11/1

A new month begins and right away we have a plethora of datapoints with the biggest being, what will Jerome Powell do and say today. Will he hint at higher rates? So much is riding on the hope that he is done hiking right now. What if that were to change? We will see. Lot’s of big earnings after the bell from PayPal, MercadoLibre, Airbnb, and Etsy. Will give alot of readthroughs into many sectors.

The SPY gapped up over the 8 ema for the first time in a long time today, is this a trend shift? We won’t know till the close but so far it is looking good with rates pulling back as well and the downtrend broken.

The RSP which is the equal weight SPY is red today and the IWM, below, is also red. This is a very narrow market, not much is working and I’ve tried to tell you this for the last few months, truly, outside of a few megacap techs, there really isn’t much you want to own as long as rates are up. If we get any hint they’re coming down, everything else probably works, but I’m not sure we get that hint anytime soon and the high rates are backbreaking for so many of the names in our market.

Some Thoughts

These last few months have been tough in here where people email me upset that I’m not posting what I’m doing day to day. I’ve been very honest with you that I don’t see much that interests me and I’m just sitting in those Amazon leaps, that’s been the right call the market has done nothing and Amazon has been the best performer since it’s report in early August. You don’t have to place 50 trades a week to outperform the market, alot of you seem to think that’s the case. You have to pick your spots, attack where your confident and that’s it. I never changed my thesis even with the recent Amazon dip and it did everything I thought it would in terms of surprises on its report. Again you have to do what’s right for you, for me, this is the right trade as I believe 2 years of overspend on capex is going to turn into some serious cashflow and outsized performance as it moderates.

With that said, I do postal least 25 trades a week of interest with the 5 everyday, is every one going to work, no, but alot do and the whole purpose of this substack to share the unusual things I find in the options market daily, not for you to copy me. If you do want to copy me, then buy those Amazon leaps, they worked very well relative to the market since I entered.

Yesterday I highlighted the GNRC calls and it’s up 14% today, those $90 calls I noted yesterday are up a few hundred percent today.

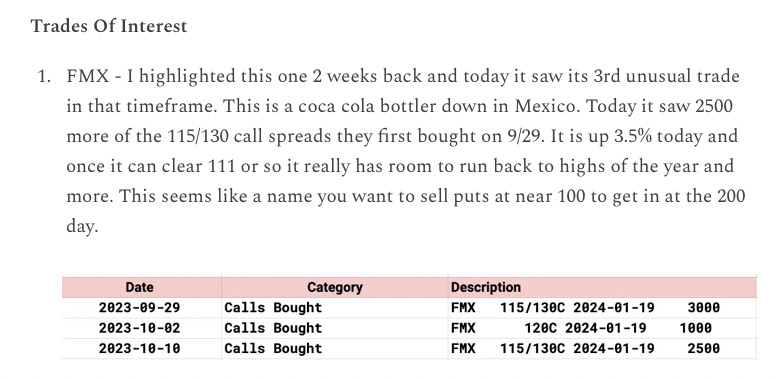

Another name someone pointed out to me today was FMX I highlighted it in the 10/10 recap, its up 15% in the last 5 days.

These recaps everyday have tons of information if you’re a self starter, if you’re not and you’re looking to copy someone, then you’re probably in the wrong spot, but if you can take in all these unusual trades and come up with your own way to play these names, lots of people here do great things with this information.

