10/16 Recap

The panic buying of puts on Friday leading to the VIX runup did not turn into anything material today as the war fears cooled off and the VIX collapsed. I would look for more of the same into vixpiration on Wednesday. We don’t really have any big data due this week other than some home sales data, but it is earnings season so you have to be wary of friendly fire to names you hold. On the front of the consumer worries and all the fears we’ve been hearing I’d like to note a tiny tidbit Amazon dropped in their Prime Day update on About Amazon:

They noted that this year 3rd party sellers sold 150M items over the 2 day event

which is significantly more than they noted being sold last year where they noted 100m+ items.

Now could last year have been 110 million items or 120m, it is possible, but I don’t see why they would note it at 100m+ if that was the case. The point is, whatever the total sales number was we do not know yet, but Amazon, the largest retailer in America is telling you the number of items sold on their platform is up dramatically year over year, that isn’t really a sign of a consumer struggling. I haven’t seen any analyst discuss this yet, which is odd because they’re always the ones dropping their “channel checks” and this is a note straight from Amazon.

The SPY is flagging here for the last 5 sessions over the 8 ema, nothing bearish about that, over 440 it can really make a strong move higher. It really is all going to come down to earnings and this week we only have 1 of the big 7 reporting in Tesla. So this week is probably nothing material until we get into the rest of the big names reports next week.

Oil and the dollar were red while yields were green again. Mixed action there, but overall we do seem set for higher assuming megacaps do not guide down or nuclear bombs don’t go off in the Middle East. The consumer seems to be doing ok, it looks like money is shuffling around from some more mediocre brands to better ones, but overall the money is still being spent. Brick and Mortar sales going down seems to be leading to higher E-Commerce sales and an overall slowdown just isn’t showing at this moment.

