1/11 Recap. All Is Calm Before CPI

Another great day for equities. We’ve been in rally mode for the first 7 sessions of the year. Not only are equities rallying but the VIX remains at lows signaling absolutely no fear in these markets. Tomorrow we get the big CPI print we’ve been waiting for and the market is pricing in a pretty substantial move in either direction. Tomorrow should give us more clarity on the short term trend to come. What’s most remarkable with this year is I came in pretty neutral, I thought stocks would be flat this year and you saw my positioning, just heavy on the short puts and without even being long anything I’m up over 10% already in less than 2 weeks this year. Seems a bit overdone for such a conservative approach, but I will take it.

Before I get into the recap I wanted to say I hope if nothing else you read the blurb I have below on unusual options because there was one super shady trade today and that highlights what I try to catch for you all everyday in this substack.

The SPY actually looks nice, look at that close today over the 200 DMA. From a technical perspective this has been a nice run since that breakout 4 sessions back above that range it was in as you can see below. We got a clean retest yesterday and took off again today, again CPI can change all of this tomorrow. We could just as easily be back at 380 by Friday, but we’re making a higher low and if we break that downtrend tomorrow, there is not much to say, you better put your bearish biases away.

The weekly as you can see below runs right into that downtrend we’ve had stiff resistance from for 12 months very shortly. Will we get through it? I don’t know, but if we close the week on the other side of it, the bull market is back on, there is nothing else to say. Last CPI we tested over it and rejected lower, let’s see what tomorrow brings.

What I want to say is, the economy is one thing and the stock market is another and as long as you can separate those two from each other, you should be ok. We could be in a recession right now, in fact, I think we are, but stocks are stocks and they’re just a game that people like to think is tied to the economy, but they are not, they’re tied to fed policy, nothing more. Remember the run we had when the country was shut down and everyone was suffering during covid? Just remember that, stocks are a game, just remember that.

