10/14 Recap. Reality Is Slowly Setting In.

This market is relentless, Thursday you have the bulls pounding their chest on a bottom being in only to be followed up with a rugpull on Friday. You have to stay nimble here, buy and hold is just not going to work for some time. You’re going to have to utilize selling premium around your positions if you’re going to have any prayer of outperforming in this environment. Slowly but surely though it appears we are heading towards a lower multiple and for longer. While I don’t think a 5% FFR will sustain for an extended period of time, the reality is that if we are going there, and right now the market is pricing that, for a short period of time we will have to trade lower. As it stands now, the market is trading a hair under 15x the 235 estimate here at close to 3600. As I stated previously 13x was where we were the last time we saw a 3.75% FFR. So at a minimum, assuming 235 is the number, 3055 is where we would be. Still a long ways down.

Let’s take a look at a few charts before I get into the unusual options activity.

On the daily, the SPY rejected the next key level up and closed below the 8 and 10 EMA thus nullifying that tiny peek above it made the day before. It just trapped some bulls, that is all, all the moving averages are still sloping downwards and there is nothing to see here.

On a weekly timeframe we closed below not only the 200 DMA but the 200 EMA as well, and again, all the moving averages are sloping south, this is just a severely broken chart that will not jut fix itself quickly. The red line on the bottom is pre covid highs and it looks like we are heading there, quickly.

As we look at the dollar, it had another strong week, but still has not approached the highs from 2 weeks ago, this is a very strong chart that we need to breakdown if you want equities to see a turnaround. Maybe it rejects the top of that channel again soon and we get that, but for now this remains a wrecking ball.

The QQQ looks worse than the SPY, it is well below everything, and last week’s gravestone candle was telling you that there was just no buyers interested at the the moment as they rejected higher prices.

Lastly we have ARKK completely breaking down on a weekly chart, down 80% from highs and the only reason I mention ARKK is because it is a barometer of small cap growth stocks. I don’t have any of these, but for those that do, you always hav to watch ARKK and as you can see below, new low, that isn’t good for those.

With all that out of the way, I have some good news for you. I don’t really care about all that stuff in terms of earnings and where the SPX is headed, I’m just here to follow trends, follow option flows, and just focus on making money week to week. There’s always pockets of strength and my hope is to find them using the data flow. So let’s take a look at all that.

