10/30 Best Setups For The Week Ahead

Here we are FOMC week. People always ask me why I don’t short more things and I always tell them because they always have some silly pump in the market. I know things are horrible, you know things are horrible, the economic data supports that, but somehow we’re closer to 4000 than 3000 on the SPX, reality takes forever to set in. “They” always save the market WHEN THEY NEED TO, to me it’s akin to welfare for adults. Adults sentiment rises and falls with little numbers they see on a screen in their portfolio. It changes spending habits. Do we buy that new car? Do we splurge for an expensive trip? And behind it all is a Federal Reserve who doesn’t want to see you spending any money at the moment. If you remember 2 weeks ago, we had a FED member, I believe Mester, merely suggest “a pivot” and stocks have been straight up since. Was it a pump into midterms? It could have been because it came right before the blackout period. If we somehow decide to pivot, this economy is finished. It would just speed up the collapse. To pivot with inflation at well over the 8% number they give us would just kill all confidence anyone has in the system. It would be self immolation from the FED, who by the way, has yet to accomplish anything in their attempt to play God. All these little pumps higher in the market end the same way with the FED coming back and crushing the market in short order, it’s just one giant charade.

Let’s take a look at some charts and what’s next. Here is the daily of the SPY, as you can see we are running into a big spot here dating back to May. It will act as resistance for a bit, but ultimately this is a bullish chart for the moment. You see the MACD, you see the RSI, there is nothing to be “short” for the moment.

As we look at the weekly setup you can see that even in this little run we’ve had the MACD hasn’t flipped green yet on a weekly timeframe but a nice bullish divergence is forming. You can see the downtrend line I drew from the beginning of this decline, until we are over that, we are not “bullish” yet in terms of just buy and hold. If I had to make an educated guess, I’d say we run to 4000-4100 to that confluence of moving averages and reject there forming another lower high, which would be our fourth. I still maintain we will see 3300 or lower sooner than later just based on math and historical averages. The last time we had an FFR of 3.75% we had a 13 multiple on the SPX, we’re discussing a 4.6% FFR by Christmas so logic says we shouldn’t be at 3920 today but we do have an election in 2 weeks and what better way to fire up voters than with a little stock market rally. The risk/reward is heavily skewed to the downside and if we touch my red line, I will get heavily short.

The dollar continues to roll over ever since it hit the upper trend line I pointed out a couple weeks back. These ranges are more powerful than most understand, it’s not a coincidence to see the weakness since it rejected the top of a decade plus long trend. This chart is interesting in that it supports the concept of a FED pivot and a weaker dollar, but would they really? It would be a horrible idea to pivot before inflation is dead and that means more hikes for longer.

Oil continues to be the setup I’m most intrigued by. You can see the bullish divergence forming on the chart below. We just saw spectacular earnings from the oil names, to me, this is a multi year bull market just forming. Everyone thinks these tech names are coming back, they’re not anytime soon, and energy is going to be the new place to be the next few years. We have fundamental shortages due to years of underinvestment, we have a war in Ukraine that isn’t ending anytime soon, we have instability in Iran and the Strait of Hormuz which will be another in a myriad of potential time bombs that can send oil higher and lastly Biden is done releasing from the SPR now, so all that downward pressure on oil should be finished. Higher oil isn’t a good thing for anyone, but it is what it is, and we’re here to make money. There will be pullbacks along the way but I favor selling puts on energy names for the foreseeable future.

Trade Of The Week

Last week was another successful week as XOM never sniffed the 98 level I suggested selling puts at. 23 of 25 of the trades have been successful now, this week we’re entering a pretty chaotic period with FOMC followed by midterms and I don’t want to put anything short term on. So this trade will be a couple weeks out.

OXY was down Friday which was surprising considering the strong numbers all its fellow oil giants put up. I find it odd to be so weak with Warren Buffett gobbling it up this year to the tune of near 30%. As we’ve seen all year, every dip under 60, he boosts his stake. I still think sooner than later he takes it private. With that said my suggestion is selling November 18th $60 puts, naked. They are .40 x .45 right now. Now here is the issue, OXY, has a high margin requirement which I hate, most safe names like this have a very low 20% margin requirement, so if you need to, you can sell a put spread just to alleviate margin issues. I really don’t know why OXY has margin requirements like a high risk tech stock, but it does.