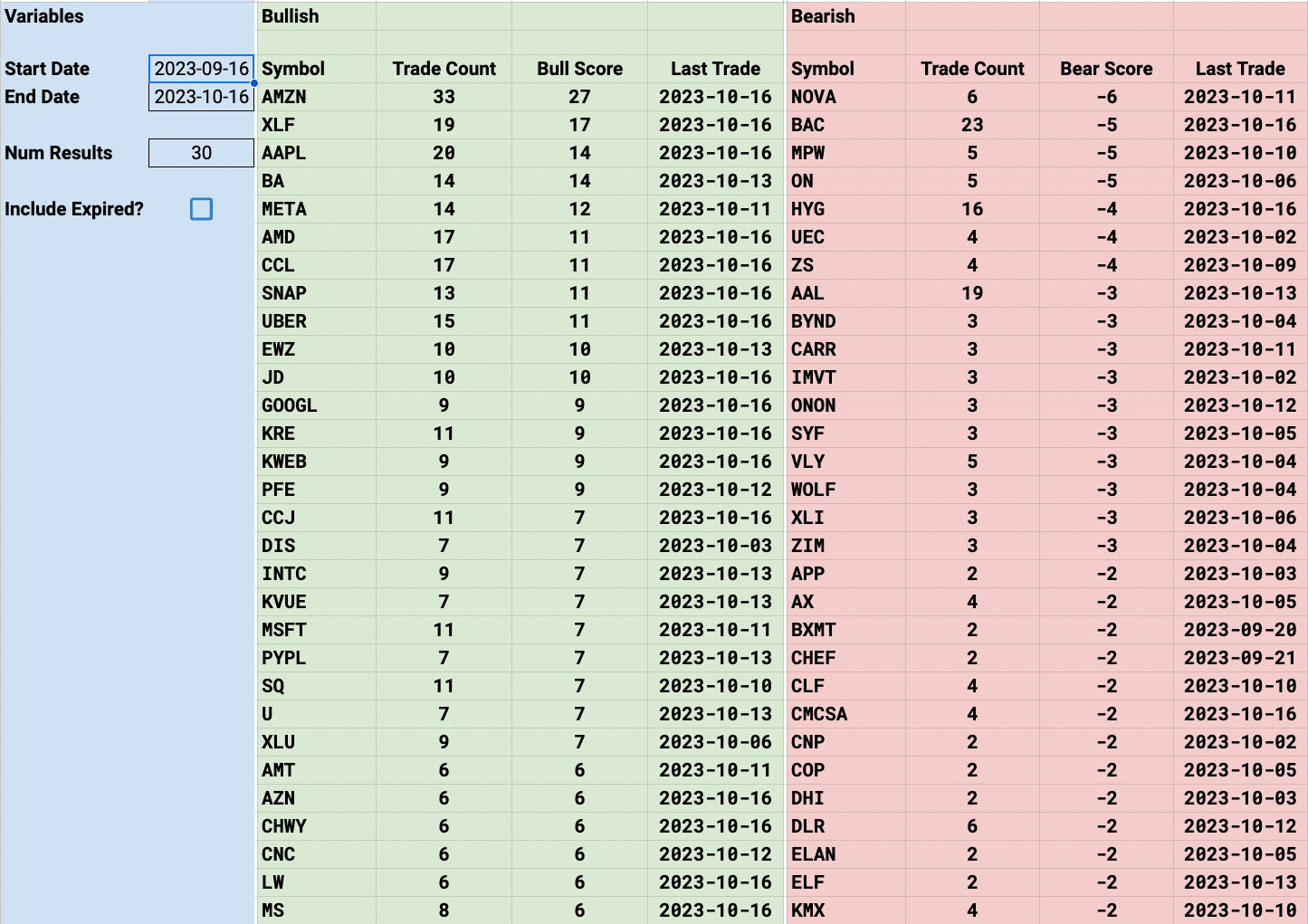

Trends

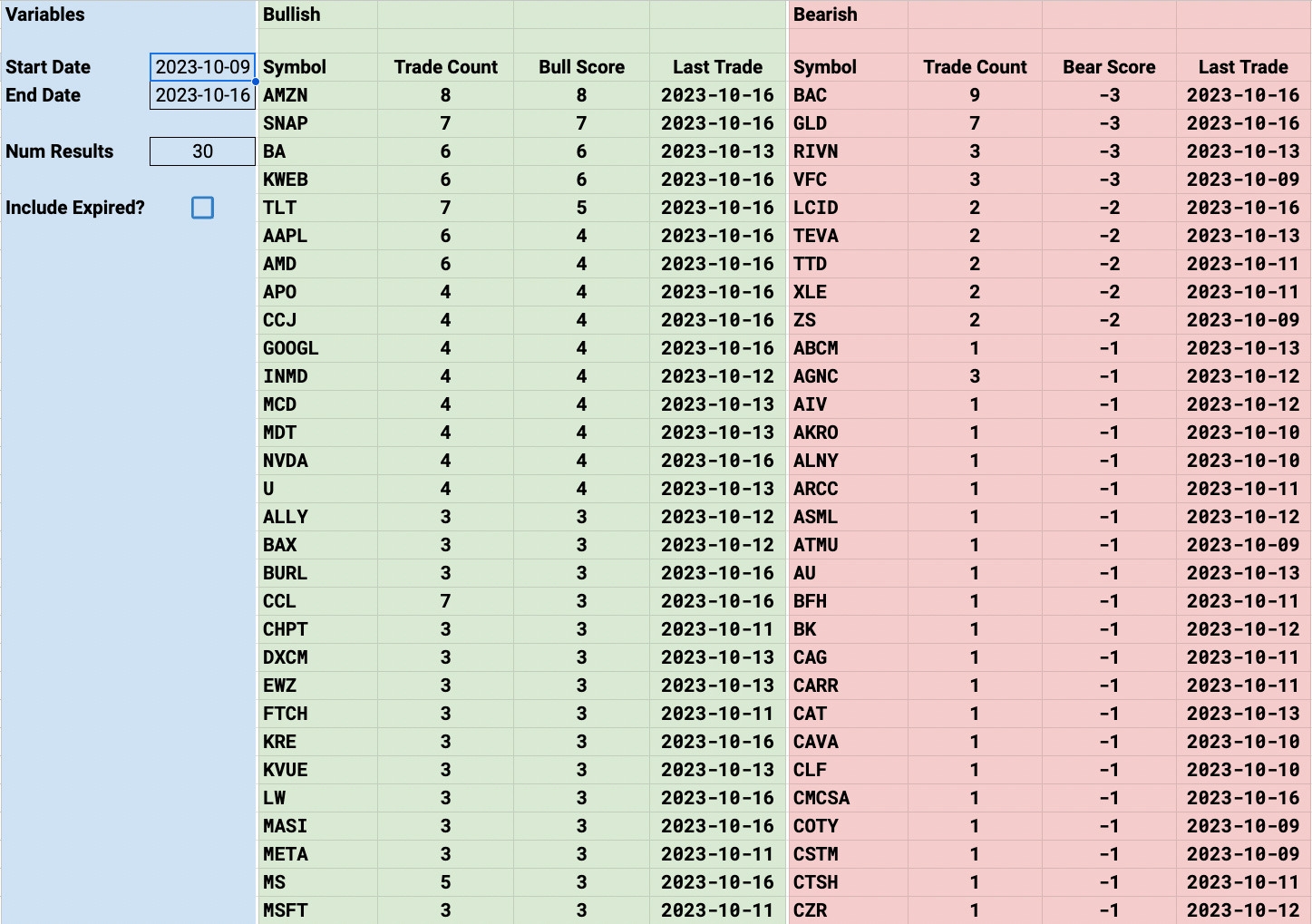

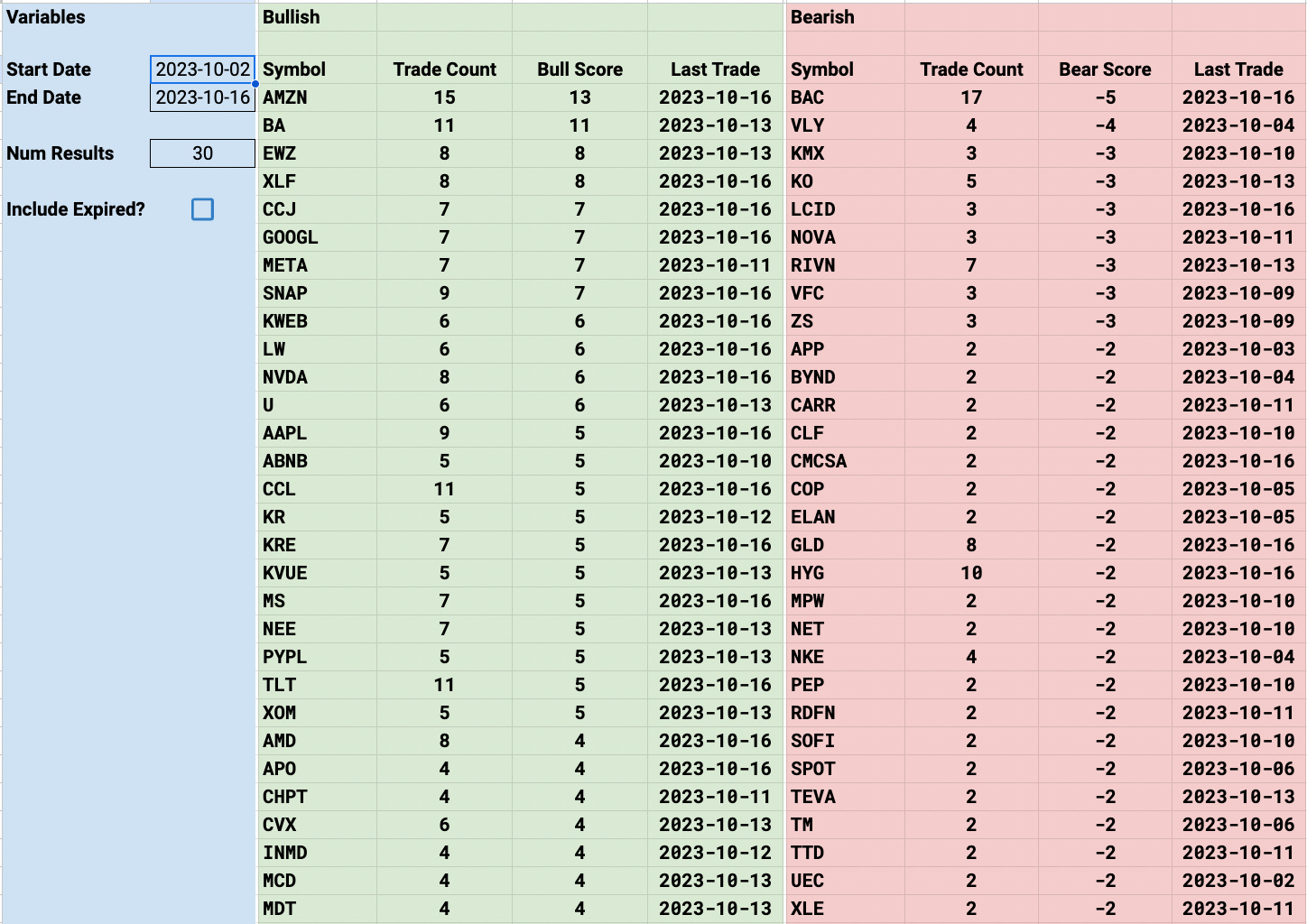

On the bearish trends, NOVA is leading the way over the past month and it is down 20% in that timeframe, SNAP surprisingly has led over the past week and today was only 2 of them so the 5 odd lots traded in the past few sessions worked out with the SNAP “leaked estimates” and the stock +11% today.

1 Week

2 Week

1 Month

