11/10 Best Idea For The Week Ahead

Another all time high close in the market last friday. The post election reaction has been nothing short of incredible. What you will notice below is although things got scary a few days before the election, we never violated that 565.16 breakout on the SPY. This remains a clean breakout 8 weeks later. Just remember as long as you de-risk when charts break you can never caught up in a vicious sell off, those 4 days before the election, they were people on the fence exiting, as I said then long term positions didn’t need to come off, and if you missed a 1 day move on small positions so be it. Risk management is just as big a part of the game as being in the right names.

This week I have a trade utilizing a risk reversal on a $300B that is having a multi year breakout. This is a name I actually wrote up in one of the recaps recently and the max strike calls have tripled in just 13 days, but I still think there is way more upside so we’ll go deeper on it today. These risk reversals are the single most powerful option play out there if you’re right on direction. Remember the EQT best Idea I wrote up 3 weeks ago here? The calls are up 100% from .70 each to 1.40 in 3 weeks on a 12% move in the equity. You could close that whole trade up right now if you want and move on if you wanted. As I wrote the other day about FLR, there is no rule on when you take profit, but try to not be greedy, take profit when you can. If I can tell you one thing about Trump and markets, if you weren’t around from 2016-2020, his market is very erratic, he adds an element Biden didn’t have which is random tweets that send markets spiraling, that makes trading options tougher in the short term because you really have to be ontop of things.

