10/9 Recap

We gapped down this morning on the geopolitical tensions potentially causing chaos in our markets. Oil was up $3 after the attack on Israel. This stuff has been going on for decades, it always seems to ramp up for a few days then return to normal. This one might be different because so many innocent civilians died, but overall it just seems like more of the same. As for the market aside from that, we have some big datapoints this week and the biggest of them might be coming from Amazon as their Prime Day even kicks off tomorrow. Last quarter their other Prime Day event surprised by 50 million packages sold over the estimates. If they surprise again, it’s going to be hard for analysts and pundits to continue with the “consumer is struggling narrative”. We will see what comes of that, we should have an update by the end of the week.

The SPY went down and retested the 8 ema after breaking above it Friday and now it looks like it is nearing highs of the day. The gap down was bought up. We just seemingly have an endless list of reasons to sell and never any to buy, but the price action is showing buyers were not really worried about the events of this weekend. A move up into the 100 day just below 440 is my short term target.

Oil is the asset everyone has their eye on now, it was in a very nice downtrend before the attack but spiked up right into resistance and faded. Obviously lower oil is a win for everyone, a quick move back up to highs would not be ideal, let’s see what comes of this but a move on the lower end to 76 would be the best outcome for equity bulls.

Trends

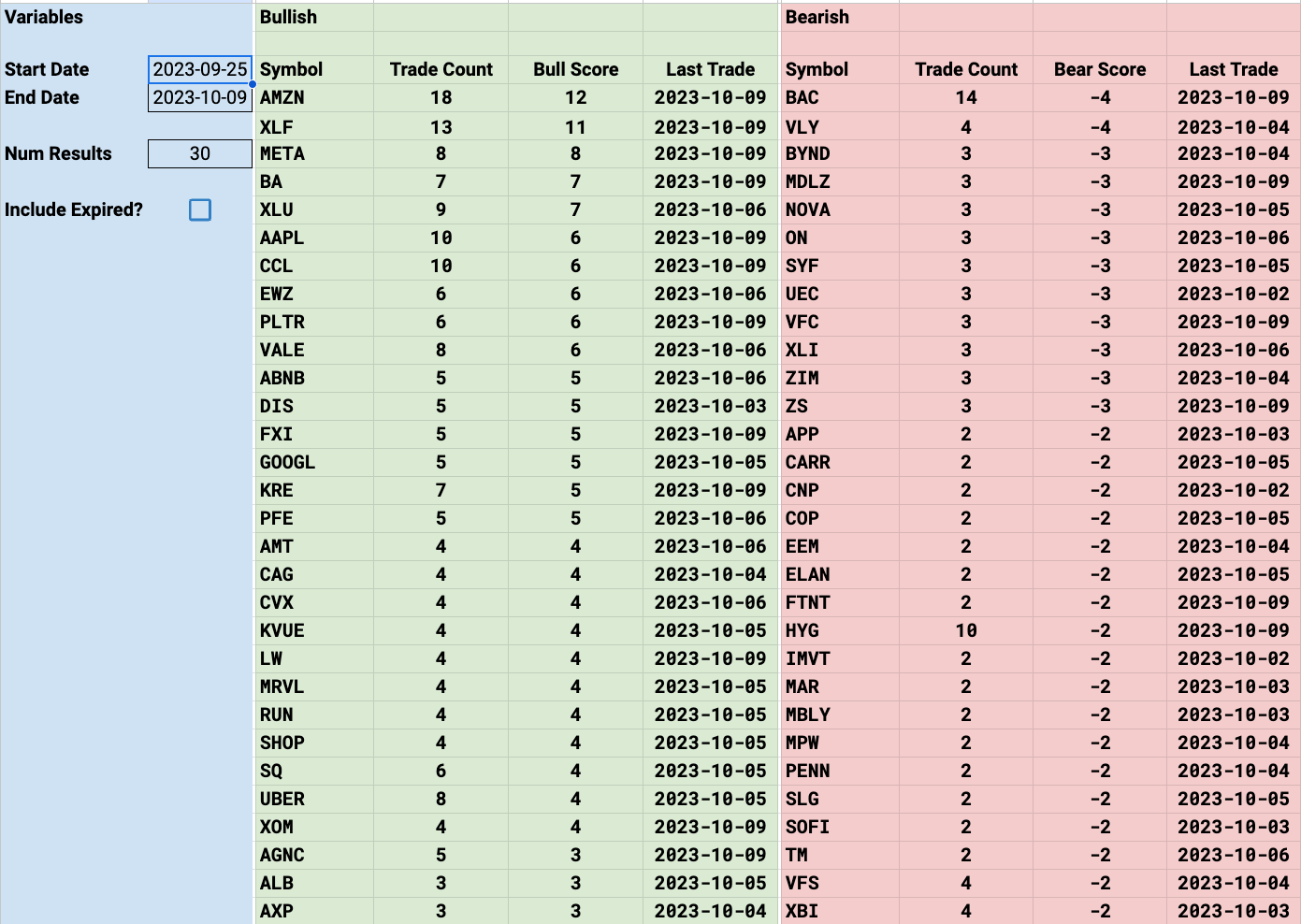

The XLF has been the top trend for the last week now, interesting to see that before all the banks starting reporting this week with the narrative being that the banks are in trouble. The XLU saw alot of action last week after the crash in utilities, it was green again today, that move was really overdone to the downside.

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

The one that stood out to me today was FRO, in Friday’s recap I noted that odd lot of 8000 calls bought and over the weekend the deal they made with EURN led to a 6% spike at the open. Just impeccable timing by that call buyer 1 day before.