10/9 The Week Ahead

Alright, I’m back. Let’s start with some charts, and there is ALOT of them, and then at the end I will have a longer writeup on my thoughts with this substack going forward.

Let’s start with the weekly chart, as you will notice we bounced back over the 2020 highs, the previous week we had dipped below that level(the line). Now the issue is all those moving averages are sloping down and what we’re facing now is a prolonged down period where all those averages take time to come down, flatten out, and then we can retake them. For now the market continues to look horrible.

The key number to watch going forward on SPY is 358.75. Now as I said above, we broke that last week, but that is the 2020 high. If you’re bullish you don’t want to see the market break and close at new lows again. We did it once but had a small bounce last week.

Let’s have a closer look. The arrows I posted are there so you can see a series of lower highs all year. This is a bearish setup. We are bullish until we close over one of these. What you will notice last week is we tested over the 200 weekly DMA and then closed below it for the 2nd straight week.

The setup reminds me alot of the Amazon post I made in late April that you can see here.

While I’d love to be an optimist with this as well, Amazon is now 5 months into that broken chart that the SPY is just coming to. So if I had to take a stab here, I’d say we’re in for a prolonged period of ugliness because of the technical damage that has now occurred. We just broke levels you never want to break. It doesn’t help things when you have geopolitical issues like Russia threatening to attack us on our own soil yesterday, you have oil soaring which won’t help inflation, and a FED hellbent on seeing people lose their jobs.

The dollar meanwhile was very strong last week, it formed a nice hammer on the chart trading over all the key moving averages. It’s pretty simple here, dollar up, stocks down. That’s the trade. Look at the chart below for this whole year.

If you zoom out further, I posted this a while back, here is an update. The dollar has some stiff resistance ahead at the top of this trend. If you look back at the 2015-2017 period where it traded along the top of this trend while the RSI cooled off you can see what I think is ahead, a prolonged period of dollar strength which would not be good for equities. As for the dollar itself, the RSI needs to cool off, look how off the charts it is on a monthly timeframe. No asset stays that overheated forever. As it does we will have small rallies in the market.

The one that inflicted pain on us last week was oil. The Biden admin strategy of dumping our strategic reserves to send oil lower into midterms backfired because OPEC just decided to dramatically cut output. Look at this candle below. While we artificially tried to lower prices, they’re now artificially trying to boost them, this whole charade could simply be avoided by drilling more here but the current administration just doesn’t want to. I’ve said for a while I thought oil was going back higher once the October SPR release was over and that’s playing out now.

So What Do We Trade Now?

Let’s start with Twitter. No really. We were just blessed with a stay of execution for Elon Musk from Chancellor McCormick. Let me summarize what just happened and what is going to happen. Elon Musk agreed to pay $54.20 last week, well he agreed to pay it months back, but he finally, for once, decided to be a man of his word and go through with the deal. He makes it sound like he had some revelation and it’s part of this elaborate attempt to copy WeChat in America via this “X” project of his, but the reality is he tried everything humanly possible to get out of this deal and just couldn’t. So in the interest of not paying PJI which is interest he owes Twitter shareholders for dragging out this nonsense, he agreed to go through with his original offer.

Here’s where the problems began and you’ve probably seen a plethora of my tweets on this all. Basically, the world’s richest man doesn’t have the money. Rates have skyrockets, funding partners have backed out because this is truly an awful deal. You have Twitter doing $1b in EBITDA and now $1B in debt service, this deal could actually end Elon Musk over time. At worst he will have to continue selling Tesla stock for a prolonged period to fund this thing unless he can right the ship and quick.

So what happens now? There are 2 possible outcomes.

Elon pays us $54.20 by the 28th of October. This is what the Judge is hoping for. She literally gave him a rope to hang himself by last week by offering this. Her tone basically told Elon if he doesn’t close by the 28th she will ruin his life in a trial he won’t win. The reason the 28th is the date is Tesla earnings. Those come 10 days before. Elon cannot sell Tesla stock until after Q3 earnings. There is a blackout period. So Tesla reports, he sells enough to satisfy what he needs and Twitter is acquired. The action in Tesla stock recently tells you this is likely to happen. It lost 15% last week and it wasn’t because of bad delivery numbers

Elon decides he is a masochist and does not close this deal by the 28th. He breaks his word again, this goes to trial and we et $54.20 + interest after the Judge forces him to liquidate assets to fund this.