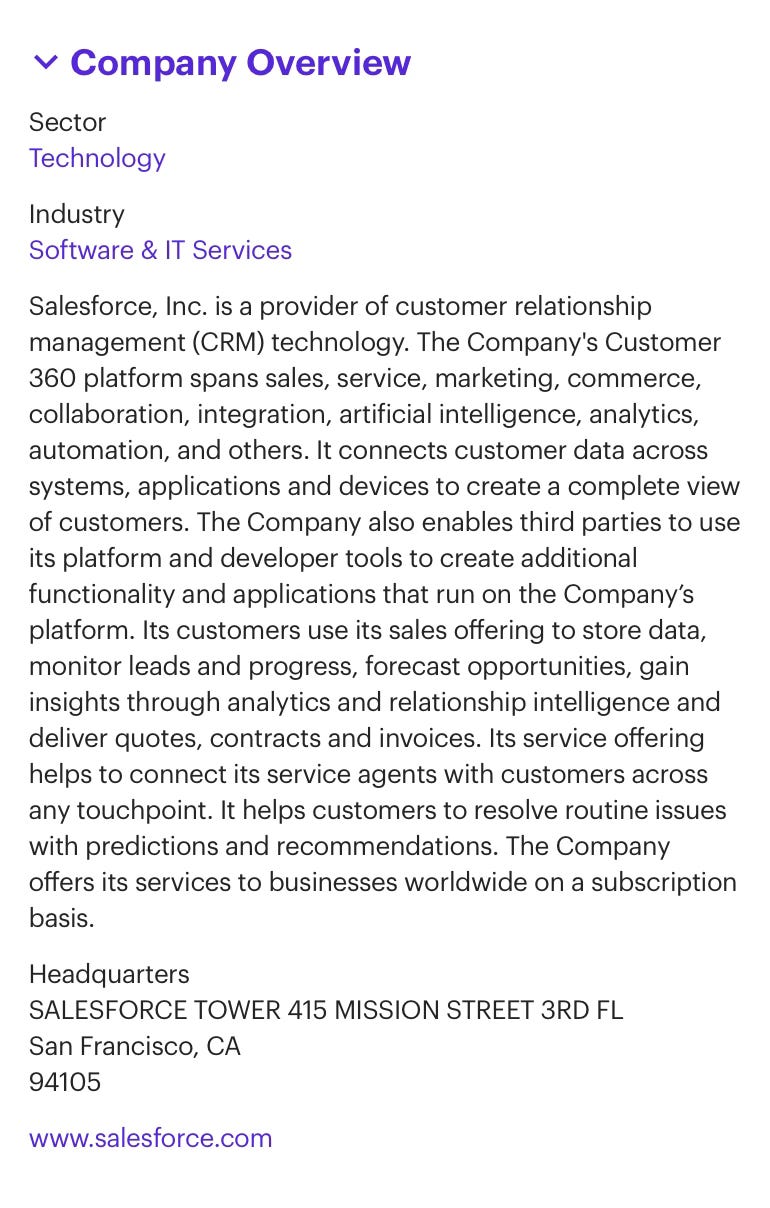

CRM

What Is It

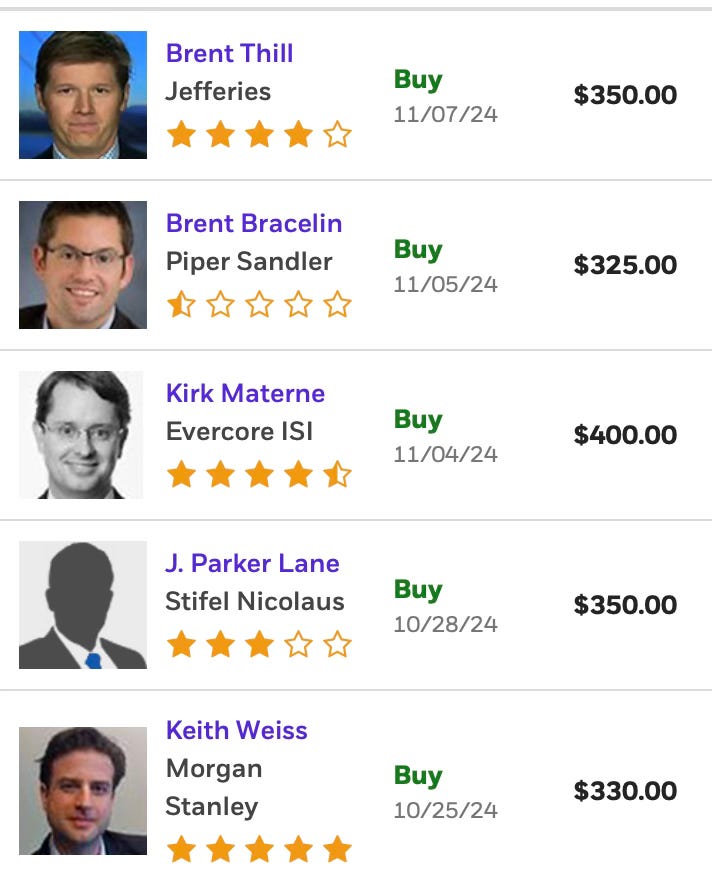

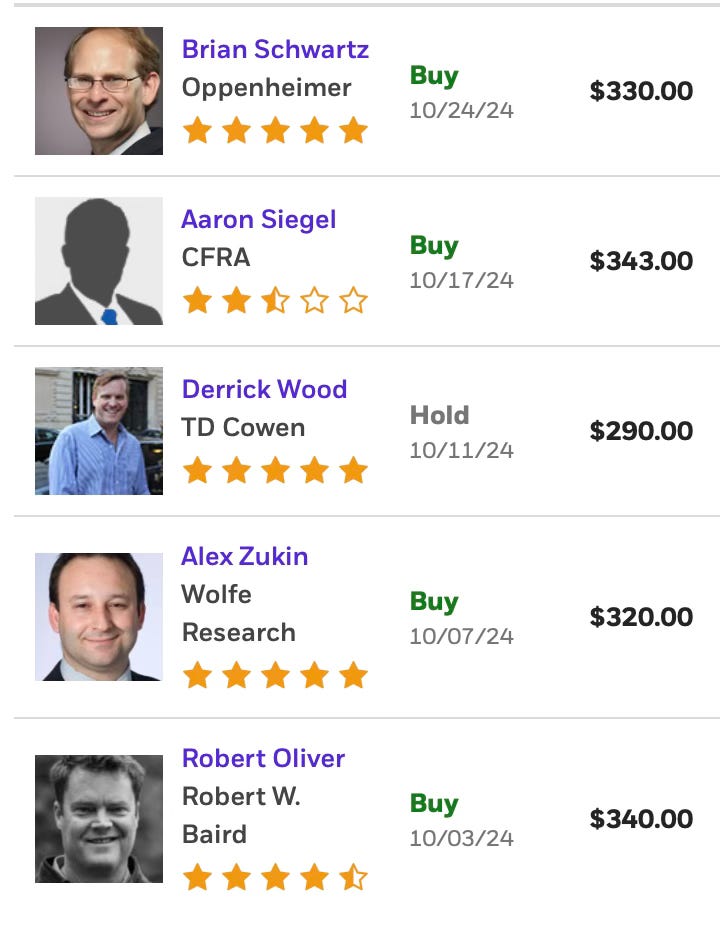

Analyst Targets

The interesting thing here is the highest target is $400 and nobody is even looking at the levels of the calls noted below in the recent mention. Will we see upgrades?