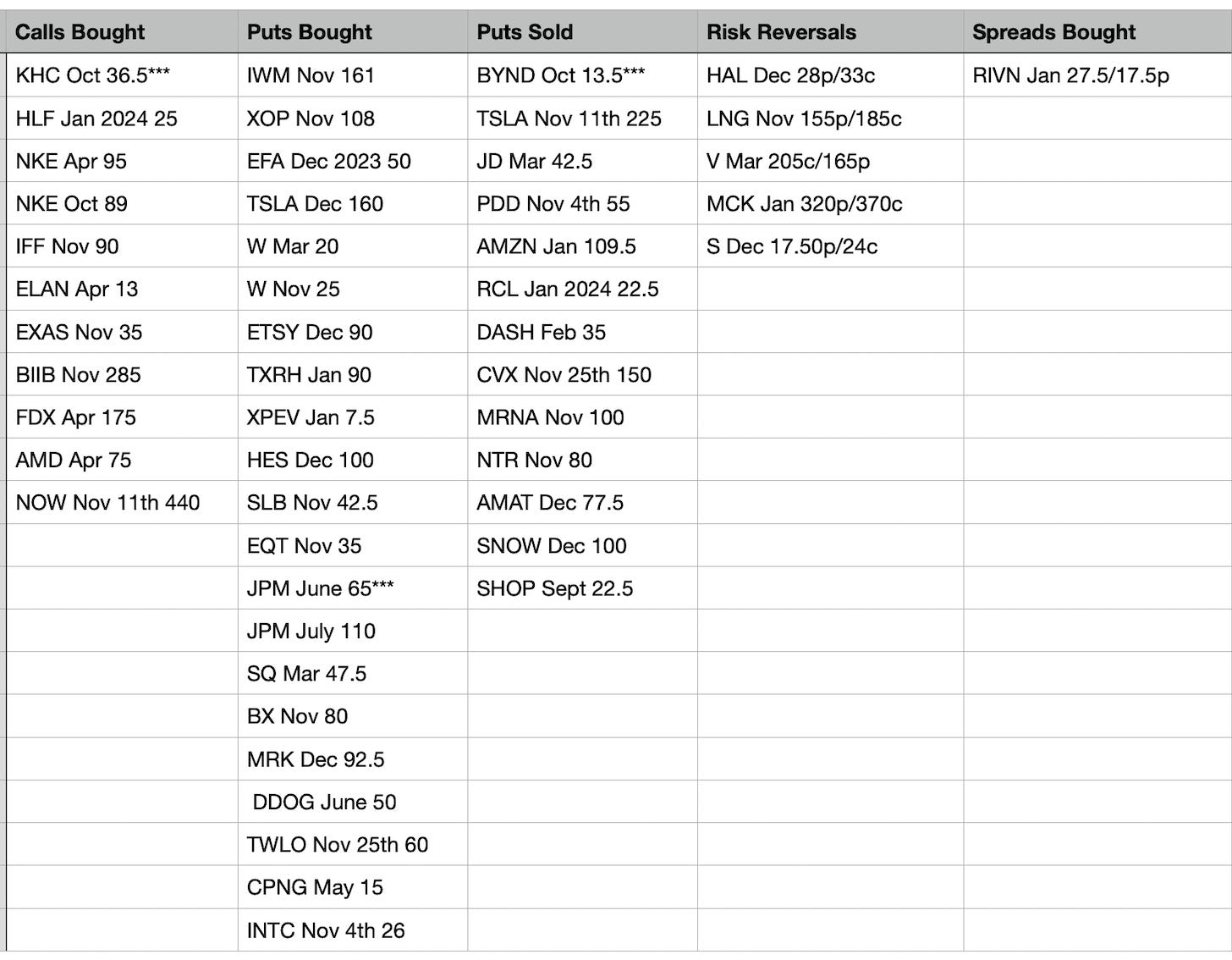

Today’s Unusual Options Flow & What Stood Out

KHC saw alot of 36.50 calls bought for next week, this is a defensive name that was up 4 days in a row before yesterday. Nearly 10,000 of these traded yesterday.

BYND saw 6000 puts sold at 13.50 for next week. This company is horrible, don’t get me wrong but it’s 52 week low is 12.76 and these puts sold were for nearly .75 so someone is trying to get long alot of shares at 12.25 next week.

JPM had fantastic earnings but someone bought ALOT of puts for next June at the 65 strike. If we’re headed into a deep recession, the banks are not going to do well.

Risk Reversals, there were alot. These are my favorite trades to pay attention to because they’re max bullish/bearish. On the bullish side we had HAL,LNG,MCK and S where they sold puts to buy calls and on the bearish side we had Visa where they sold calls to buy puts.

NTR I mentioned this one in my last writeup, they were selling puts on it and then all the AG names died yesterday, someone came back in and sold a ton of November 80 puts this time, last time they sold 90 puts. This is a good name.

Growth puts galore. Look at the puts bought on DDOG,TWLO,SQ,CPNG. As I noted in my chart above, ARKK broke down, I don’t see growth doing too well here, so this put buying makes sense.