That’s it. There is no third outcome, one way or another he will acquire Twitter. Timeframe involved now just depends on how honest a human being Musk is. So this trade has given us 3 more weeks of free money to sell puts on it. Actually friday someone sold 8,000 $46 puts for this coming week and I will say that is my best trade AGAIN. I know it was last week as well, but you have the market pricing in a potential deal falling apart because of who Elon is and the realities say that is not a possibility so when there is free money, you take it, right? It has to be done.

Other Pockets Of Strength

When I begin my discovery process every week it starts with a few things, I look at all the ETF’s are try to see what had strength. A few had green candles this week XLE,XOP,XLI,XLV,XLB,XHB,ITB,XRT. Within those, I try to look for nice setups. The problem is even those green candles on the weekly ETF charts, is many still look BAD. Oil looks good, materials look good. The XLI & XLB seem to be rotating to a position of strength here but nothing individually really stood out to me when I looked over their components. What stood out to me as a shocker was Casinos. No, really, they all put in monstrous green weekly candles.

Here is LVS, impressive strength amidst all the blood in the market.

Here is WYNN

Now admittedly I don’t follow casinos much, they’re just not equities I like to trade. WYNN is riddled with so much bad debt from covid, the lockdowns in Macau by the chinese government have weighed on them, and geopolitical tensions with the US and China are always going to be at the forefront with these 2 since they’re basically Macau centric companies nowadays. With that said as a trade short term, this seems like where money is going to hide. What concerns me more is I think we’re in a recession right now, in the 2008 GFC casino stocks died. LVS went sub $1, so in a real recession, this is the last sector you want to be in. Short term, there probably was news out of Macau and I recall posting many LVS bullish trades the last few weeks, so money was flowing that way. IF you want to trade these, selling puts lower is the way to enter.

I’m all cash now after having Twitter called away last week. I will be re-entering tomorrow with short puts. Look at the first few charts I posted, this is either a market bottom here or we’re going into the abyss. I still stand by my previous calls for 3300 on the SPX and in a worst case scenario 2800. Rates will stay higher longer, multiples will compress, and the last time we had a 3.75% FFR the multiple was 13. For the moment analysts are at $235 of earnings(I don’t see it) and if they’re right, but we get a 13 multiple we’re at 3,055. We are currently at 3,650. So if multiples do compress to historical norms, we’re much lower. That’s all a moot point, in here, I trade what I see that is all. Week to Week is my focus and for the next 3 weeks, until this Twitter saga is over, the risk/reward of playing that vs the market is a no brainer. The market will not outperform it in that timeframe, not a chance, so it will continue to be the focus of my attention.

Final Thoughts

Last week was a whirlwind, I’ve never made that much money for myself in 1 day before. Those who have been here long enough know how incredibly long Twitter I have been for the last 6 or 7 weeks. I never really thought Elon Musk had a shot at getting out of the deal but in the back of my head, knowing him, I always worried something bad was going to happen. It left me in a spot where I really did want to take some time off and just not even want to mess with this chaotic market for a few weeks/months and just enjoy some time off. Then I started reading the emails you all send me followed by the comments on my last few posts and I felt like I’d be letting some of you down by taking break so here I am. This is what I mean

When I started this substack in June. I did it as I mentioned a few posts back the day of the Sierra Wireless unusual options trade I posted on Twitter that nobody paid attention to. While many follow me for my indepth takes on Amazon, that’s not my passion. Amazon is the most fascinating company to me and yes I joined Twitter late 2021 to voice my concerns about how things were being run there but my passion has always been “the real market” that is charts and option flows. In the end as you’re seeing here, that is what actually moves the market. Coincidentally, the market happened just crumble even more from the onset of my substack and my performance gap has widended dramatically. After this past week with Twitter, I’m nearing 40% outperformance of the market since this substack began June 8th. That’s just crazy to even me seeing myself outperform by 40% in just 4 months. I think this might be my best overall stretch ever if I’m honest in terms of Alpha generated.

