10/24 Recap

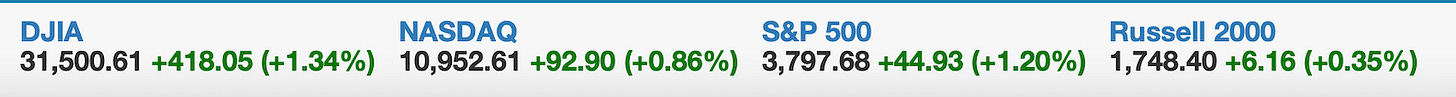

Call me a skeptic, but how is what happened in China this weekend bullish equities? We have our #1 enemy who is toying with a potential conflict over Taiwan that we would get dragged into basically annointing their dictator for a lifetime term. They increased his grip on power dramatically, the China stocks did not like it, all of them were slammed. Many names like BABA went below their IPO level from nearly a decade ago. Others like JD went to 35, well below where Google invested in 2016 at 40. Combine that with rising rates, a currency crisis in Japan, and the UK political circus and we have quite the situation today.

Let’s look at some charts

On the daily, the SPY closed over some key levels today, a nice bullish MACD continuation as I mentioned over the weekend and for now, things like ok. Where they get questionable is on the weekly.

Here on the weekly, while I do like the bullish divergences I’m seeing, it’s too early to tell because so much of the market is reporting this week, how those go will tell us alot. What if that candle ends up lower forming a bearish engulfing? What if we end up at 400? I don’t know, I just let the candles form and I decide what story the market wants me to see after. That is why I will remain in Twitter for the rest of this final week and then see what the candles have in store for me after.

The dollar continues to weaken, look at the bearish divergence here, look where it is getting stuck, this is looking good for equities for the short term.

