10/19 Best Idea For The Week Ahead

We wrapped up the week at another all time high close on the SPY. This has been a textbook move higher after the breakout 5 weeks ago. Are we a bit extended? Sure, can it extend more? Absolutely. It really all comes down to what sort of guidance we get over the next 2 weeks from all the megacaps. So far we’ve gotten great reports from the banks and Netflix. Nobody has issued any sort of caution to worry about. We also have the election in 2.5 weeks. We’ve been green 10 of the last 11 weeks the best streak we’ve seen since markets were green 14 of 15 weeks in late 2023.

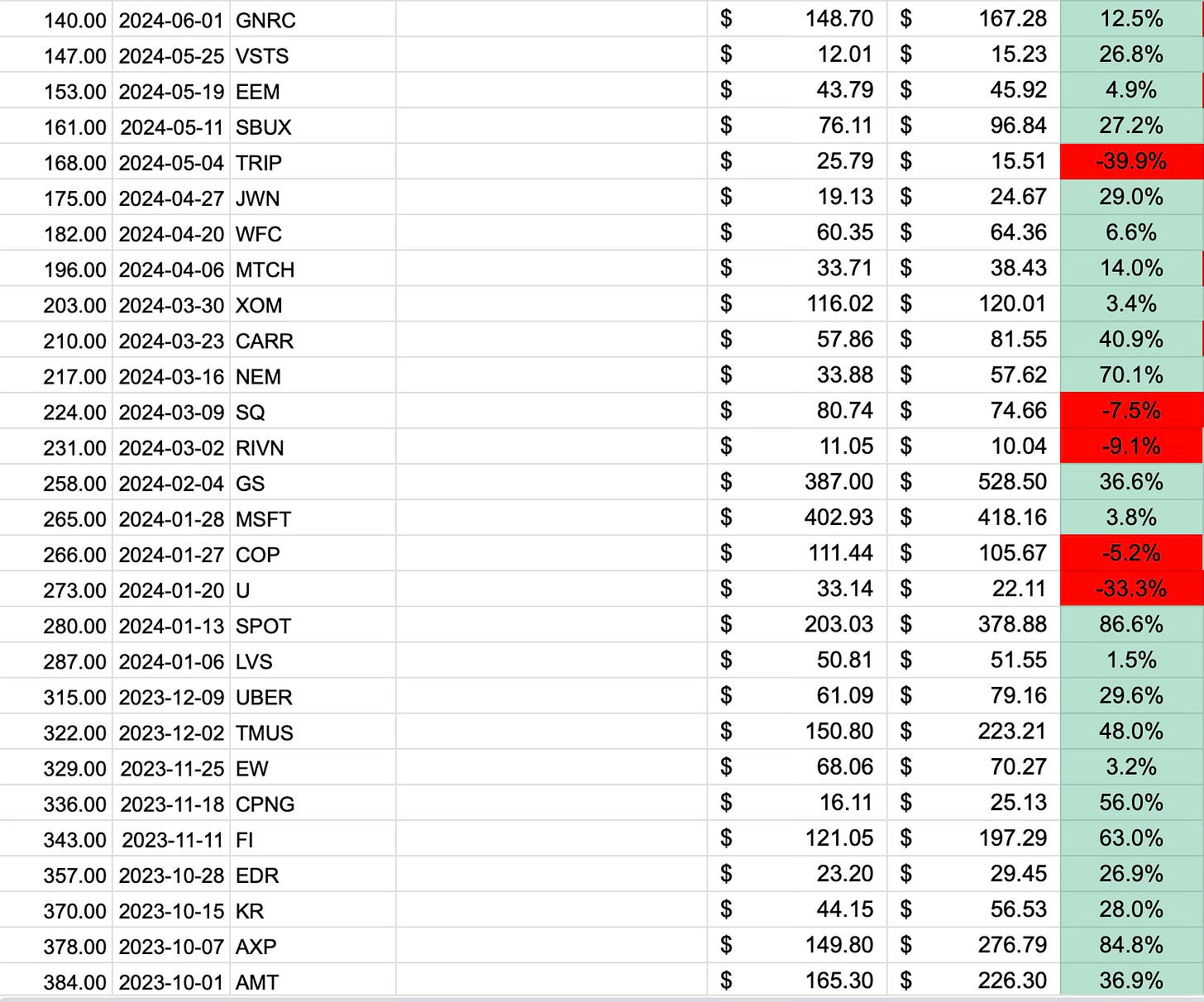

I’ve had some of you ask me, so here is some data on these weekend best ideas from the last year. The date of the post is on the left and the total return since is on the right from a spreadsheet I track these on.

