Here is the weakness I’ve been pointing to the last couple sessions, the SPY has finally broken down below the 8 ema and closing in now on the 21 ema. The market has this massive bearish divergence forming, I didn’t think it would play out until possibly after the election certainly not before megacap reports, but you really have to start thinking about your move should we break below that 21 ema at 576.17 right now we are just $2 away. You know my stance on the 21 ema, any close below that is time to exit all longs that you aren’t holding long term for tax purposes. The weakness would officially be here, how long will it prevail, nobody knows but there is nothing to be long below that level. If we break that 21, the next level of interest is 565.17 the previous breakout. That should hold or way bigger issues are coming. In a perfect world for bulls we test that 21 ema and bounce today or tomorrow.

The dollar continues its ascent higher, monday when it reclaimed the 200 day, that was your signal to go long and simultaneously worry about equities. That upward move on the dollar is pressuring everything, stock bulls need this to cool off quick, this is actually a pretty big move 4% higher on the DXY in under a month.

Recent Trades

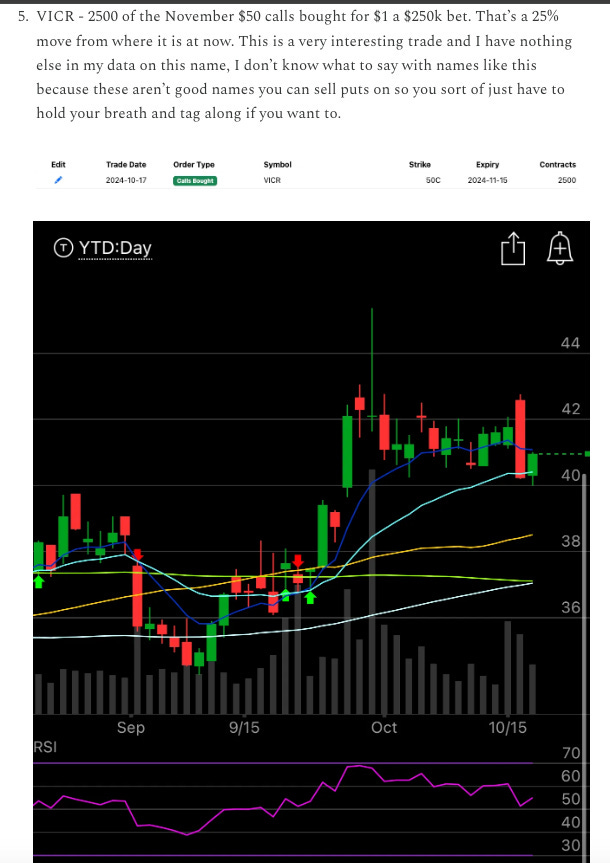

VICR - So this one we discussed yesterday, last thursday it was 40.xx then the odd trade below came in.

Today it popped 17% on earnings, oddly enough though, the calls are barely up 20% from monday when the name randomly ripped 9%. This is your case study on why you should sell calls that are up into earnings. You would have taken all that risk holding into earnings and while it worked and the calls are nearly a 4x from last thursday on a 25% move that seemed impossible then, the calls barely budged from monday’s pre earnings hype. Remember this next time you think about holding calls into earnings.

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will be active until the open tomorrow. The rest of today’s trades will be added by the afternoon so check back for updated trades and trends.

Keep reading with a 7-day free trial

Subscribe to The Running Of The Bulltards to keep reading this post and get 7 days of free access to the full post archives.