10/8 Earnings Preview

Before I get into this week’s earnings preview I want to say something. The purpose of this substack isn’t for me to hold your hand and let you copy off me like in high school science lab. I get far too many emails telling me the data doesn’t work, I don’t do enough, I don’t show enough of my work, and the options don’t predict anything. I’m here to tell you, that if you thought there was some magical reason options would give you the right answer to every question you sought, your expectations were unrealistic.

First off, did you know only 7% of funds beat the market? The whole investment community that exists and only 7% can beat the SPY, it isn’t easy to do.

That was here in Barron’s recently Barron's

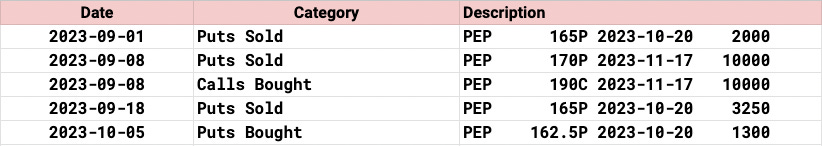

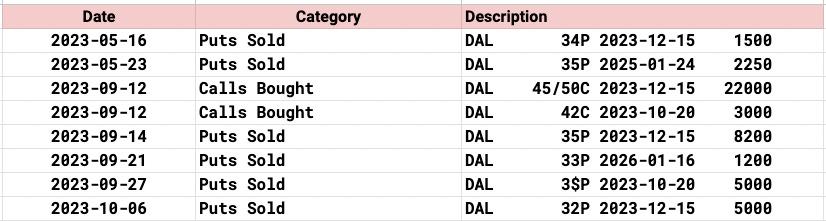

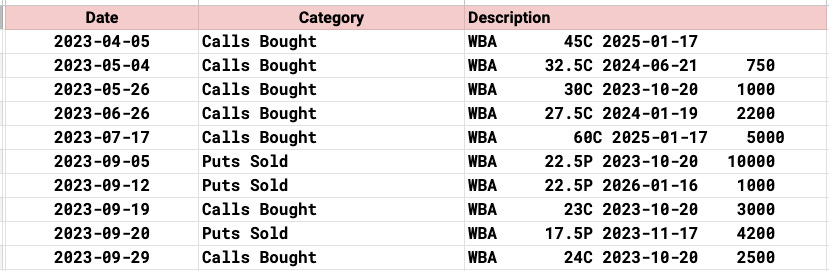

So if 7% of fund’s beat the market and I’m trying to highlight all the unusual options activity I find daily, what do you think the success rate is going to be? It surely isn’t going to be 90% or something. You have to realize these bets are bets like anyone else places and they’re placed after alot of decision making has occurred between analysts, traders and fund managers. Even with all that, they too can be wrong, but many times they’re right and the payoff is huge. You saw the RIVN puts last week go 30x overnight or we’ve seen in the past in here where COHR was seeing call buying 75% OTM for a couple days and then it pops almost 50% a week later earlier this year. Not every trade works, but many do. Moreover, what do I tell you all to do with the data? I tell you constantly to use it, in alignment with charts, to understand where you want to sell puts to get long a position. When I note put sales everyday, those are not potentially hedges, those are funds telling you what level they’re willing to go long at. Data is data, what you do with it is up to you, there are so many ways to utilize this information from copying it directly to using it enter trades lower. If you notice everyday when I highlight the 5 most interesting trades of all the ones I see I always post a chart with all the accompanying options flow I’ve noted. The purpose is for you to see where the big bets are going and to have a better view of where on a chart you may want to set your alerts, sell puts, whatever.

What I’m getting at is this, before I ever wrote this substack, I compiled a list of all the days unusual activity and I would spend my outside market hours going over charts one by one, to see what trades interest me and I would execute them. Last June when I started writing this, everyday I would post my entire book of trades, I had alot going on. What changed? Alot, previously I wasn’t at my computer all day, I would let my scan run and send out a recap after the market closed early on. Then alot of people began asking me to send it early so they could have time to act on things intraday, I obliged and began sending it out at 12:30 my time in the middle of the day. Then, many of those realized that wasn’t fast enough as options move very quickly many times after they’re placed, so now we have the live part which occupies my entire morning from 8:30 to 12:30 where I’m there every single morning posting every single odd trade I see the instant it comes in. I never did that before. I never spent every second staring at my screens, typing up trade by trade, then in the middle of the day, while posting all that, pulling together all the charts/tables for the write up which is another time consuming task. You can’t hold open positions in size unless you’re dedicated to watching every tick and I just can’t.

Aside from all that, I’ve got alot of real estate developments I’m working on daily as that’s most of my focus now that I’m retired. So to be honest, what began as a small time commitment of me thinking I would just share my notes when the market closed last year in a simple recap has turned into a big project that takes up alot of my time and I just don’t have the ability to manage 30-50 trades like I used to early on while doing all of that. Now don’t feel bad for me, this has become an incredible venture on its own as one of the highest grossing substacks, but there is only so much time in the day for me so I made the decision to not be active anymore. It helped that I do feel Amazon is dramatically misplaced after years of lag and I have a chance to place a levered bet and watch my thesis unfold.