These weekend best ideas have gone fairly well, I’ve written up 44 of them from last October and 35 of the 44 are green from the time I wrote them up or 79.5%. Some of the losers were actually winners technically because Tesla was a 2 week trade expiring before the event, but in general, I try to write these up as longer term holds for your book. 15 of these went for gains over 25% on common. The bottom line is think about these weekend best ideas as longer term positions, sell puts to enter before you buy common, take shares, sell covered calls and keep your stop losses in place. I’m not always going to be right but thankfully I’m right alot more than I’m wrong and only 3 went really wrong to the tune of 10%+ loss and anytime you’re long common a stop loss should be in place to stop your losses at 10-15% max, whatever number you choose.

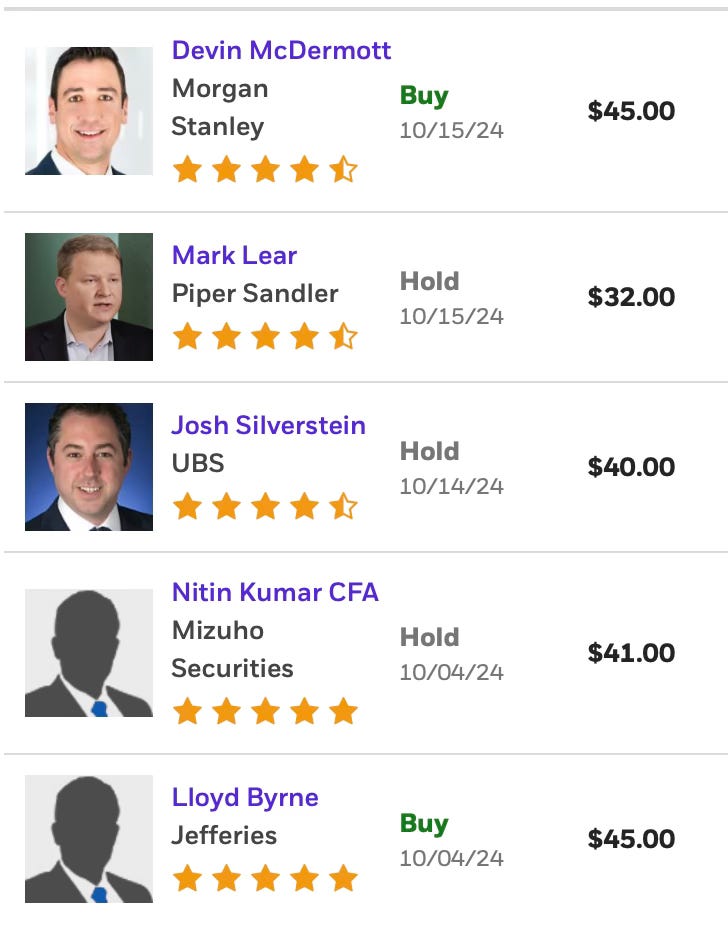

This week’s best idea has seen some 75% OTM call buying looking for a big move up over the next 12 months and is trading well below the average analyst target. So let’s take a look at it and discuss a great risk reversal I drew up for a credit where you get 2x the calls. I will say this trade reminds me alot of the NEM trade I wrote up back in March here where you saw far OTM call buying long before a big move up. We’ve also seen that in APO, AXP,KR in the last 12 months, those OTM leaps are rare trades but tend to work. That NEM trade below was a risk reversal when the name was 33.88 and 7 months later it sits at $57.62 and those calls below went from $1 to $8.90.