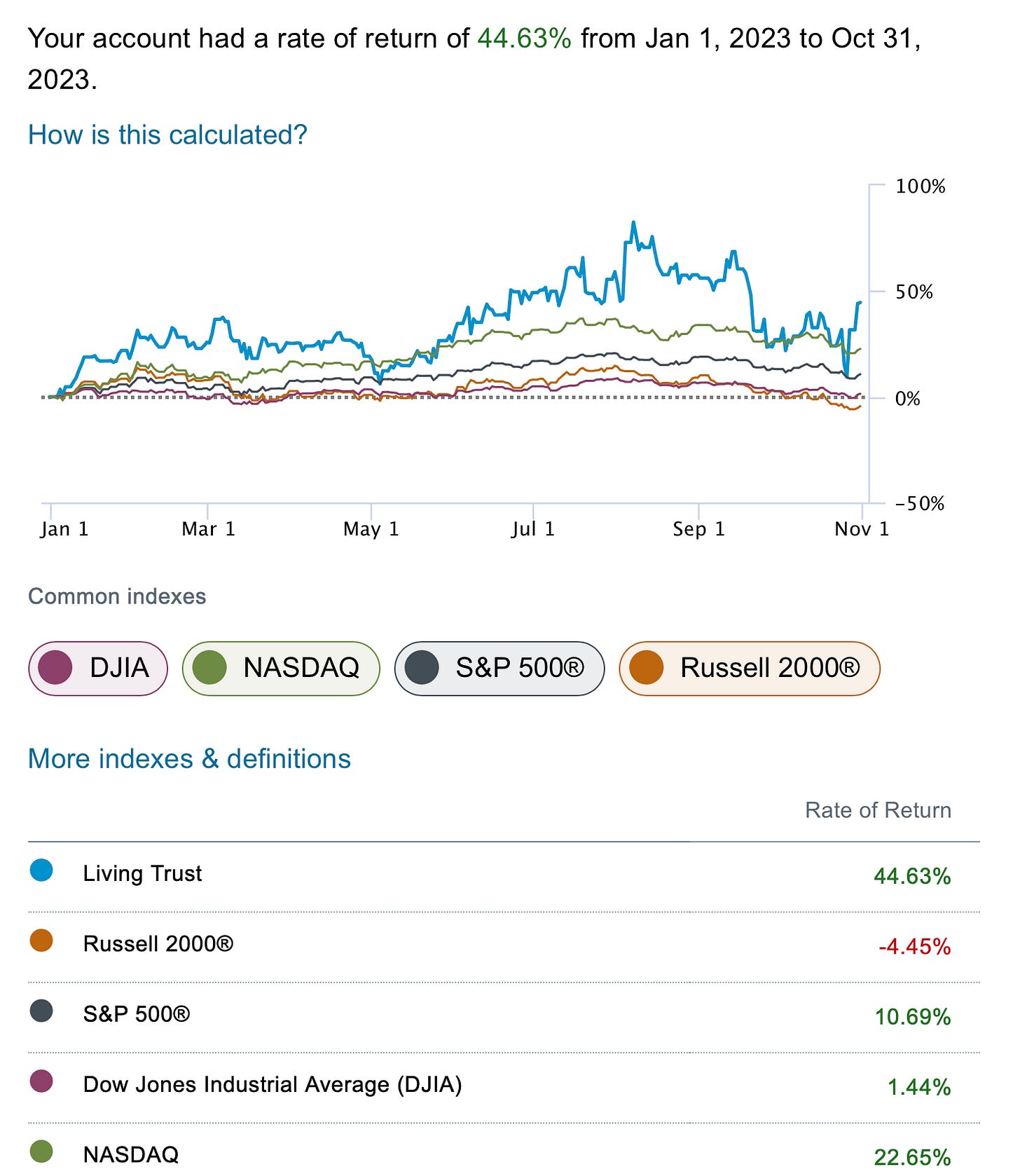

Again if you want to copy me, I’ve always posted what I do, you can, but I’m in 1 trade for now, obviously there was a big drawdown from the September highs that Amazon had but I’m still up 4x the SPY this year, what more can I ask for? If the goal is to beat the SPY, then I’m accomplishing my goal.