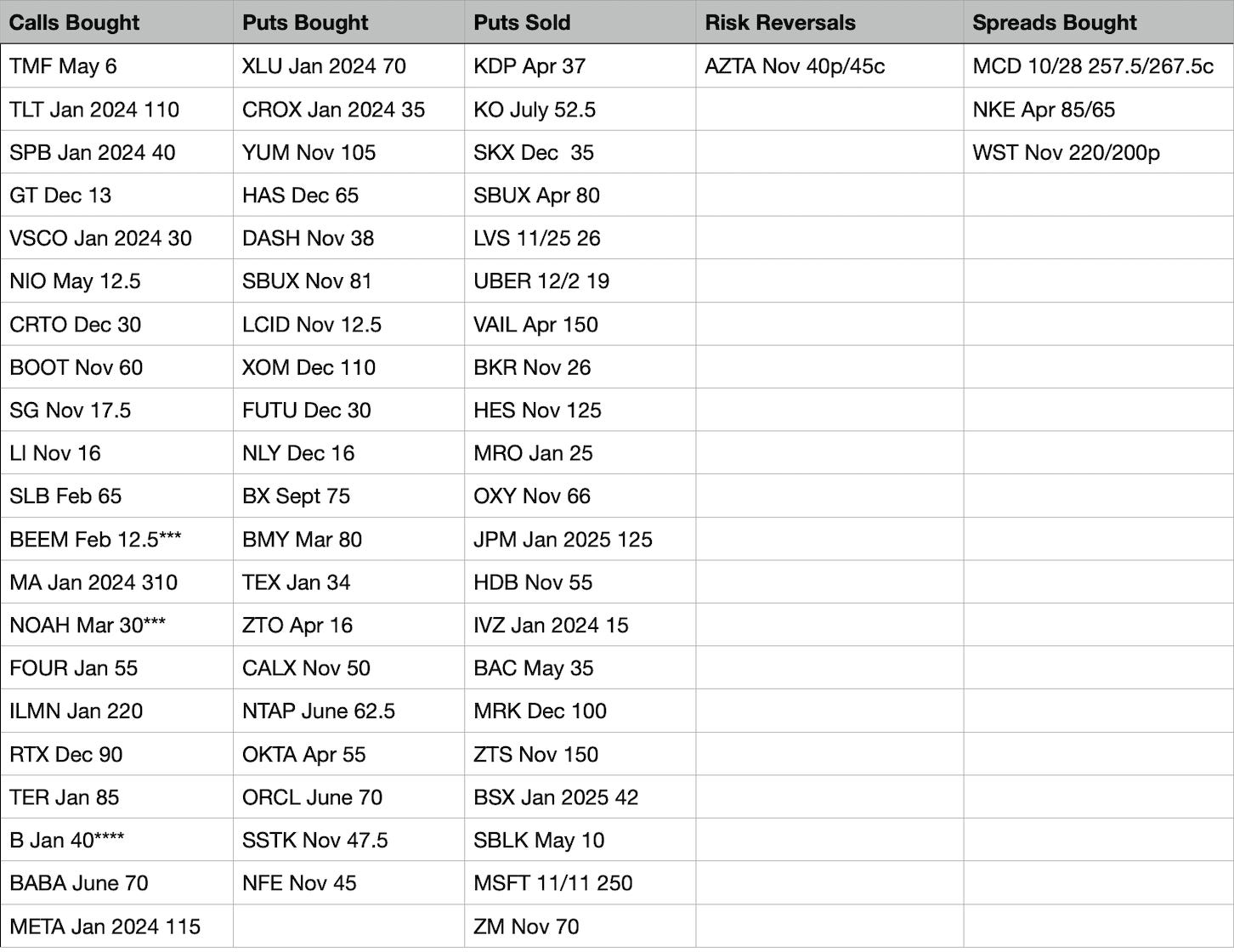

Today’s Unusual Options Activity & What Stood Out

BEEM Feb $12.50 calls, this isn’t a name that sees flows often

NOAH with alot of March $30 calls, another name that rarely sees action

B With a large buy of January 40 calls, unusual for this ticker

META for the umpteenth time in the last 2-3 weeks with a huge buy, this time Jan 2024 ITM $115 calls. This is easily the most bullish in terms of flows into earnings.

AZTA with an interesting risk reversal selling 40 puts to buy 45 calls in November, another name with very little options action.

TLT saw call buying again like friday, this time in Jan 2024, but what caught my eye was the buy in May on TMF which is a 3x Treasuries ETF.

Trade Of The Week Update

XOM was green today, the 98 puts I suggested selling over the weekend should still be a nice trade even with earnings this week, this chart is a thing of beauty and it continues to rise above all the key averages.

How Did I Do Today?