Trade Of The Week Update

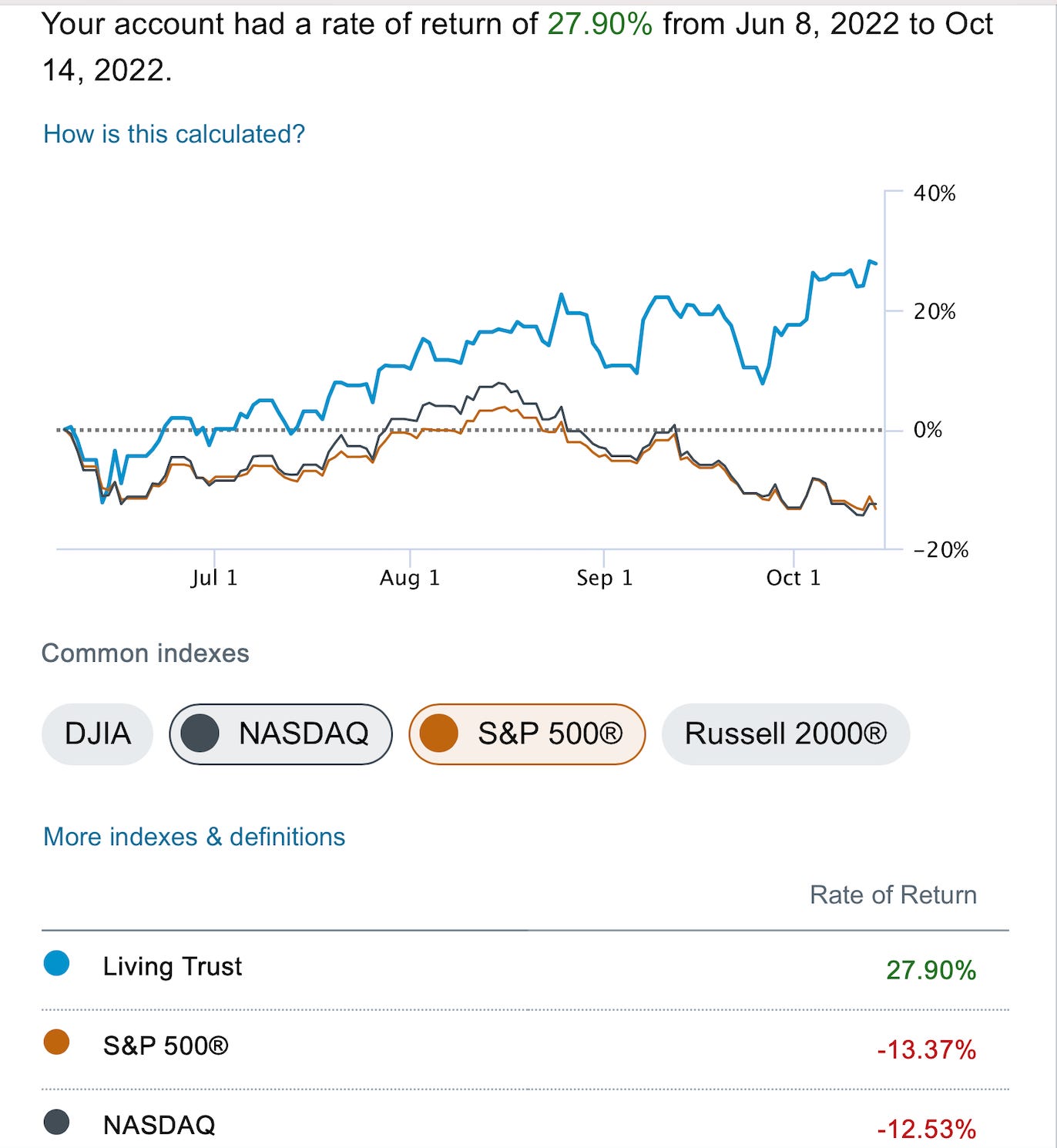

Twitter short puts worked out, 22 out of 24 of these trades have now worked out. I will have a new best idea tomorrow along with a few charts I think are of interest going forward. When I started this substack on June 8th we were already deep into this bear market. I’m proud that these best ideas have worked at such a high clip, it just shows you the importance of charts and option flows in dictating what you do short term.

How Did I Do This Week?

I ended the week with 1 long position, I was short those META puts after all those calls I saw the last few days, I didn’t even want the shares and mid day yesterday I closed the 128 puts I had for a 50% gain and rolled down to 127 for almost .30. It proceeded to go lower and I got those shares, ugh. Right before the bell I sold 127 calls for next week at 3.85 which is a 3% 1 week return. Hopefully I can get out of this trade before earnings soon. Otherwise all my short puts expired worthless, I have a few positions left that I will update monday. All in all another great week. As for totals……