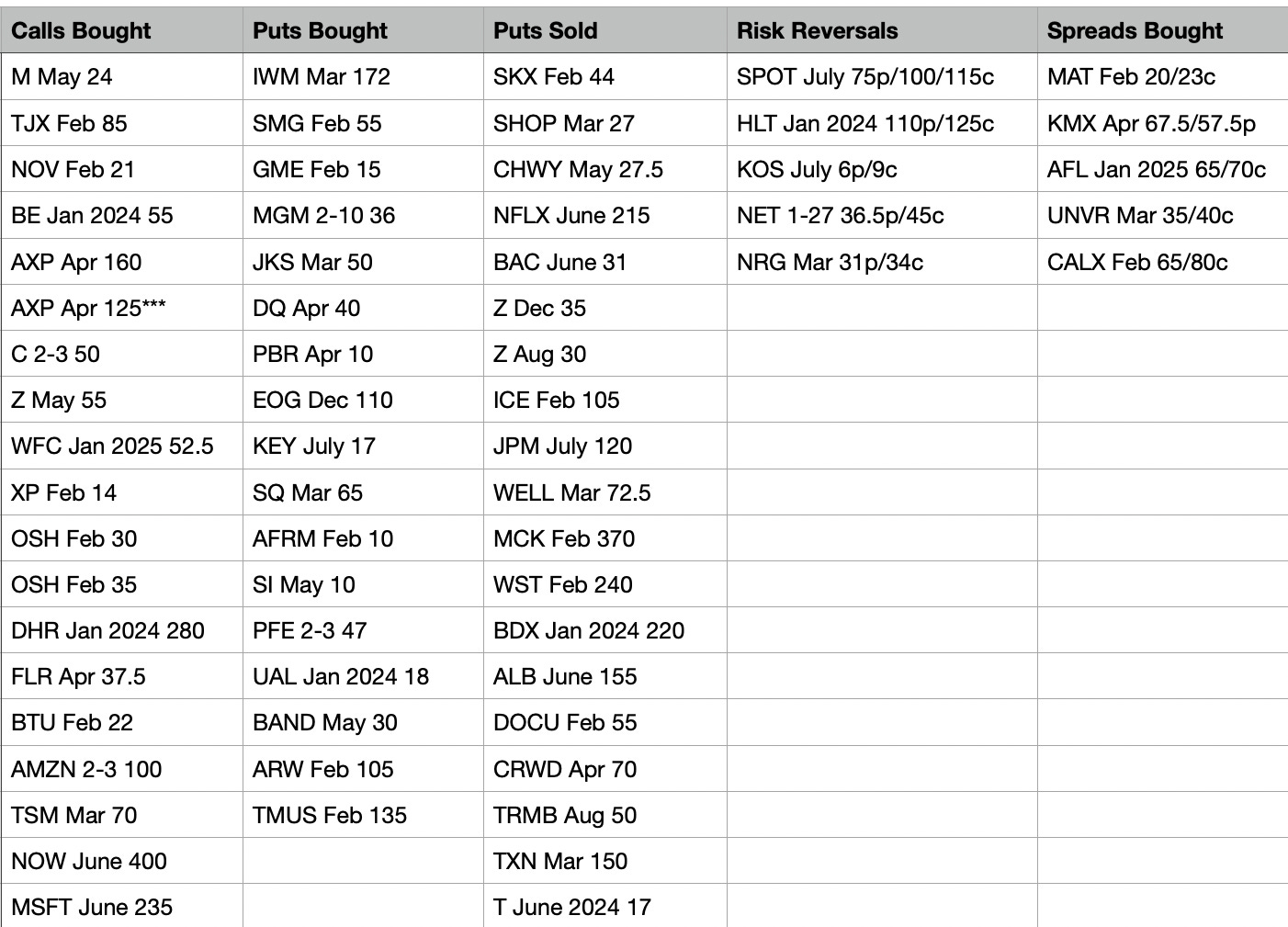

Today’s Unusual Options Activity & What Stood Out

So, I want to mention 1 trade today that really got me heated. It’s one thing when someone puts on a monster trade like the Amazon put sale I noted yesterday with 10,000 contracts, Amazon was technically clearing a huge level and starting to look nice as I showed you on the charts. That is just being an astute trader, but today the trade I saw in UNVR was just blatant fraud. There was a huge 10,000 lot 35/40 March call spread bought on UNVR that I had taken note of for my recap and within 2 hours there were rumors Apollo was going to take them out and it exploded. Mind you this isn’t even a name with option flows like that. Just highlighting why I go over these trades everyday

AXP had 2 large buys in April, one at 160 and one at 125, that one at 125 was huge, over 20,000 contracts deep in the money, this was a mega trade, millions of dollars.

Z had May 55 calls bought and 2 huge put sales in December at 35 and August at 30. This name has been running the last few weeks.

NET is a name alot of people like and I’m short puts but today someone sold January 27th 36.50 puts to finance 45 calls.

CRWD saw large put selling for the second day in a row, today at April 70

AMZN had a huge call buy at 100 for February 3rd. This chart looks great now.

DOCU continues to see large put sales almost weekly, today at 55 in February

How Did I Do Today?

Fantastic, I have no complaints, I’m up almost $250k in less than 2 weeks this year without having been long 1 stock. I wasn’t planning on my neutral strategy picking up so much so soon, but equities have risen and my short puts have evaporated. Tomorrow could be a blood bath, I really don’t care for me it’s about the total cash in the account and that number keeps ticking up as I sold a few more puts today. If we get slammed tomorrow, we get slammed, my short puts are at levels I don’t think we will see regardless. Would I prefer equities up tomorrow? Sure, it will free up margin so I could put on more trades, but if we go down, we go down, I don’t really care, it doesn’t change my thinking at all.

Puts I Sold Today

TTD Jan 2024 $20 for $1.40

PINS Jan 2024 $20 for $2.68( I added to an open position)

That’s it, I didn’t do much today. Pinterest cleared its yearly value area and I’ve always said that was my favorite, so if there was a time to add it was today with the chart breaking out. Will I regret it? Maybe, Pinterest has so many days it falls 5% on nothing, but for now, the chart looks primed for a run. Trade Desk is another profitable small cap name that really outperformed today, so I added to it over 50% lower.

Last thing before I go, I want to discuss the Amazon chart and the important of charts and the levels I always point out. I tweeted about Amazon and it’s battle with the support line for a while, look at these:

Look at that last tweet, 2 days ago, I said this is it, it’s finally time to buy Amazon when the RSI broke out. That was followed with the huge put sale yesterday from whatever institution put that on, but you saw in yesterday’s recap that I added 300 short puts on Amazon for next January and we followed it up today with this beautiful 5% move you can see below. I always get people asking me how I am right so often on direction, I just want you to understand it isn’t me, I simply am a guy looking at charts that any of you can see at home, I just have done this long enough to understand how the game really works. Hopefully you are starting to see how it works as well the longer you read my daily ramblings.

Anyways hope you all had a great day in the market, let’s see what mr market has planned for us tomorrow in the casino.

Hi James - love the daily update! Do you mind me asking from where do you mine the options data that you share in your newsletters?

Final question. These days I tend to think of the size of a position (actually the size of a commitment for a given underlying) in terms of the aggregate maintenance requirement for all the positions in the underlying. When that amount goes beyond about 3% of my account value, I start to feel uncomfortable and think about trimming it. Do you have any rule of thumb in that regard? Is there a mental limit you tend to impose on your positions?