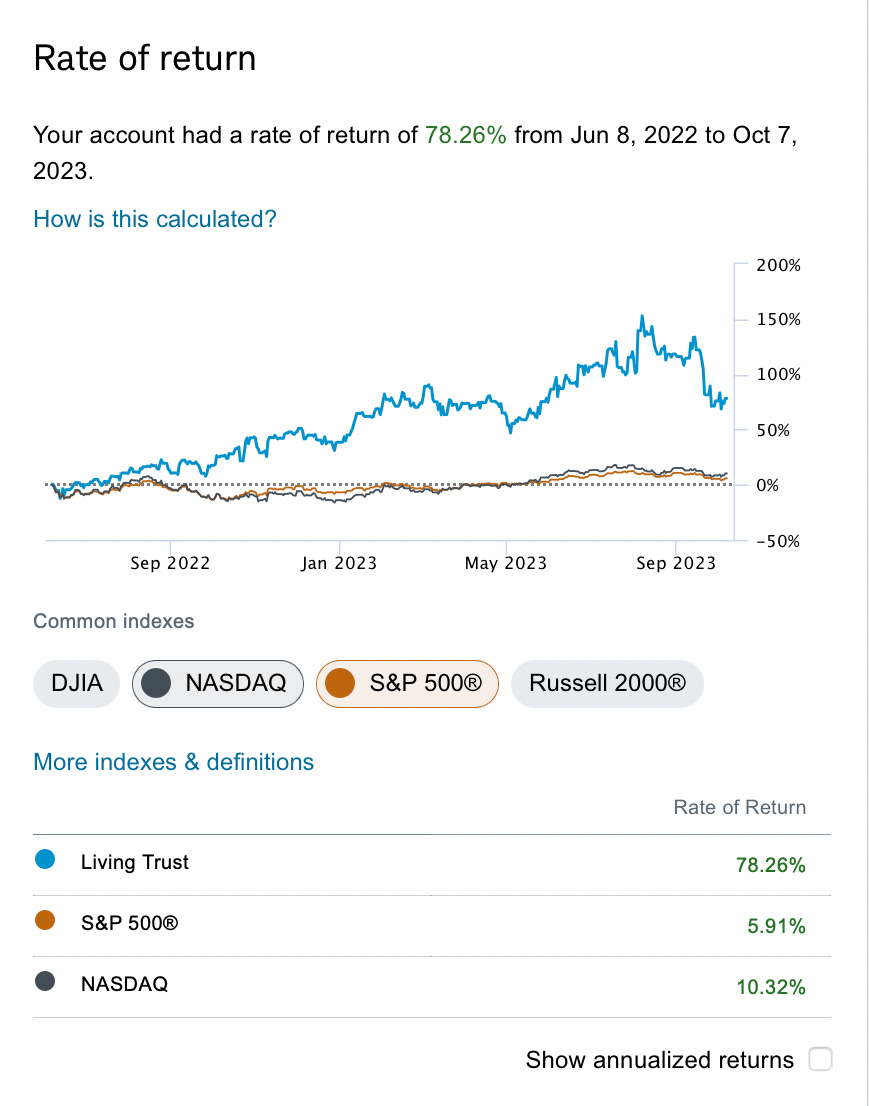

Overall, the point of all this is to say all these emails/complaints about the data being wrong or me not being active are just too much. I’m giving you access to data that costs many multiples of what you’re paying directly from the CBOE. I’m then modeling it for you to show trends, I’m organizing it for you and sharing it everyday along with insights on what’s standing out. Instead of realizing that there is a treasure trove of information for you to dig through daily, I’m getting chewed out because you can’t copy my trades? Except you can, you know what I’m in and I’ve posted every trade I’ve taken from the day this began. I’ve always posted what I’m holding and what my returns were, even with the big drawdown recently in the market and in that position I’m in now, I’m still outperforming the market by almost 15x since this substack began 16 months ago.

So all I’m trying to say is, of course the options data isn’t some guaranteed cheat code, if it were guaranteed, you’d be paying a hell of a lot more than what I charge. I’m simply sharing my daily notes with you to try and help you see where the big bets are being placed and you’re supposed to be using it to adjust your positioning, that is all.

This Week’s Earnings Preview

Not many names this week, but I will break it down for you by premarket/afterhours

Tuesday Premarket

Thursday Premarket

Friday Premarket

I hope you have a great Sunday and I will see you tomorrow.

I just don't understand some people. Those writing such emails are just pathetic. But still most people here seem to be glad for your work and commitment as I am. Thanks

Tell the haters to stick it where the sun don’t shine and unsubscribe!