new sanctions placed on Russian oil today sending oil up significantly. Then consumer sentiment numbers came in well below estimates. Every potential negative catalyst you can think of is right there for the bears to enjoy and those all come after a hot CPI and PPI print this week. There isn’t much to say other than there are worries galore and the only way these worries will calm is in the next 2-3 weeks as companies report and give guidance based on what they’re seeing. As for banks they all reported today and there were no issues. Most had provisions for losses far lower than estimates and most were green which was the flows I had highlight with the XLF leading the past few weeks except for BAC which had seen a ton of put buys and that actually was red too. So all in all pretty much what the data had been telling us leading into today.

A bigger concern for me is the weekly chart of the SPY is about to see an 8/21 bear cross if/when that 8 week ema crosses down through the 21 week. You can the blue line(8 ema) and the light blue line(21 ema) below. If we don’t get moving higher and quickly, that likely happens very soon and would likely be a period of prolonged weakness in the overall market. We have not seen a weekly 8/21 cross in a long time.

Trends

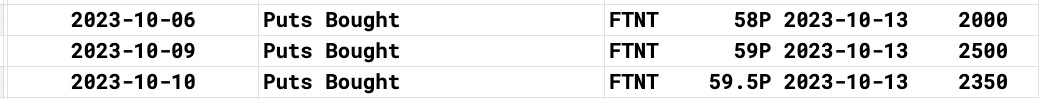

The biggest takeaway here was all those FTNT weekly puts I mentioned a few days back and it still is one of the top trending bearish positions this week

This morning I know you’ll be shocked to hear it but a big bank downgraded FTNT and it went as low at 56.07 and all those bearish trades they had accumulated played out perfectly even moreso than they already had so far this week.

1 Week

2 Week

1 Month

Today’s Unusual Options Flow