On the options side

1100 Dec 2nd $70 calls were bought on 10/27 for $6.95

6000 December $60 puts sold

1500 May $80 calls were bought on 10/26 for $8.70

10,000 March $75 calls were bought on 10/21 for $8.25

900 Feb $70 puts were sold for $8.60 on 10/20

1000 Jan 2024 $65 puts were sold for $11.70 on 10/20

There’s plenty more, but those were the most recent ones that stood out. The bottom line, like all the other energy names, you want to be long, especially with the Buffett buying every dip. This has a floor in it that others do not sub $60 and that’s why I suggested selling puts there truly whenever you want whether it’s the November expiry or further out.

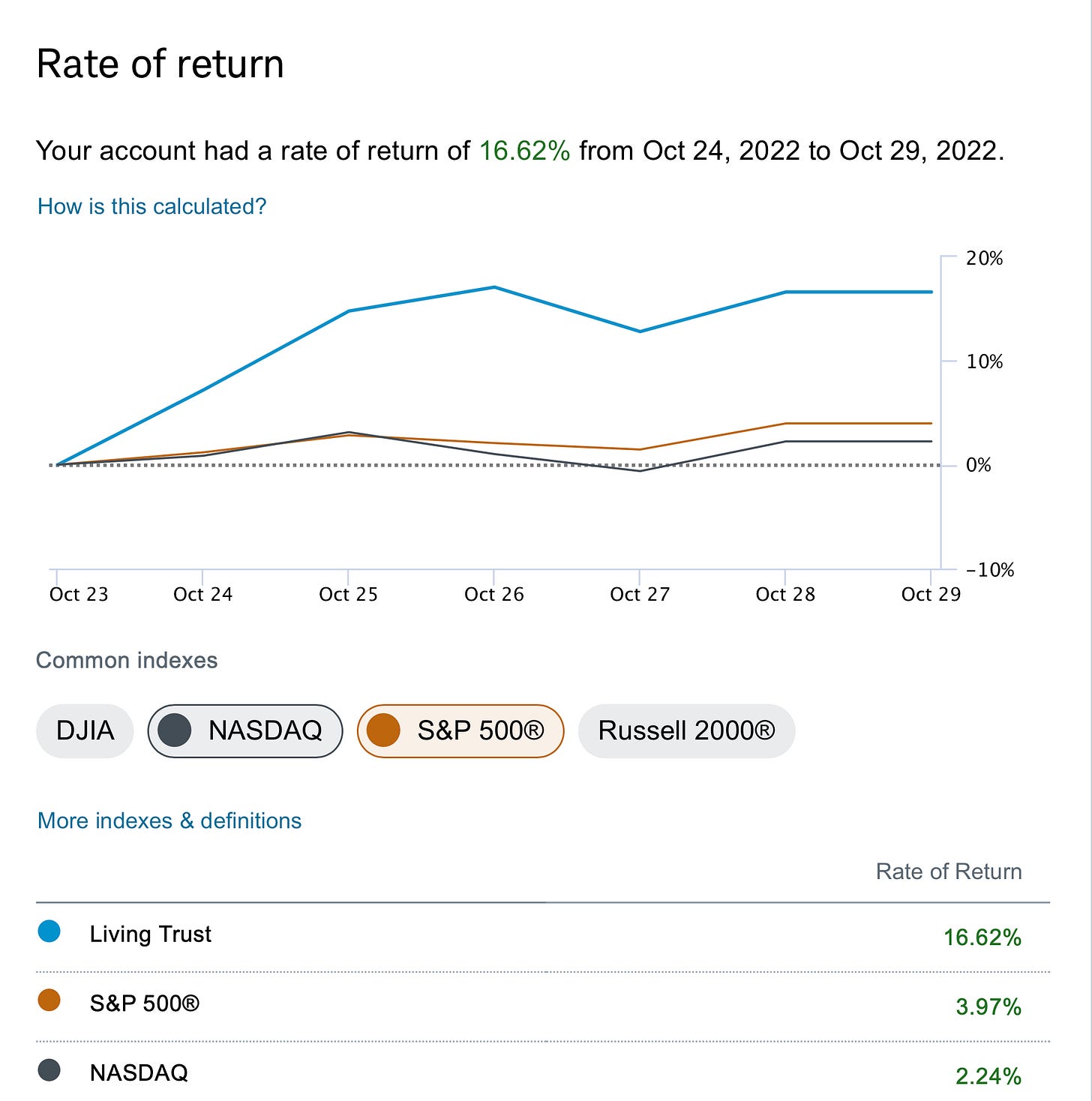

How Did I Do This Past Week?