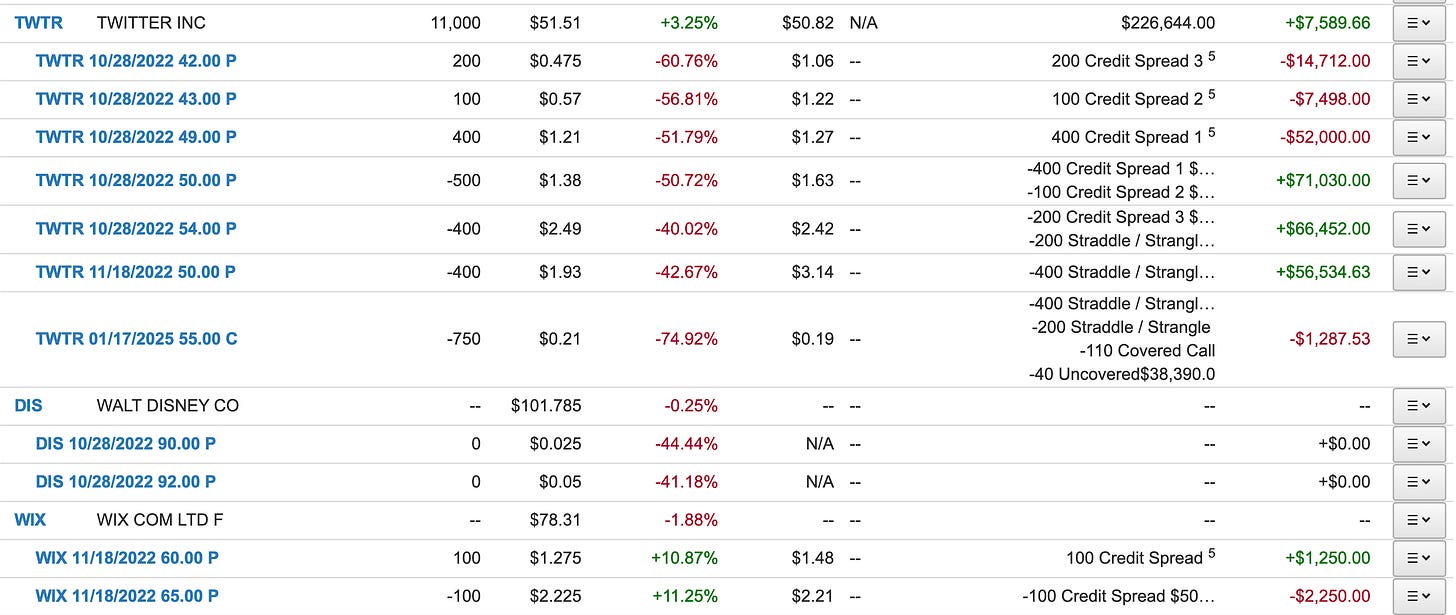

Really well actually, I got back most of what I lost friday on that fake report. I mentioned Friday that I didn’t believe what was going on with Twitter as material and so far that turned out to be true. Almost criminal what those 2 reporters from Bloomberg did. I actually went all in this morning premarket adding more shares, I even closed out other positions I had so I could buy more once I saw the huge volume Tesla put in the first 2 hours. To me, that was likely Elon Musk selling and we will see a Form 4 soon. This deal is winding to a finish, likely by friday the 28th, the deadline. So for me personally, not much to trade this week, just going to let this final week play out. I sold some Jan 2025 55 calls against my positions today, the deal is at 54.20, these should expire worthless when the transaction executes. The only reason they have a bid is because he could not pay, we go to court and Twitter gets more with interest. I do not see that as a likely scenario at this point. The banks have all announced their financing plans.

I actually had to close out so many positions I had open last week to take on the 11,000 Twitter shares I added today, due to margin. I closed out my positions in XOM, DVN,DIS,NET,TTD, and some of my OXY ones. Like I said this morning premarket, TWTR was still below 51 and I’ve been here this long, I was going to see this through to the finish line. Obviously I never advocate for you to do what I do because I have a higher risk tolerance, and again this is just my trading account so I make moves with the best short term reward in mind and this week with all the potential landmines of earnings I’m happy and comfortable in Twitter which appears to be 2 feet from the finish line.

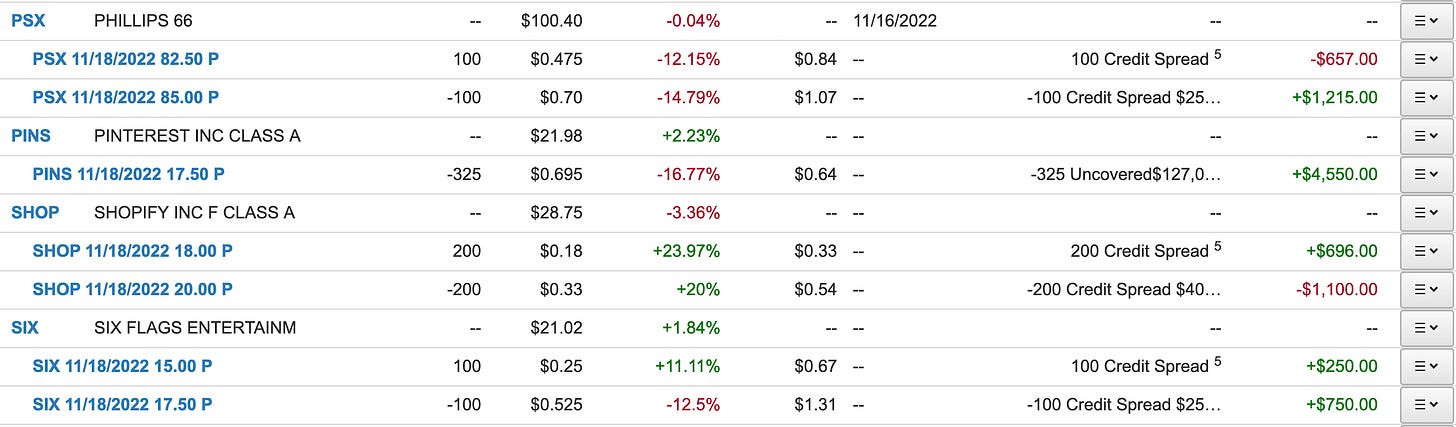

As I do every monday, here are all my open positions. Still have huge short puts on META and PINS into META er this week, the BAC short put spread should expire worthless, otherwise I have nothing short term at risk this week other than Twitter should Elon decide to play games.

Anyways, hope you all had a great day in the market, and I will see you tomorrow. BTW I enjoy the conversation all of you have going in the discord now, it’s nice to see so many of you in there now I think we just crossed 100 people.