The market continues its weakness with the SPY attempting to move back over the 8 ema today but rejecting and moving lower. Yesterday we briefly dipped below the 21 ema before bouncing and that usually is a sign that another test is coming and we are close again today. This isn’t looking good, now all the megacaps report over the next 5 sessions and those are over 30% of the market, if they all have impressive reactions we can bounce. This very well could be a headfake but I can’t tell you this is looking good right now because it just isn’t. As I said yesterday just take caution and if we get a close below the 21 ema at 576.20 begin to remove long positions that you aren’t holding long term we’re at 576.80 right now so this isn’t far away. You will save yourself alot of headaches. If we don’t bounce soon you probably see that 8/21 bearish cross in a couple sessions. With possible weakness emerging it is more important than ever to note which names are having strong earnings reactions and making a watchlist to focus on those names for post earnings drift now. Those will be the leaders regardless of what happens.

Recent Trades

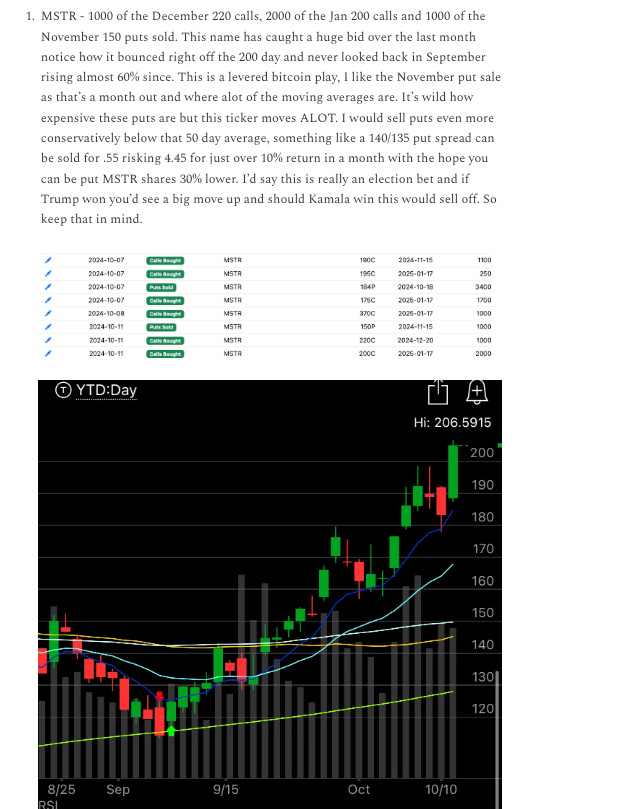

MSTR - In the 10/11 recap here I noted all these MSTR calls when it was 206 and today it hit 230. This thing is schizophrenic it moves up and down 15% every week, but if you caught this move I would think about taking some off because at the end of the day it is a levered bitcoin instrument and bitcoin is a levered nasdaq instrument so if we’re seeing some market weakness, this would likely be hit.

Today’s Unusual Options Activity

Here is today’s link to the database, it will be open until tomorrow morning, the rest of the day’s action and updated trends will be there by the afternoon.

Keep reading with a 7-day free trial

Subscribe to The Running Of The Bulltards to keep reading this post and get 7 days of free access to the full post archives.