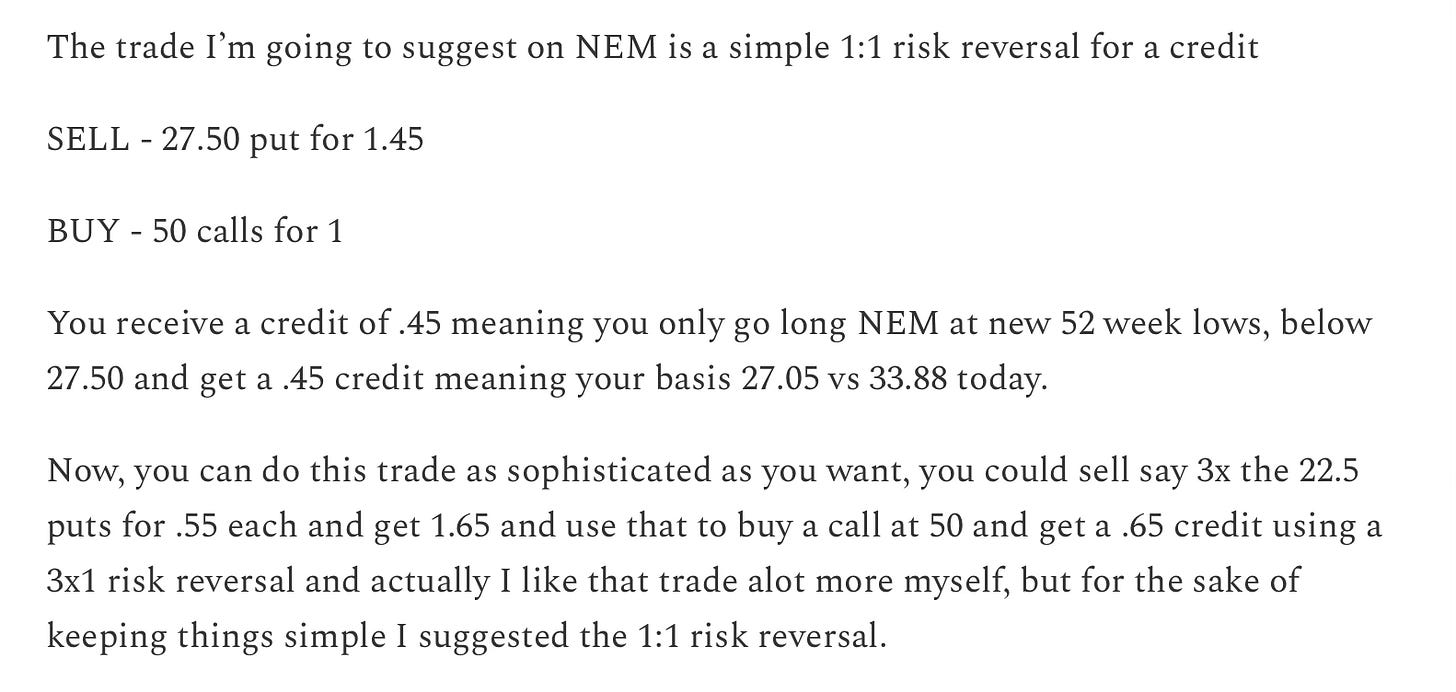

EQT

What Is It?