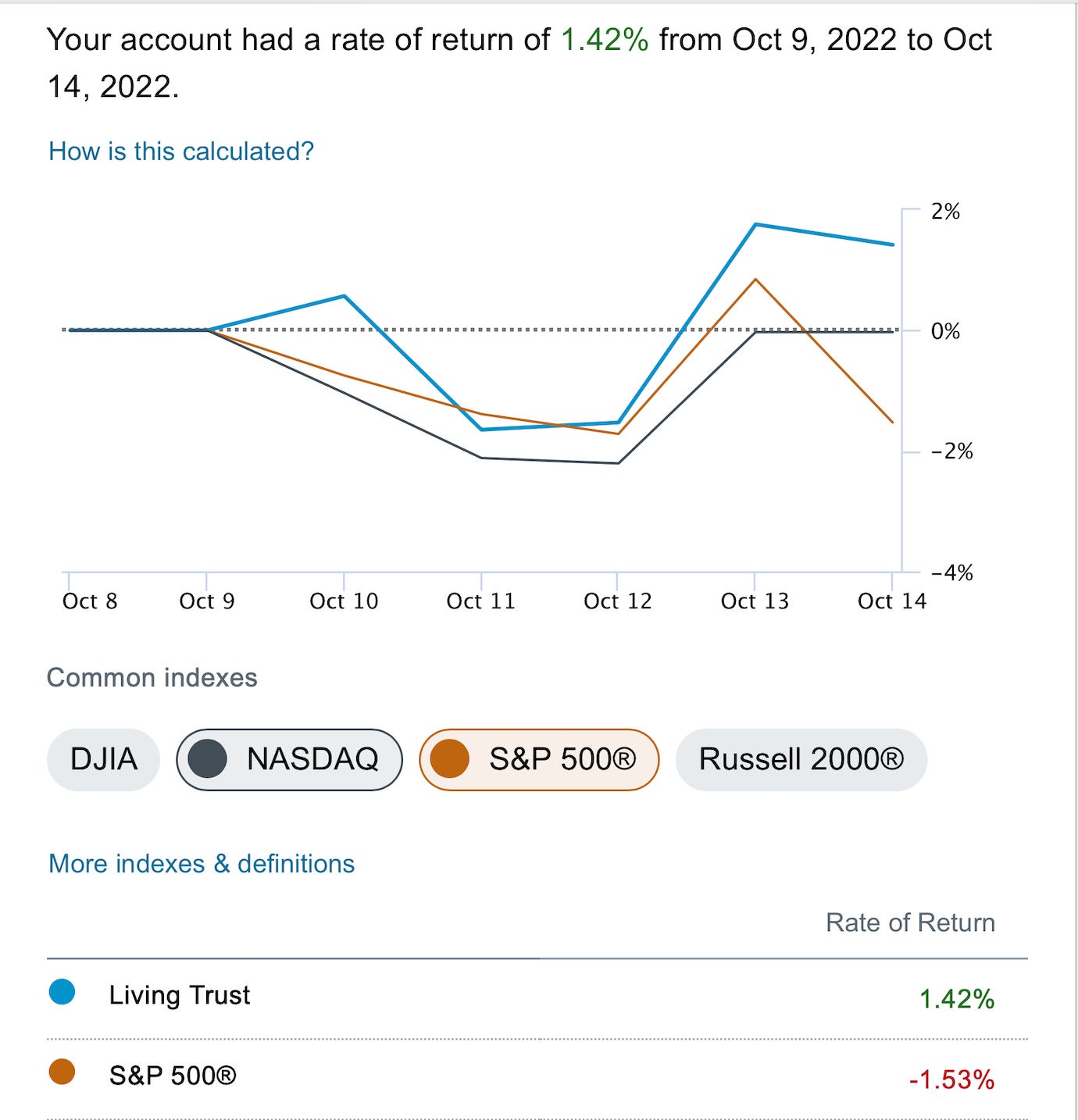

I did it again, I was +1.42% and the market was -1.53%.

Further out, I’m now up 27.9% from the start of this substack vs the S&P down 13.37% and the Nasdaq down 12.53%. Outperforming by 41% now since this project began.

I will see you all tomorrow, have a great weekend.

I tried this week selling calls on a TQQQ position. I was able to sell about four batches of calls after the previous ones went to 0 and I bought them back. Not going so great tbh lol the loses are intense probably offset only about 25%. If only I could sell naked calls!