10/6 Recap

We opened this morning with news that job growth was stronger than expected and equities plunged, but they’ve now reversed course for a huge 80 pt swing on ES.

We’re at the point in the cycle where too many people have jobs and too much money and that means everything the fed has done to this point has been a complete failure which means the fed has to keep doing what its been doing and hoping and praying they’re eventually right at some point in time. Now, what does that mean for equities? Well, the higher rates go, the more adjustments have to be made to valuations. When we talk about an FFR of 5.5% now that means a return of 5.5% with no risk which now means a price to earnings ratio of 20 which is an earnings yield of 5% is no longer cheap and the higher rates go, the lower multiples need to go.

So we’re stuck now in the same spot we’ve been in for months, what is the right valuation for equities when we have no idea how long rates can stay this high? That remains to be seen.

The SPY is putting in a powerful candle today reclaiming the 8 ema for the first time in weeks. Momentum looks set to turn positive soon as well.

Short term, it looks like we’ve found a bottom for now and bank earnings starting next week will probably tell us alot more regarding the economy now and in the quarter ahead before big tech reports later in the month. With today’s news of more people with jobs and money, I’m not sure fundamentally what the bear case is for megacap tech now. The re-rating of the equities based off rates is a whole separate topic, but fundamentally businesses should post very strong numbers in Q3 and Q4.

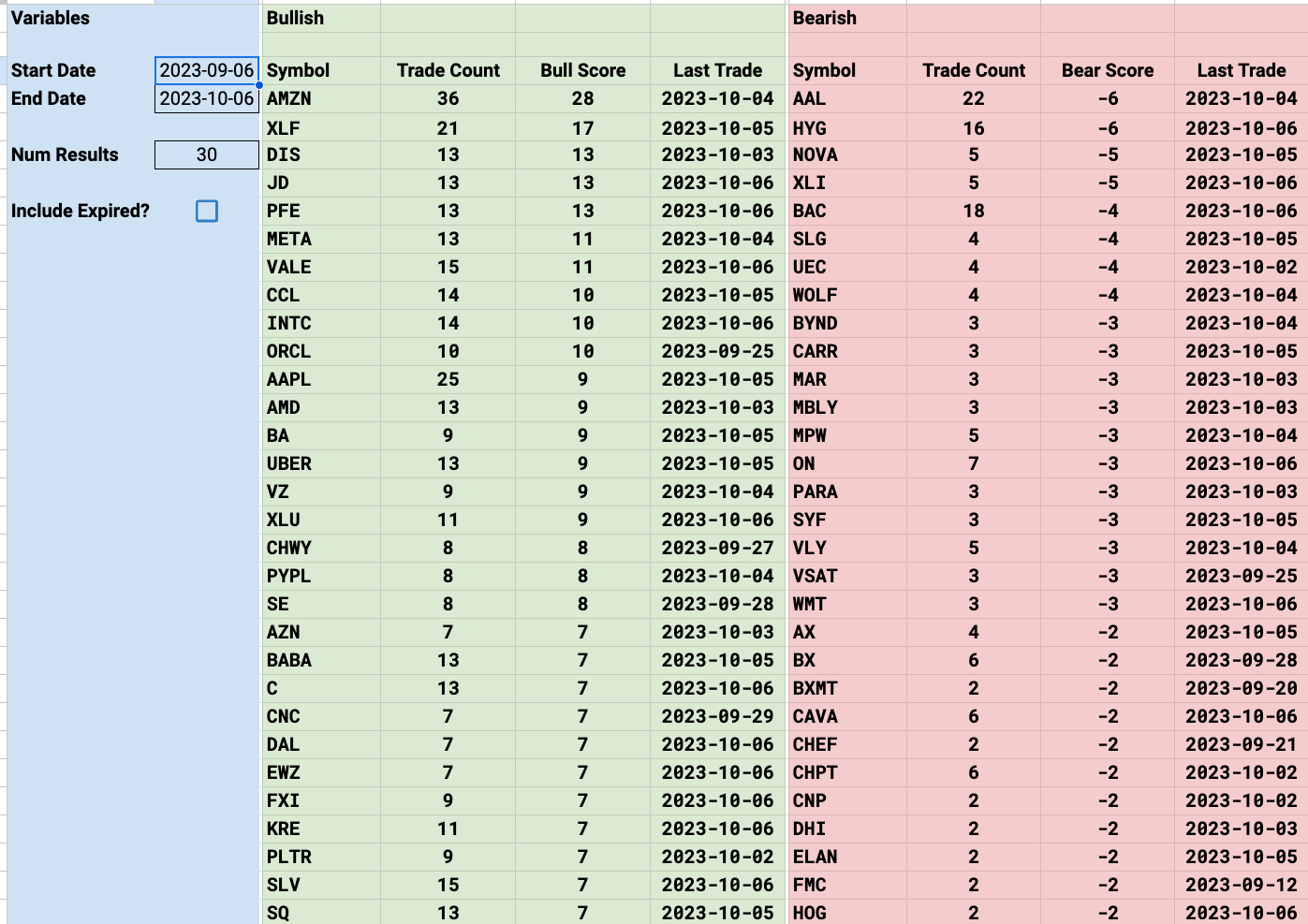

Trends

Week To Date

2 Week

1 Month

Today’s Unusual Options Flow