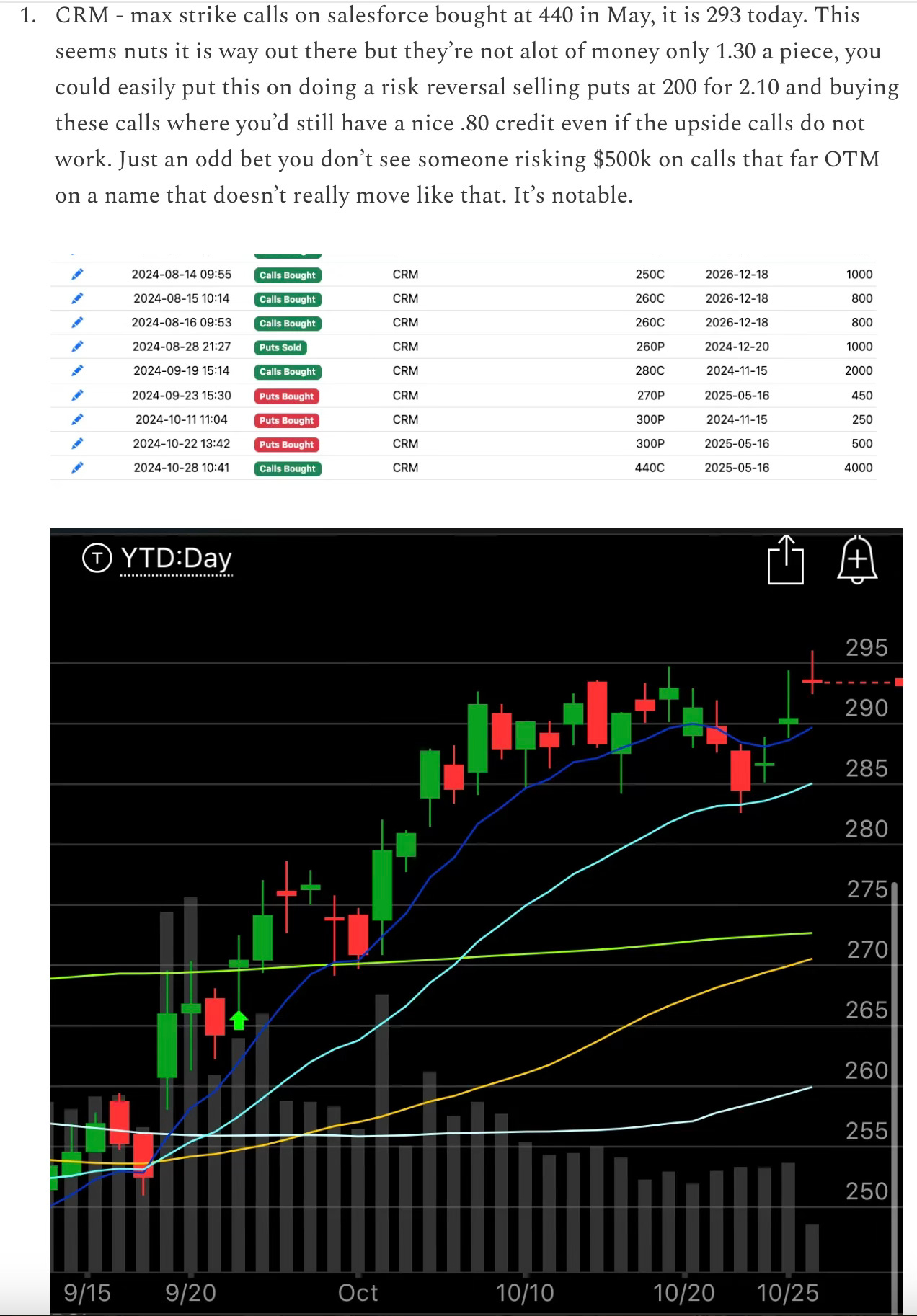

Recent Mention

In the 10/28 recap I noted these Salesforce max strike calls here and they’ve gone from 1.30 to 3.90 it has been an insane run the last 2 weeks. 4,920 remain in the open interest so they’re still open and they have not taken profit yet.