Today’s Unusual Options Flow

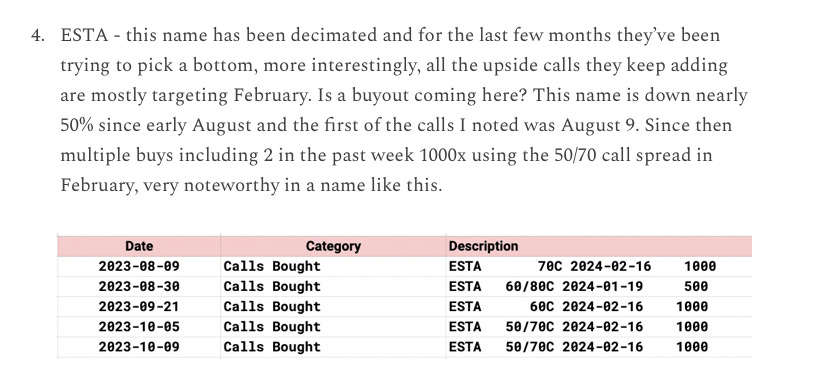

Odd session today, I don’t think I’ve ever noted so few puts bought. I’m not sure if that means anything or just a one off. One that stood out to me today was ESTA, I highlighted it 1 week ago on Monday after all the odd action came in, it was up 10% at the open and has given a little back now. I’m not sure what news they got today, but not shockingly, the call buyers came beforehand.