10/13/25 Recap

The SPY is gapping up because Trump did exactly what I joked about in friday’s recap, he posted on Truth Social yesterday that frieday was a misunderstanding. Whether it was or wasn’t, we will see by November 1st but my guess is nothing gets done and we extend the deadline again, it has been 6 months and he has not been able to secure a China trade deal and I’m skeptical he will with 2 more weeks. The reality is Donald shoots from the hip but when equities are negatively impacted he reverses course quickly and has done so multiple times this year. He has to, he has built his entire identity on stock market = economy and if he reverses course the media will eat him alive. So on that alone, the coast is clear as he will do all he can to ensure the market is ok, but right now we are below the 21 ema, which is usually a no go zone for me. You can see we ran straight into it and stalled, my guess is we have a period of weakness here, probably a couple weeks into that November 1 deadline and then when he pivots and extends the deadline we gap back over the 21 ema and resume higher. That’s just my guess, we could of course cascade lower and it wouldn’t shock me as moves down begin below the 21 ema so as I said friday, this is where you take chips off if you are concerned about the short term. Long term I’m concerned about nothing into year end as I do think we still go higher into year end.

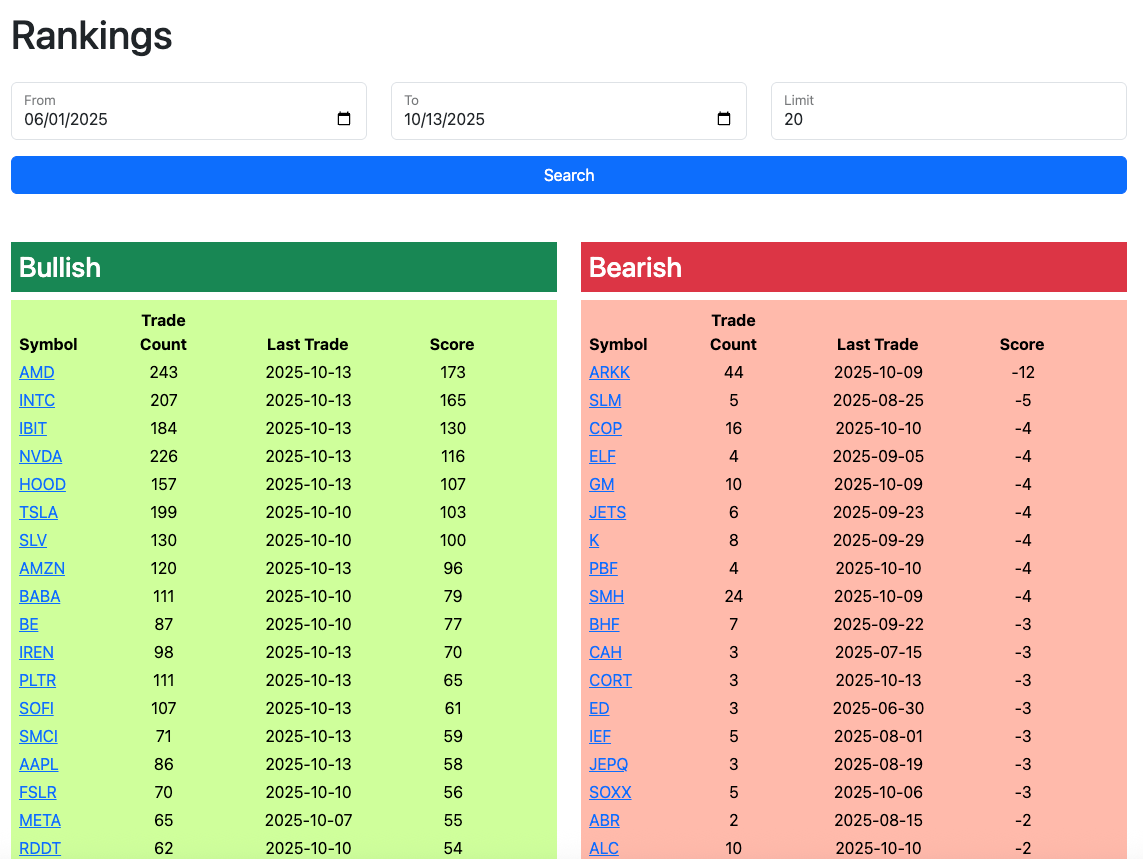

I wanted to answer a question about the database I get often, I guess I don’t do a good job explaining things in my welcome email so let me explain the rankings in the database. I have a net score system here that is bullish trades - bearish trades ie calls buys + put sales minus put buys. That ranking system can be viewed on whatever timeframe you want, the below is from June 1. It’s hard to argue looking back to June 1 that the top ranking names have not all been top performers from AMD,INTC,NVDA,HOOD,TSLA,SLV,BABA,BE,IREN,SOFI the list goes on and on. Why is that? Well institutions are the ones mostly placing these huge trades with a few rich guys at home also buying huge lots, but whatever it is, when people are making big directional bets repeatedly, it is likely that name is near a material move higher most of the time and that is the whole purpose of the database. So alot of you tell me you can’t use options or you don’t want to and the reality is just play with the top trending names, take them long, sell covered calls, whatever you’re going to be in the right names I promise if you play the top 10-15 of these you will do very well. So hopefully that cleared up any questions you have about the database and I will work on a better FAQ.

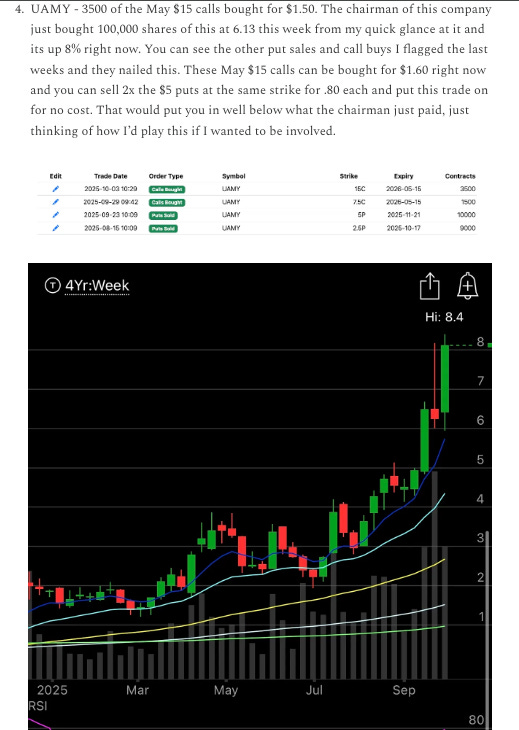

Speaking of the database, I know alot of you only stick to the well known names and that’s fine but I don’t think you realize how much alpha is in some of these names you don’t know. In the 10/3 recap just 10 days ago I highlighted this UAMY below because of a weird call buy, it was $8.40 then, it’s up 27% today alone to nearly 15 up just under 100% in 10 days. It’s crazy to most to be involved in names they don’t know about, but sometimes the flow is so egregious that you have to play it in some way. Just remember why you’re here I’m not here to give you deep dives on fundamentals, I’m here to point you into what I think are the oddest trades in the market, trades like UAMY were never going to be found using fundamentals. Just allocate a small percentage of your trading book to stuff like this when you see it.

My Open Book

Trades I Made Today