1/10 Recap

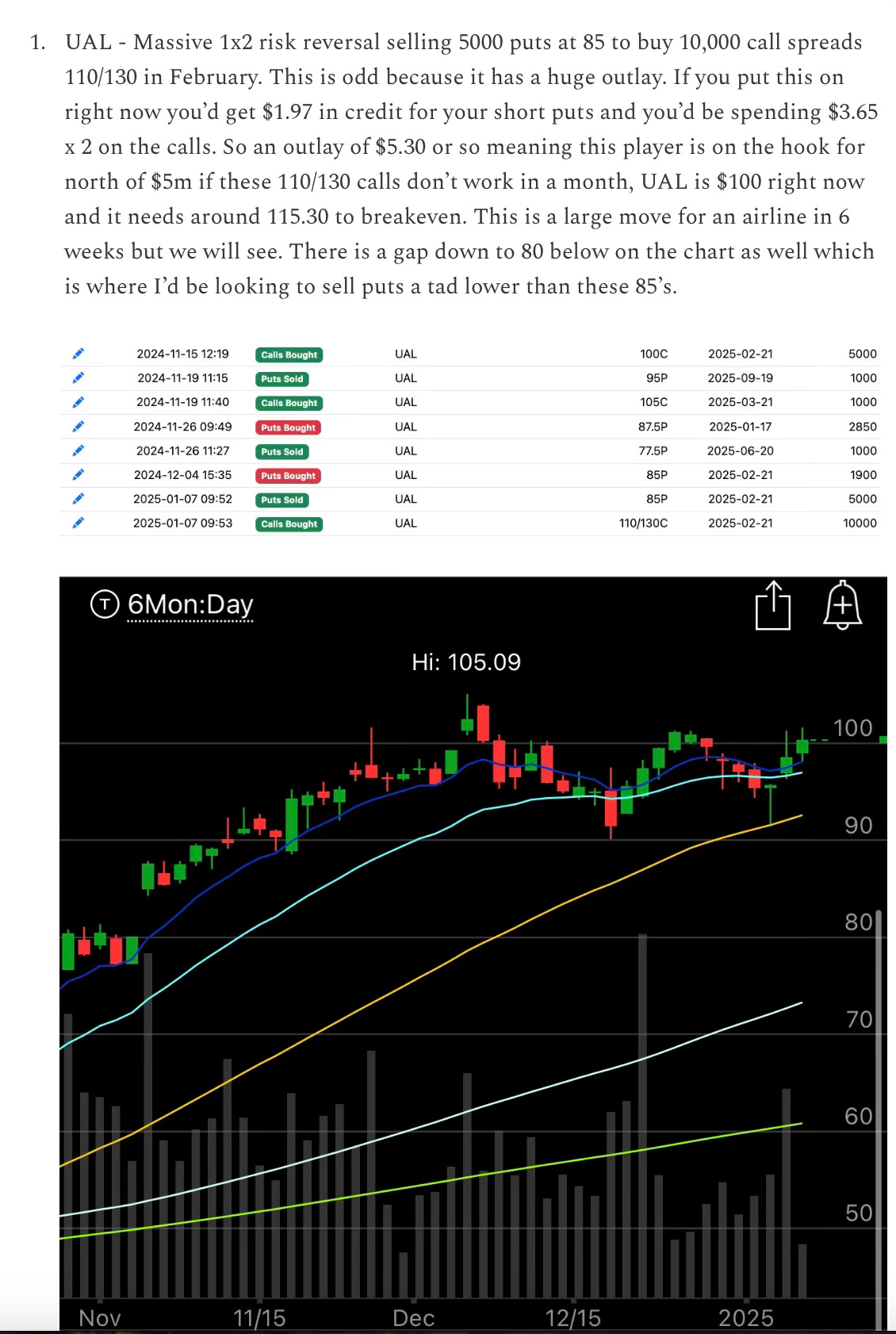

The SPY looks absolutely AWFUL right now, we’ve been in this bearish trend for a while now, but we’re losing the 100 day today. The jobs number this morning was great, too good in fact, it means the economy is doing great but that isn’t good for tech stocks because tech stocks need lower rates is the theory. Actually large cap tech loves high rates because they’re printing all sorts of cash and putting them in short term treasuries so the megacaps are big winners of higher for longer rates. The losers are all these overvalued small cap tech names but today panic happens, but sooner than later you will see how good these high rates are for large caps, probably in 2 weeks when you see how much interest each one of these large caps generated on their cash pile. For now though, the market which is mostly tech looks weak, the non tech names we’re been discussing for a while continue to do really well look at these EQT and BP I’ve highlighted a ton recently they’re doing great in this environment. They will rotate back to tech stocks at some point, they’re all we have, but for now they’re buying other stuff.

When I say they’re all we have I’m not kidding, look at this, the last 2 years all the earnings growth was from the Mag 7, this year we have more parity, but the Mag 7 remains the bulk of what we have.

Looking at the weekly of the SPY, we are toying with possibly closing below the 21 weekly EMA today, we have not done that since late 2023. This has been an incredible uptrend we have been in, but all good things do come to an end and it appears barring a stick save this week or next, momentum is rolling over and we’re going to break that trend with a close below 579.88 on the SPY. So please be cautious with your positioning here. Personally you know my barometer, the 21 ema on the daily, below that, which we’ve been for a few sessions now, all short term positions to the long side should be off the table.

Recent Trades

UAL - 2 days ago in the Tuesday recap I noted these UAL bullish trades and it was up 7% premarket to $111 and in today’s selloff has fallen back to 109.77 right now. I mentioned the other day the short timeframe involved here combined with the size of the bet and this player was right on the money with airlines all exploding higher this morning.

My Open Book