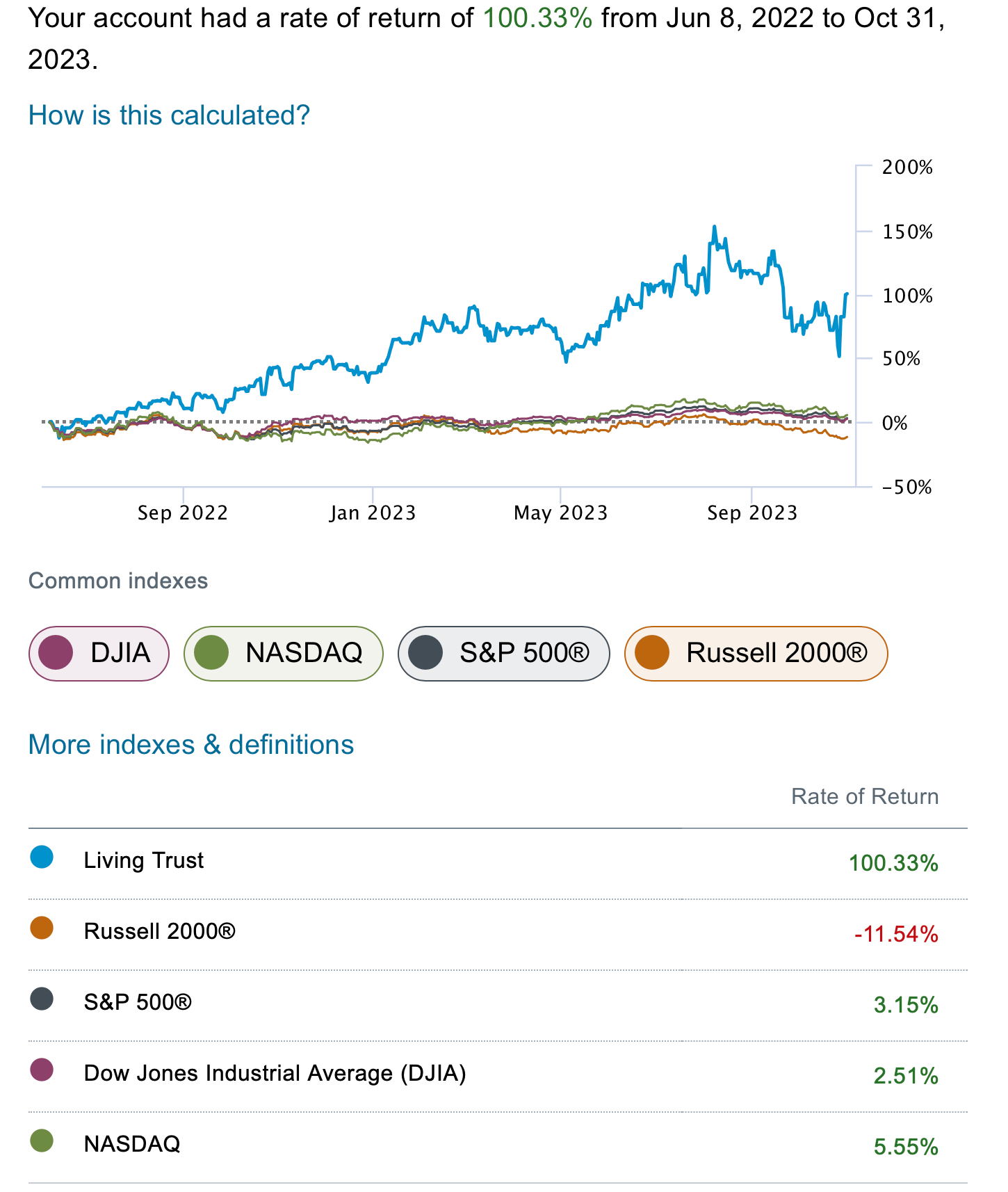

If you just scroll back to when this substack began in June 2022 I’ve posted every trade I’ve made. I’ve returned 100% since last June with the SPY up 3% in that timeframe. How many people have really beat the market by a factor of 30x+ in the last 16 months? You can say what you want about my style or how I size things, but you have to admit more often than not I am in the right place at the right time whether it be the Twitter takeover last year or Amazon since this May. People overtrade, that is the reality of things, can you place 50 trades a week, sure. You can also place 1 trade a month and outperform, all that matters is how you sized your risk when you made your bet. That’s it. If you place 1% of your book on a trade and make 300% does it really matter? For me that wouldn’t move my book, so my focus is on finding bigger moves and sizing them appropriately for my risk tolerance.

Anyways that’s all I have to say about the people telling me I’m not doing enough. There isn’t a set rule on how much one has to do to outperform. You don’t have to do alot, you just have to allocate your resources to the best possible trades, the more the merrier isn’t a thing with stocks, it’s a sign you lack confidence in your positioning.

Trends