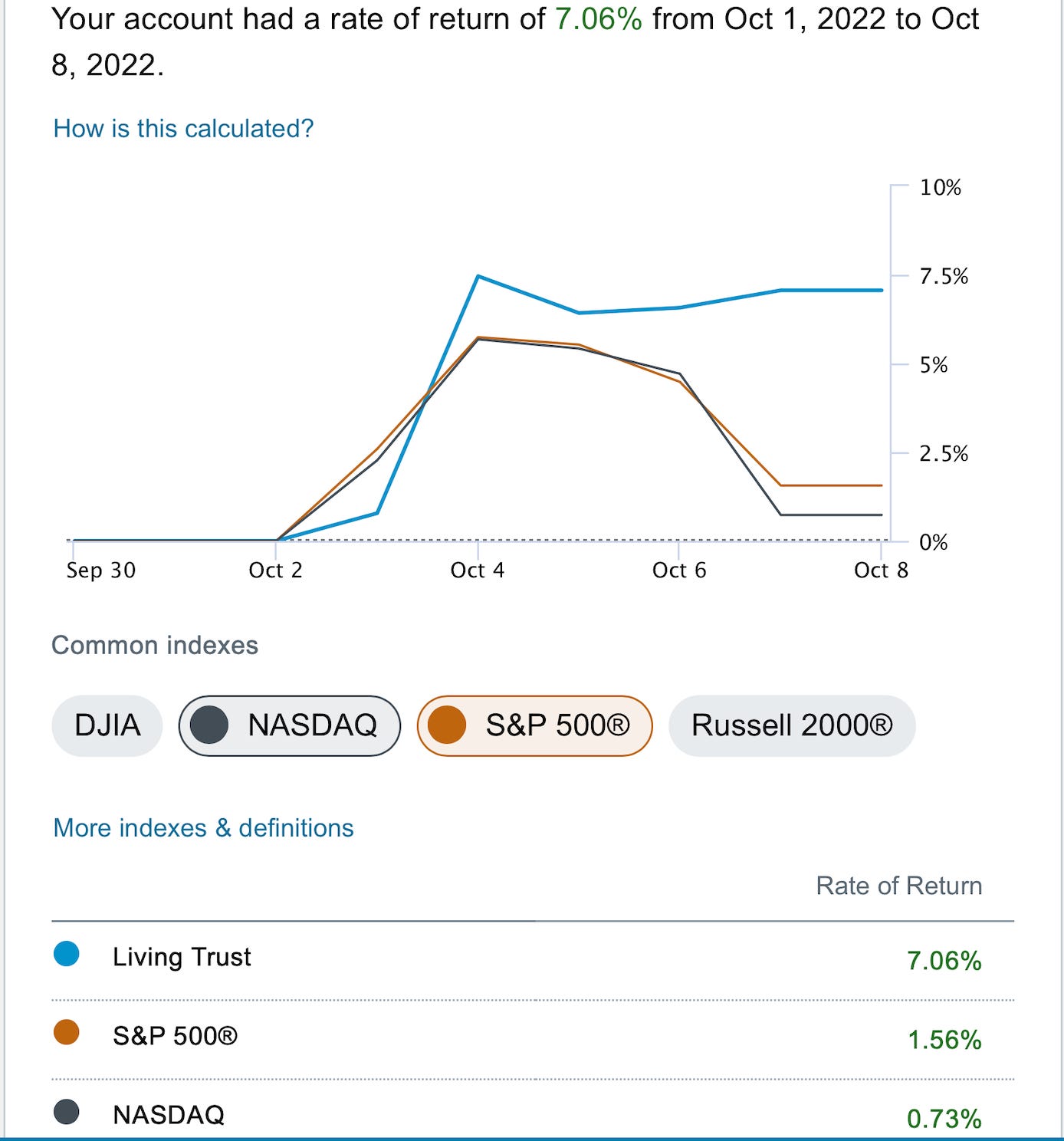

Last week I only returned 7.06% in my trading account because I got conservative with my covered calls on Twitter. I wasn’t expecting the takeover to see the news it saw before the trial. Elon was fighting tooth and nail then just folded out of nowhere. Although I was mad I missed so much upside, it was another week where I outperformed both the S&P and Nasdaq by alot.

Overall as month 4 wrapped up this week, the divergence widened even more and I’ve returned 25.92% while the S&P is down 12.02%. You can see below even before I got into Twitter in late August I still had a wide gap vs the market, and while many of my other positions I’ve had to take losses on recently, Twitter did what I thought it would do which was protect me into what I thought was a weakening tape. It did it’s role perfectly.

So in the end I’m not heartless, I’m happy to see many of you progressing and improving your abilities in the market. Although I am a bit burned out by writing these long posts daily, I’m going to stick around because I don’t want to let anyone down. Again I originally started this with the idea of posting the unusual options trades of the day and which ones I thought stood out. It’s evolved into an overall market commentary, going over my new positions, some of you wanted me to launch a discord and post my trades intraday,etc and it just became far more than I originally intended.

Hope you all have a great rest of your weekend and tomorrow I will be back with the unusual options action.