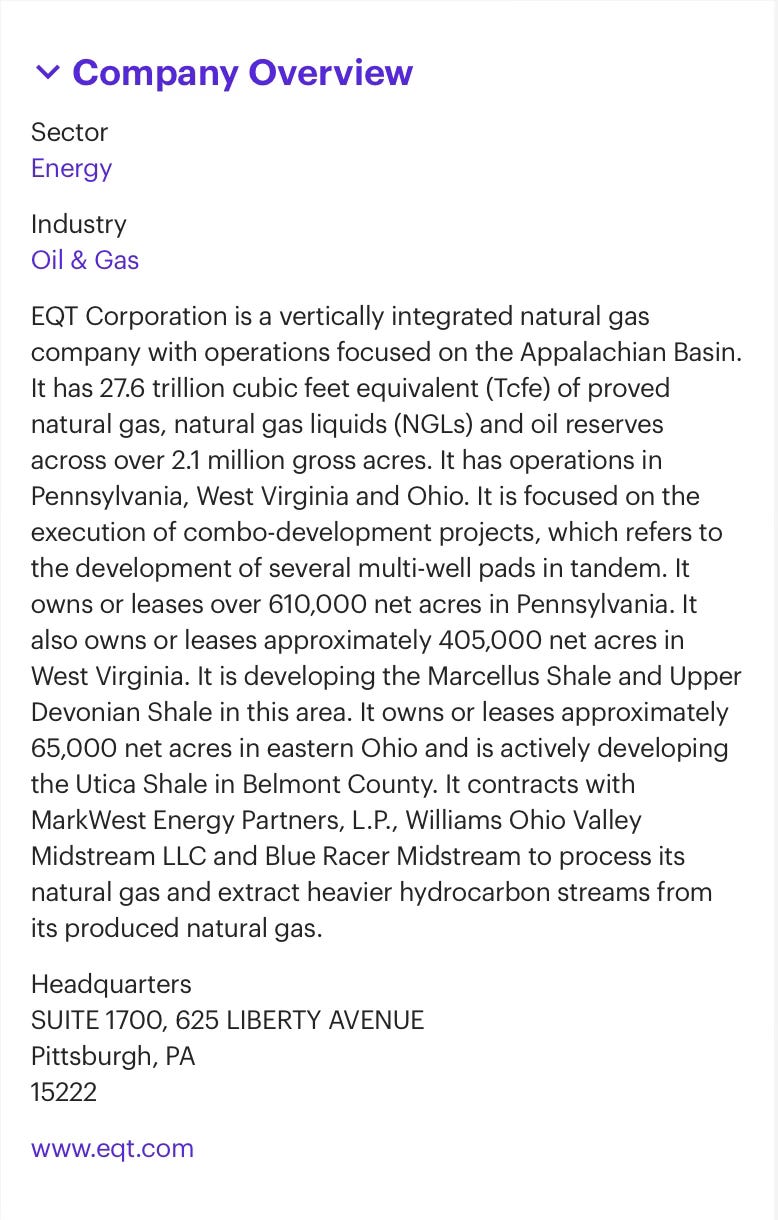

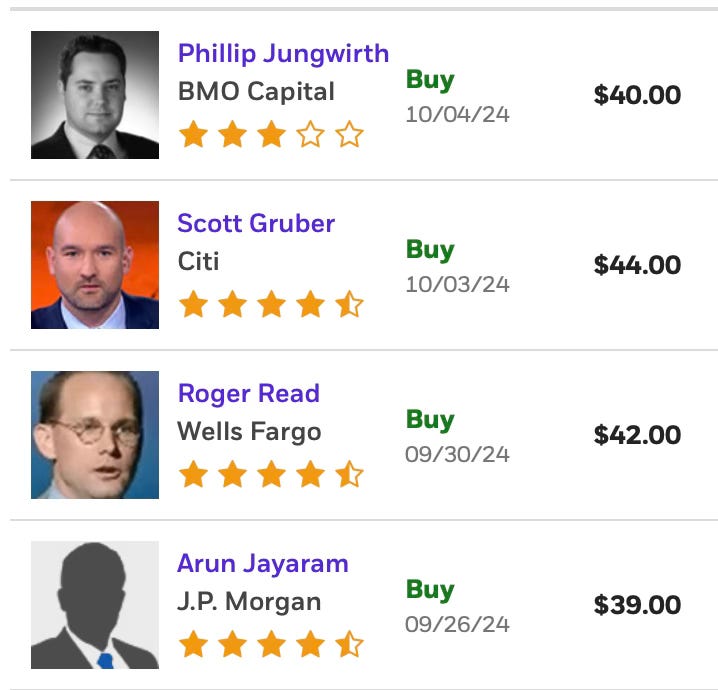

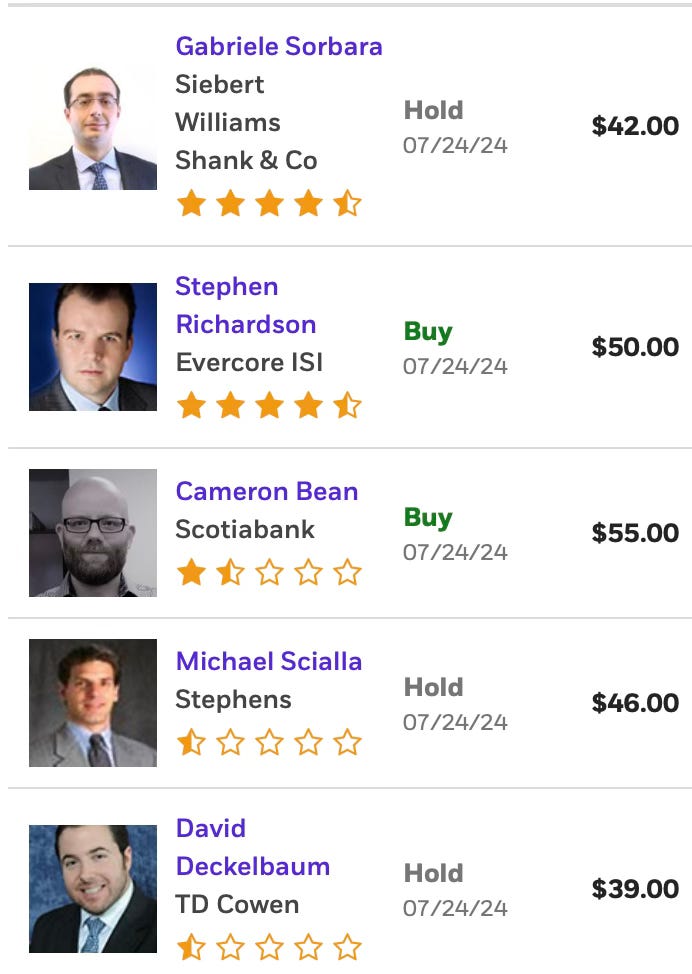

Analyst Targets

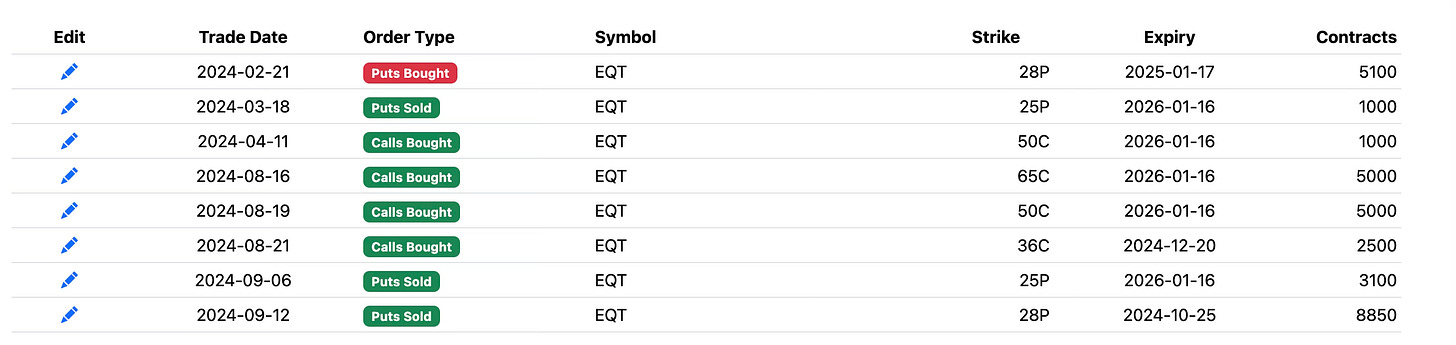

Options Flow

you can see the 2 big call buys of leaps in January 2026 2 months back. Those calls are still in the open interest at 50 and 65.

Charts

Daily - sitting right ontop of the 200 day, I’d look to 33 for support on the daily if you’re wanting to sell puts lower.

Weekly - the 200 week is just over 32, that is usually the level you want to take quality names long which lines up with where all the bullish activity came in late August.

Monthly - You could argue this is one giant bullish flag on the monthly over the last 3 years just waiting to breakout, maybe that’s what the calls about at 50 and 65 are looking for.

Trade Ideas

36.49 today, it pays a near 2% dividend. If you want to buy shares and sell upside calls, you can. Personally I’d prefer to sell puts at the rising 200 week and try to get long there if you only want to get long shares but, for me, the best way to play stuff like this is a risk reversal where you can catch a big move should it occur.

