10/24 Recap

The first of many big days is here. What will Microsoft, Google, Snapchat, and Visa tell us today. Microsoft will give big insights into enterprise spending. Google and Snapchat will tell us alot about the ad market, and Visa will show if consumers are still spending. Alot can go wrong today. The big move up we had this morning has already faded with many names, including MSFT already going red. This morning we had alot of nice reactions from some of the old guard like VZ,KO,MMM.

The SPY has been very weak since we broke the 200 day on Friday. Each of the last 2 sessions we’ve tried to push over it and we got rejected lower. You can see the ugly inverse hammer candle forming now today. Bulls really need strong earnings reactions to MSFT and GOOG today or there could be trouble ahead. Google has been really strong his Q, but MSFT has some lingering questions regarding margins and a chart with a series of lower highs. We will see this afternoon.

Oil looks weak at 83. This wasn’t what oil bulls were looking for when tensions began to flare in the Middle East. For every other company in the market, lower oil is a welcome boost to margins.

Yields keep stalling out with the TNX having another weak session after the bearish engulfing candle yesterday. Bulls want to see this trend continue. Ackman did note covering his bond short yesterday as well

Did any of you get those COIN weeklies in yesterday’s recap? They went 10x at one point today when it was up 15%. That was an incredible trade for whoever bought those.

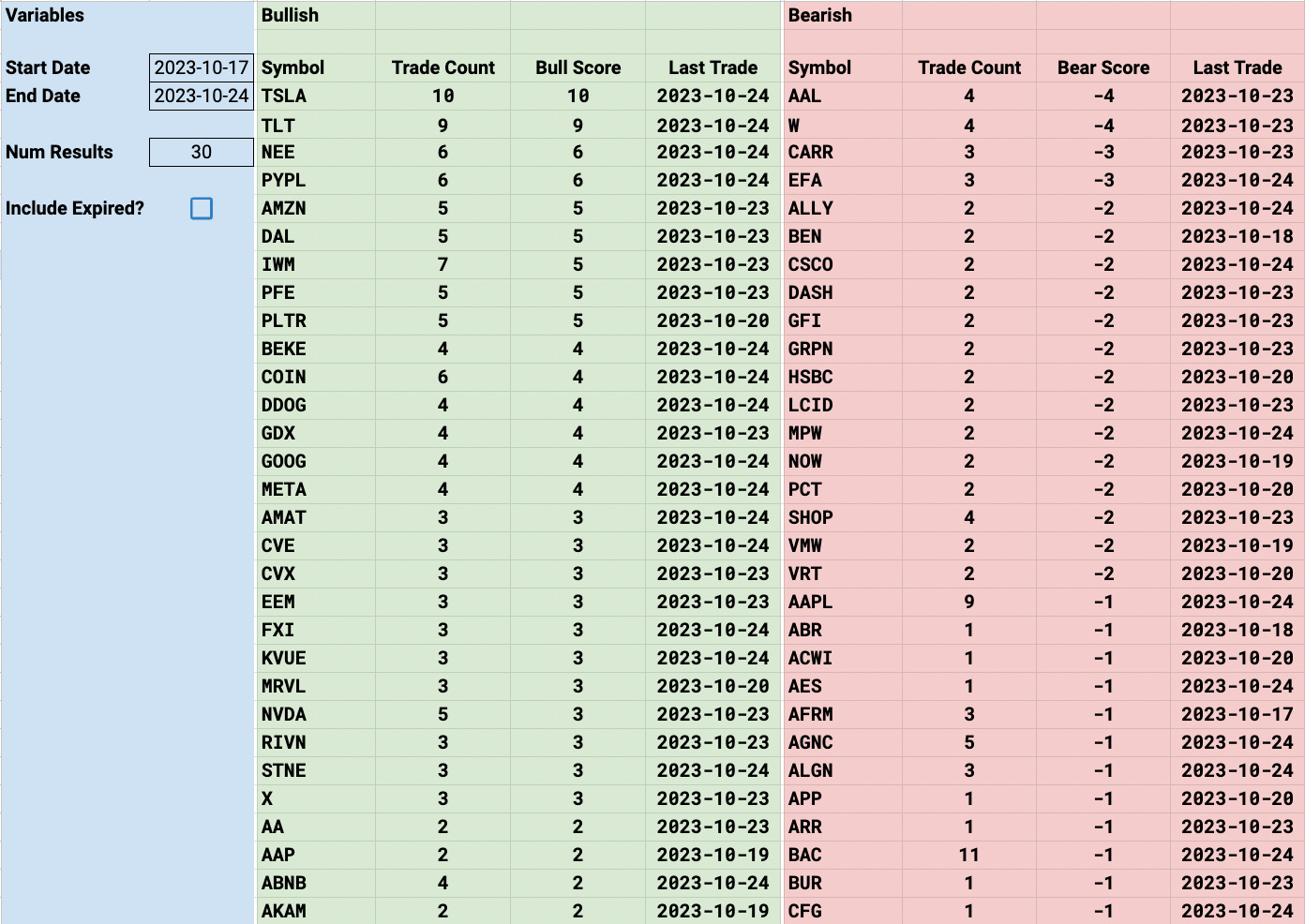

Trends

1 Week

2 Week