The final week of the Twitter Arb went as expected. I was able to reload heavily last Friday on that hit piece Bloomberg put out. At the time I said it was nonsense and it turned out to be. This trade was a once in a lifetime opportunity because so many really thought Elon Musk was untouchable. It’s nice to see that even the richest amongst us have to abide by the rules set forth by society. I had one pretty large loss on META short puts and without that I would have been up significantly more.

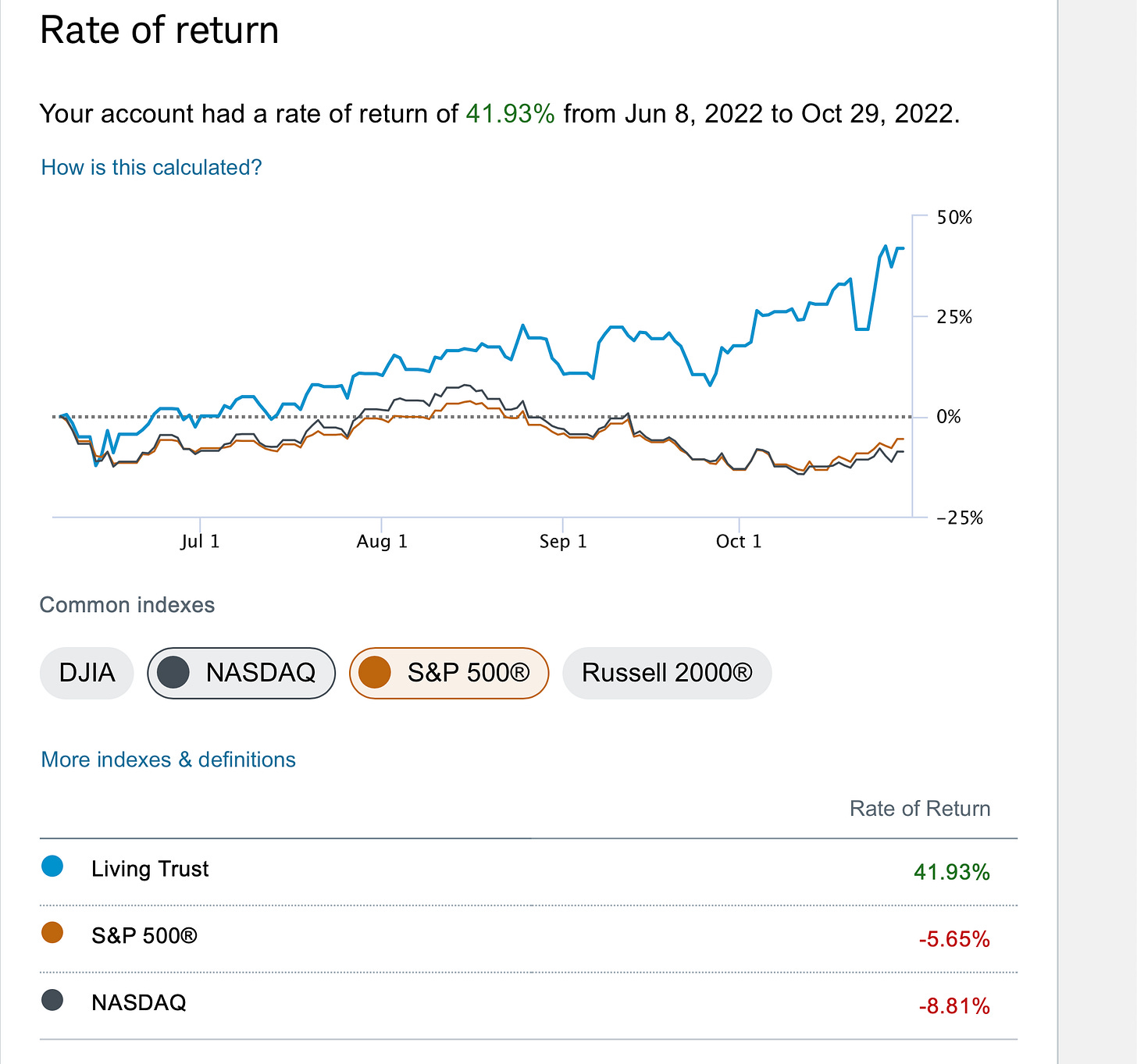

Back to June 8th when this sub stack began, I’m now nearing 50% outperformance vs the market. It’s been an incredible run through probably the toughest period we’ve seen in a decade, I consider myself lucky to have seen and executed so well on the Twitter arb in terms of sizing and positioning. I always felt the market was in a bad spot and being able to avoid it with that trade was tremendous.

As I now look to deploy all this capital with the Twitter trade over people always ask me how I would describe my style. I would say I’m a believer in PEAD, Post Earnings Announcement Drift, it’s a market phenomenon that many don’t really know or understand properly. It’s the concept that when names have a good earnings report and reaction they continue to drift for the near term. As someone who is a premium seller like myself mostly, this makes life easier when you’re selling puts and don’t want to take assignment. Take a look at Netflix recently and how it just continues to roar higher after earnings. I think one of the big mistakes traders make is attacking names of weakness because of fundamentals. Again look at Google, could be argued it has the best fundamentals of any company in our markets and it just continues to drift lower. It has no strength and although it is a deep value, you don’t want to trade it because there are no buyers now. I always get the buy and hold crowd telling me I’m wrong, the thing is, while Google is a great long term buy TODAY, it isn’t a great trade, and I’m here to make money. Amazon is now flat for 5 years, Meta is flat for 7 years, buy and hold may be a proper long term strategy for some, but it’s not for someone like myself who is