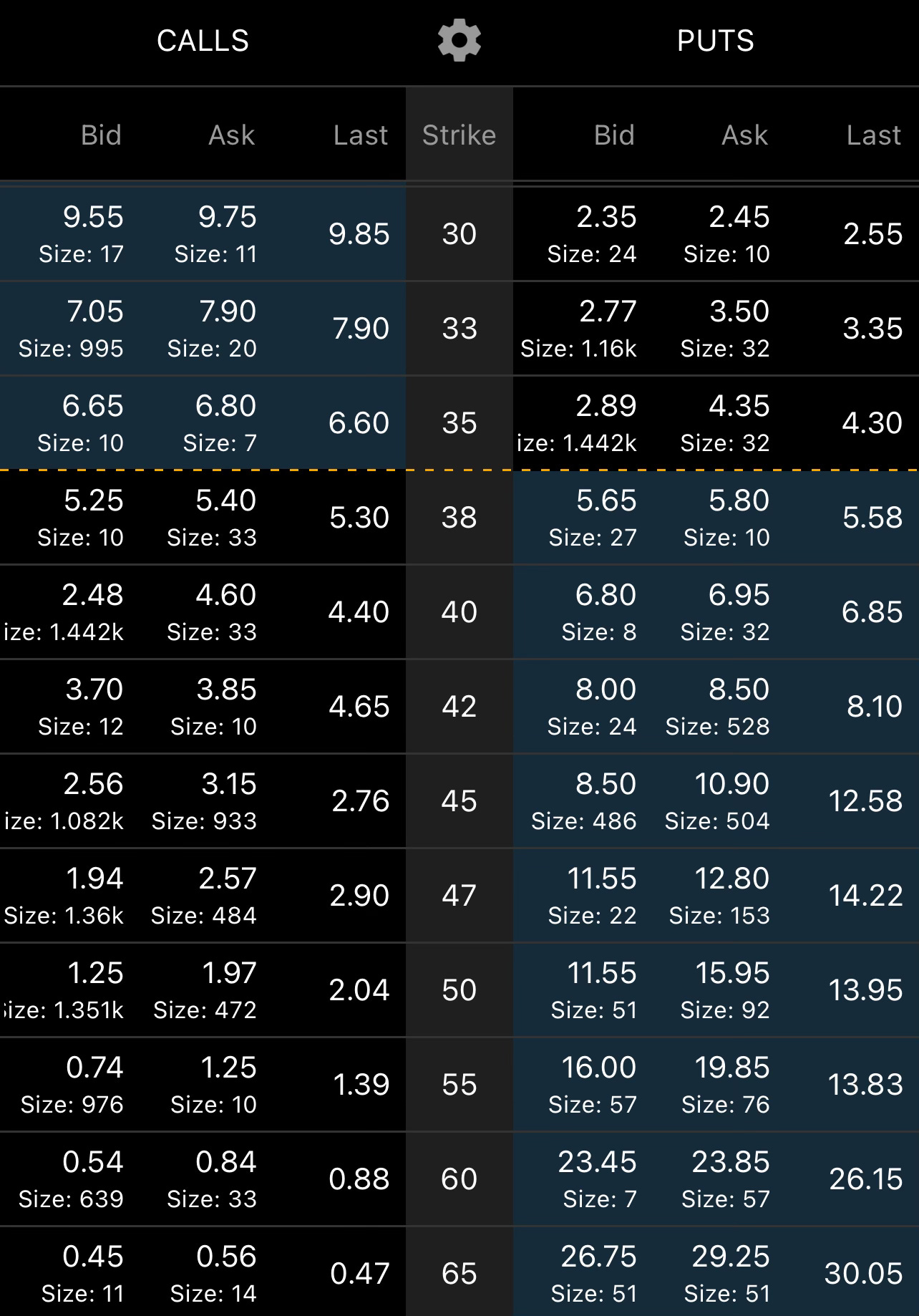

Here is the January 2026 chain, remember we know the rising 200 week is around 32. Below that is where we want to target put sales. We also know there is big open interest in 50 and 65 calls in January 2026. So here is what I’d do

Sell 1 January 2026 $30 put for 2.40

Buy 2 January 2026 $60 call for 1.40

Credit $1

Why this trade? Well if you’re going to get a big move up you’re getting 2x the calls and you’re still getting a credit of $1 since the 2 calls are .70 each and the put sale is 2.40. Here is the great part, the stock could fall 20% and worst case you get long at $29 with the credit. If EQT has a sharp 20-30% move up in the next 6 months you can close this all up for a nice profit. Whatever happens, it’s always a win when you can sell puts on a quality name below the 200 week while also buying calls and still having money left over ontop. You can also just sell the puts if you want without the calls. There’s many ways to play this you can buy commons, whatever you want, I just try to highlight what I think is the best risk/reward while getting in lower on a worst case scenario.

Have a great rest of your weekend and I will see you Monday.

Hi James, just share my story. I saw your idea on $C in June, got hesitate and missed its run to 67. But when it dipped in Aug and Sep below 58, I entered exactly your setup and hold as the RR will be 2 years out. I exited all the RR recently before earning will more than 50% gain on both put and call. It dipped after ER, I am still looking to enter $C again if it felt below 60. It only shows 1% in your excel, but volatility is not small for me to profit.👍