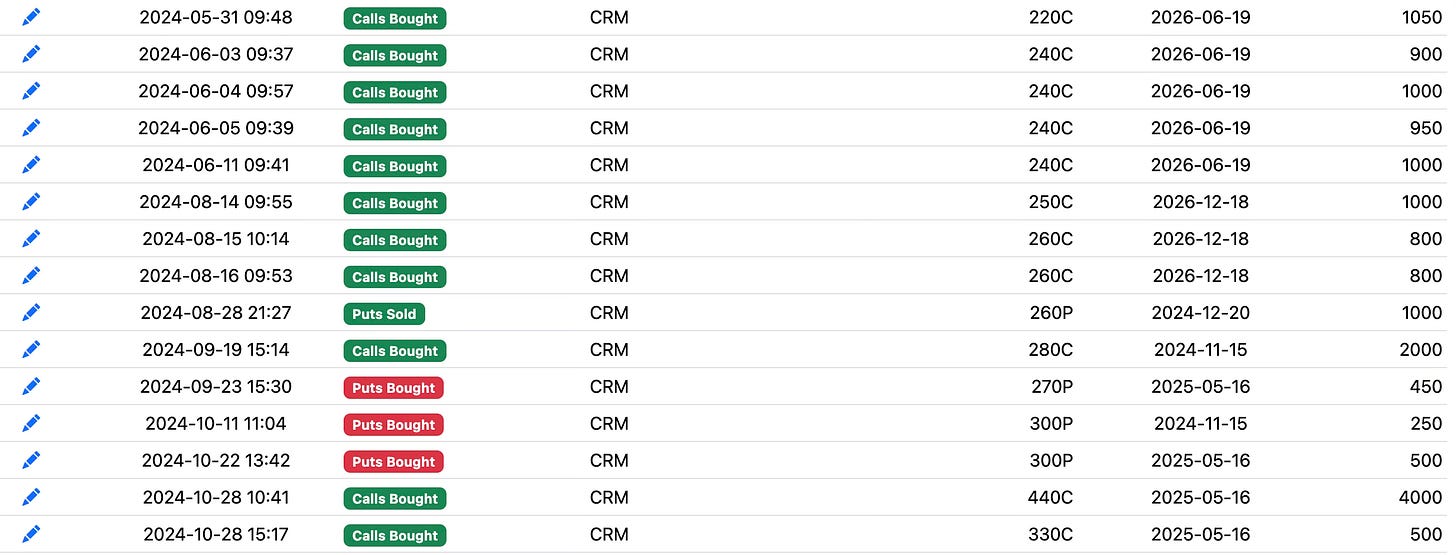

Option Flow

There hasn’t been much since that day, one more buy of $330 calls in May came that same day on 10/28 but nothing since even as the name rallied hard. Note the plethora of June 2026 calls bought back in June well before the name ran almost 40% since.

Charts

1 Chart is all we need here. Last week CRM closed at its highest weekly level ever. Down below is the monthly chart going back years, you can see a clear breakout so far, how we close this month is big, but right now, the weekly is confirming. This has the potential to go much further, fundamentally I couldn’t speak much on CRM, I don’t know it well but I can say the price action is saying buyers aren’t worried about adding at these new highs and in the end that is all that matters.

