We got a big move up on the NFP data this morning. Honestly I don’t know what to say anymore because if the NFP data is real, we can’t really keep cutting rates even though odds are at 90% for a cut next time. Was today a print for the sake of the election? I don’t know but if jobs are this hot, you cannot be cutting rates into that. There is still a lot of time left today and I imagine there will be selling into the weekend of the unknown in the middle east but overall we’re back over the 8 ema and the market bounced right where it needed to because if we broke that recent breakout to the downside, we would have had major issues. Barring any escalation in the middle east we still look set for markets to go into the election at all time highs.

Recent Trades

TCOM - In monday’s recap here

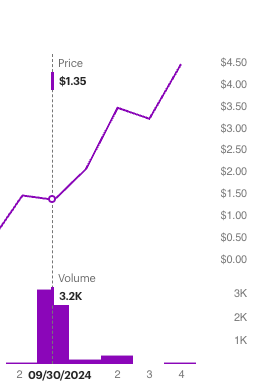

I noted a couple weird trades, the in the money put sales at 65 were really fishy with the stock at 63.xx. This morning it is gapping up huge over 69.50, those put sales from monday at $5+ are now under $2. That was an incredible trade 4 days later having in the money short puts rise 60%. Those January $80 calls I mentioned, they were bought for $1.35 on monday and are $4.50 right now

Today’s Unusual Options Activity

Here is today’s link to the database, it will be open until monday morning and the opening bell, I will have the rest of today’s trades added by tonight.

Keep reading with a 7-day free trial

Subscribe to The Running Of The Bulltards to keep reading this post and get 7 days of free access to the full post archives.