10/25 Recap

The SPY broke back down under the 200 day today and remains perpetually weak from the first dip below 4 days ago. The weekly chart is sitting right at the 50 week right now. Google being down 9% is the main cause, but Amazon is down 5% in sympathy with the cloud reports and when 2 of the 4 largest companies in our market are down like that, the market can’t withstand it.

The credit card data we saw from Visa yesterday shows a strong consumer, Google showed a really nice advertising number up 11% year over year so advertisers aren’t pulling back spending. Everything seems to be ok in our economy in terms of consumer sentiment at the moment. The issue today in markets is the cloud sector.

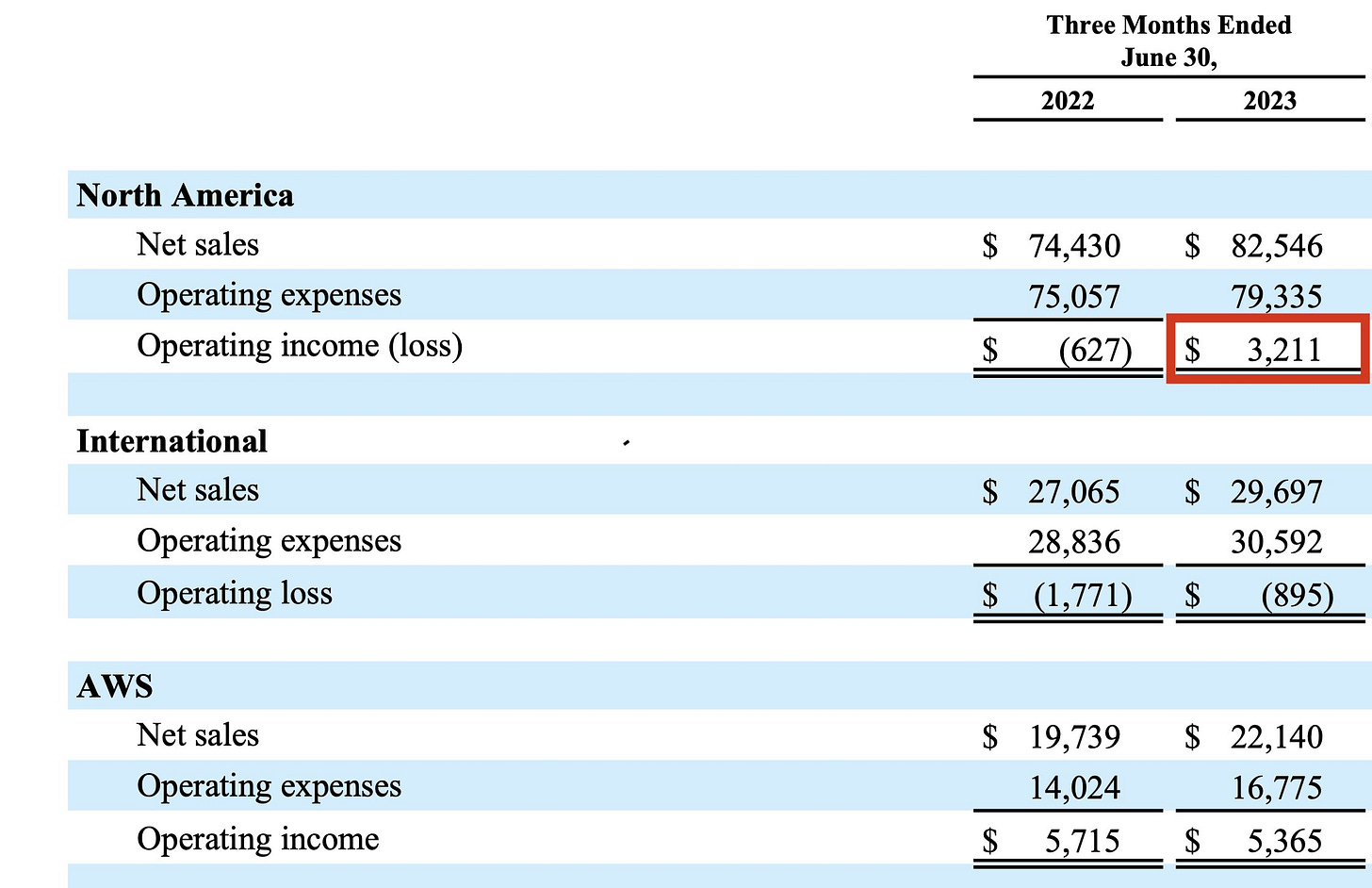

Speaking of Amazon, nasty reaction to the reports and commentary from Google and Microsoft. They stoked alot of fears regarding cloud and you could see the reactions today from cloud names like Snowflake, DataDog, Cloudflare, etc. I have to say, as an Amazon bull I’ve never seen so much misguided focus on cloud from every market participant in my life. I get it, cloud is a wonderful business and up until maybe 2021 it was all Amazon had. Today though going back to last quarter the North America business highlighted below generated $3.2B in operating income while AWS was at $5.36B. I really think people are overstating the important of AWS in today’s environment. This isn’t all of Amazon’s operating income anymore.

Amazon didn’t spend hundreds of billions of capex on logistics without an end goal in mind. That end goal was not to be a retailer but a 3P business with significantly higher margins than retail due to storage fees, seller fees, and advertising galore. Moreover as we lookout to the future cloud and AI are wonderful things to pontificate about and I’m sure the market is enormous, but at this current moment cloud is a $600B/yr industry and retail is a $28T/yr industry, yes that is trillion. So at this current moment retail is a far bigger opportunity that cloud will ever be and Amazon is a mere 3% of it and rapidly gaining share. I think people don’t grasp how long this runway is for 3P fees, ad dollars, etc as Amazon eats up more and more of the competition with unrivaled logistics capabilities allowing unparalleled delivery speeds. So for me, AWS, it is a nice story, it makes alot of money, but I think way too many analysts and investors are focused on the wrong thing when looking at Amazon and you will see tomorrow as the gap between North America and AWS operating income closes. It is absolutely not priced into the stock that North America overtakes AWS in operating income anytime soon and I think it is possible within 12 months.

I still maintain regardless of whatever today’s panic over AWS is, this is far and away the most exciting story in our markets because it involves so many segments like retail, advertising,logistics that are going after some enormous TAM’s. I still believe Amazon is a $250 stock by 2026 as the narrative slowly shifts to wow this retail business is actually very profitable and has been funding more of the CAPEX and R&D than anyone ever imagined. One of the big complaints in the FTC suit was how Amazon takes almost 50% of every dollar for items sold on its platform, this isn’t your typical low margin retailer. Again Amazon spends a fortune on R&D, about on par with the revenue AWS does, so AWS really doesn’t fund the whole company the way everyone makes it sound. As they show cost discipline and margins on retail tick up you’re going to see a monster unfold in the coming months and I stick by that.

Trends

1 Week

2 Week