Trade Ideas

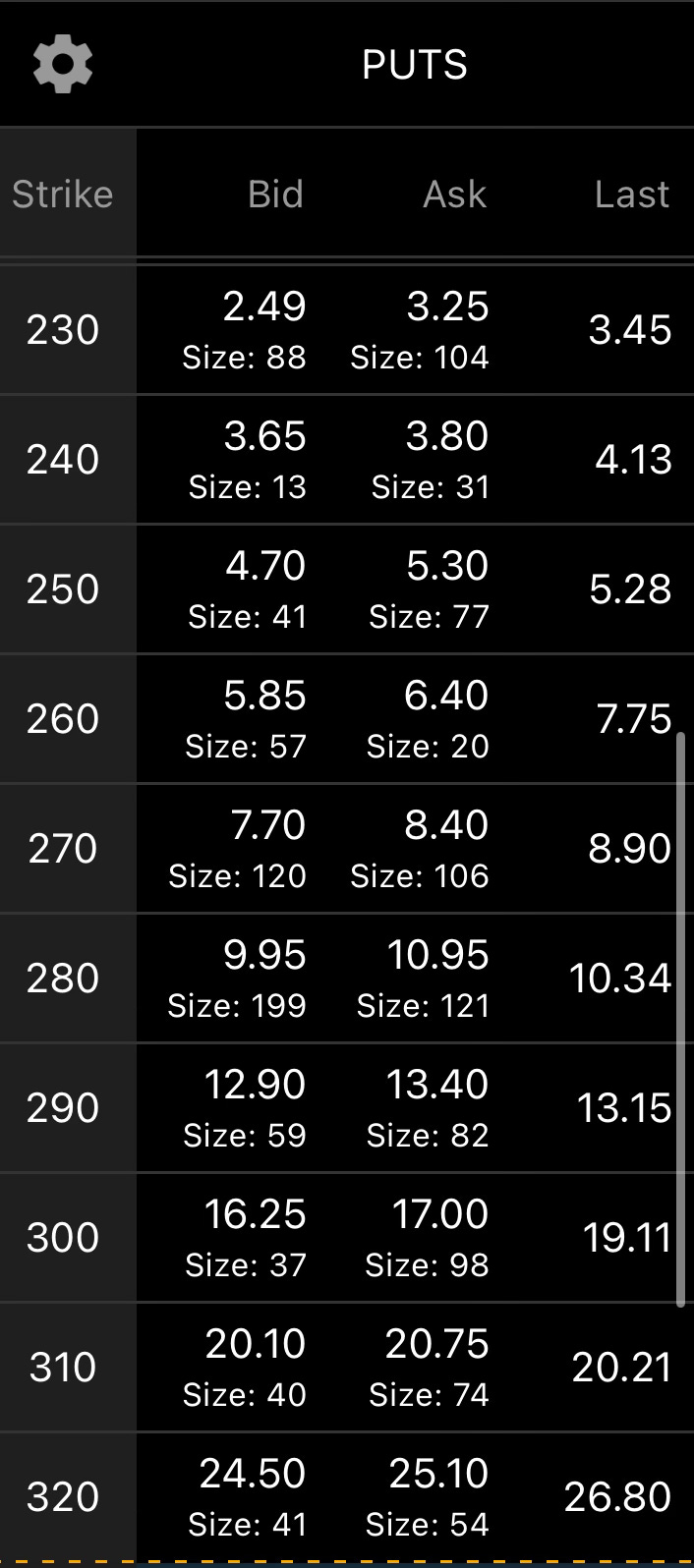

If you look at the daily chart there are a couple gaps below and with last week’s breakout I think you can be aggressive and target the 250 level with the name sitting at 321.95 now. If you have the trade from 10/28 do not close that for this one if you wish to remain in this name, you have a massive cushion now, this is for people who didn’t enter then and want in.

Sell May 250 put for 5.00

Buy May 440 call for 3.90

Credit 1.10

Below are the options table, basically this trade will get you 1.10 in credit and you will profit either way as long as CRM remains over 250 by May. If it continues its torrid run who knows where this goes, those May 440 calls seems insane still, they were insane 3 weeks ago and look what happened. Again it’s all about structuring a trade to potentially profit regardless of what happens, this allows that. If CRM comes back down to 250 I’d be really shocked after this multi year breakout, but it is a buy down there, lots of volume has traded there so it is nice support. If margin is an issue being an expensive stock, you could sell a 260/250 put spread for 1.20 risking 8.80 and just wait in that. You’d still return around 15% on the trade in a few months, but wouldn’t capture the potential upside if it comes. I know it’s hard with these expensive equities because some of you have smaller accounts, but I have to focus on the best potential trades and you can still profit selling risk defined put spreads. If you sell a put spread sure you miss the upside but if you make 15% on the capital you set aside in 6 months, that’s 30% annualized, which is still a great option.

I hope you all have a great Sunday and I will see you tomorrow.

good analysis, thank you!

How do you size these plays ?