calm and in control of what he sees in the options flow and charts. As I’ve stated before, I do think we’re in for a bumpy road where we go sideways for years, I don’t think we take out last years SPX highs anytime soon. We’re entering a period where stocks stop going up everyday without the FED behind them and you have to be able to make money with stocks going sideways and that involves selling premium, not buying it.

I also think going forward into all this uncertainty, a focus on activist involved names will be better for selling premium as there is a floor. Some of the names like

PINS

PYPL

SPLK

CRM

OXY

WIX

Some Charts For You To Consider

I just ran some scans to begin my research on setups for the week ahead, I always try to begin with weekly bullish engulfing and weekly bullish MACD crossovers as a starting point, from there I try to overlay them with charts to decide what strength I want to trade ahead. I also try to look through all the sectors to see what sector show relative strength, I don’t want to be in any weakness whatsoever. It’s just part of trying to ensure you’re directionally right. Look at all the META calls we saw the last 2-3 weeks they didn’t work out, so options flow alone isn’t the whole story.

Weekly Bullish Engulfing Candles

LIN

NKE

BA

VRTX

LULU

MRVL

YUM

GLW

RBLX

HRL

ULTA

PINS

J

DKNG

TRU

CUBE

PGNY

ENVX

CHGG

NVR

SHAK

Weekly Bullish MACD Crossovers

AMGN

JNJ

HD

ABBV

PEP

ORCL

ASML

CSCO

CRM

RTX

HON

LMT

IBM

LOW

INTU

GS

UL

MDT

BLK

BKNG

MMM

ITW

MAR

AON

VLO

HSY

KHC

RACE

KKR

MSCI

TROW

I hope you all have a great rest of your weekend and I will see you tomorrow, I will write the write-ups later in the day this week because there are so many earnings and I want to see how markets react to them first.

Now that the Twitter trade is wrapped up, how did you all do with that one?

You are one of the most well-reasoned humans I have ever come across. Thank you for all the great insights!

Great write-up for the week. Are the scans that you run every week done in Thinkorswim? Can you share the setup at all? Also, how does WMT look to you right now? Came across my scan last week and I liked the chart but didn't touch it.