11/10 Recap. Inflation Is "Only" 7.7% BUY EVERYTHING.

Sometimes even I marvel at the moves the market makes. I’ve never had a move this size on my overall portfolio but I will go over that below. I had a bigger move when I was locked in on Twitter last month, but on an overall basket, I’ve never made 11% in a day on a trading account at this scale while only using a small 65% of my capital. If you had told me in March that inflation would be 7.7% and that the Nasdaq would be up 8% in a day on that news I would have called you insane. Yet, here we are, November 10th, and that’s what just happened. I can’t even recall the last time I saw Microsoft and Amazon up double digits on nothing material. I don’t even remember moves like this during the covid boom, but what can you say other than, price doesn’t lie and people wanted into the market today. If this was a move on low volume I’d say it was fake, but it wasn’t and there was another $2b to buy on the close.

Look at this daily chart of the SPY, I had said the last few days that we were in no man’s land until today and we finally picked a direction. We broke out of a big consolidation. While I do hate gaps like this because they eventually fill, for now, the trend is bullish and we are likely headed to that red line at the top.

Why that? I’ve posted this chart for a while, the weekly on the SPY has rejected that red downtrend 3 times and it appears we’re going there again. It’s a good spot to put short positions on with a tight stop because your risk is limited. If we break out of that downtrend, you close your short position and move on. If not you press the short lower. The MACD is now positive on the weekly, let’s see how we close tomorrow, but wow what a power move today. Alot of the moving averages are now pointing up and we appear set to trend north for a bit.

The dollar of course continued its collapse today. It’s remarkable how I mentioned the top of the decade long trend a few weeks back and we’ve rejected lower ever since. Even over the weekend when I said the dollar put in an ugly candle last week all that’s happened since is a follow through to the downside. Anyone who really tells you candles,charts,etc are not important is truly kidding themselves. These are telling you a story within a story. The dollar has played out perfectly before the “news” came out.

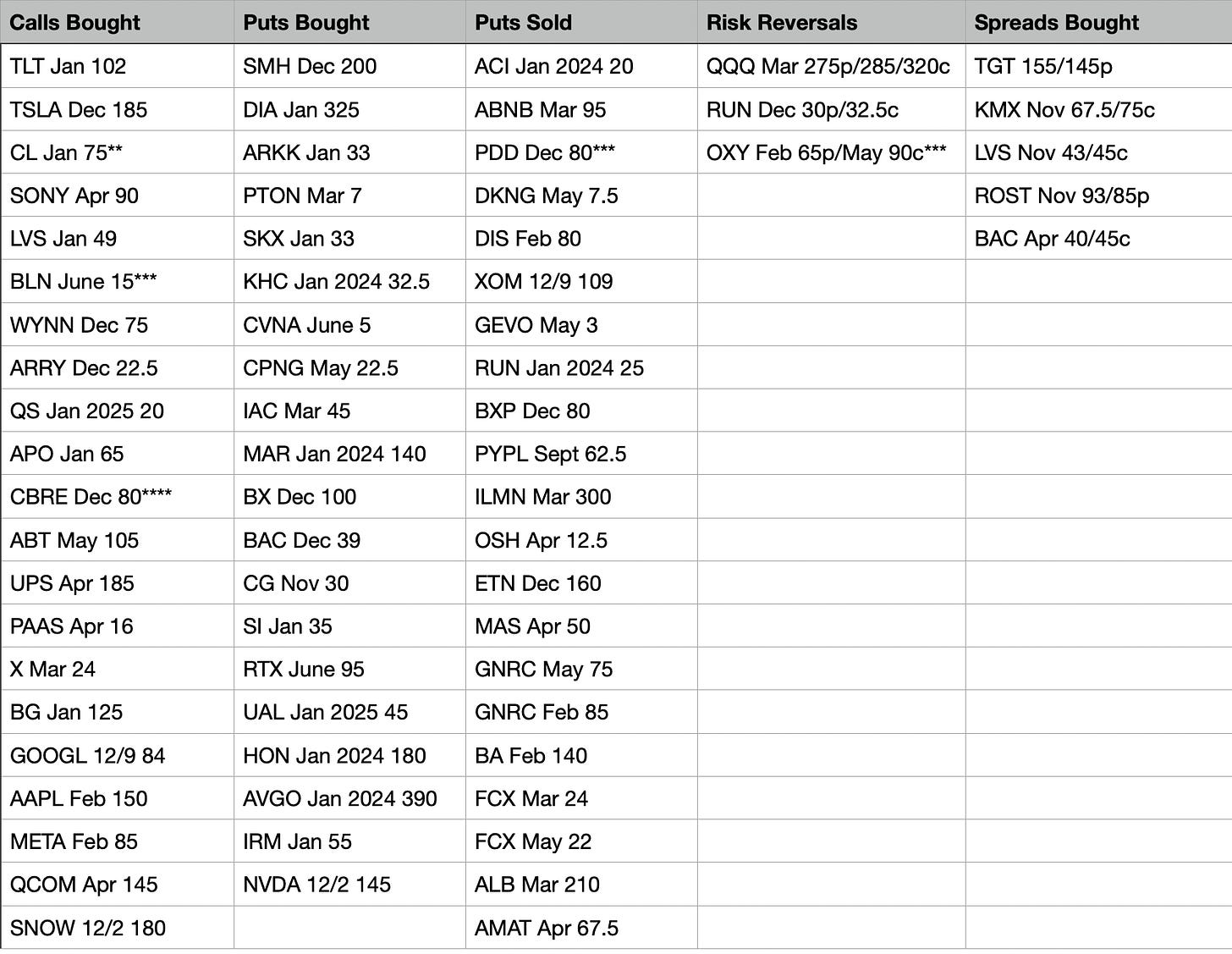

Today’s Unusual Options Activity & What Stood Out

I cannot believe how well WIX played out today for me, it was +20% and I’ve been noting all the unusual action there for weeks. If you remember a couple days ago all the bank puts were coming in, that was the tell rates would be falling. There was alot to go over today including one of the biggest tech trades I’ve ever seen.

CL another activist name with Jan $75 calls bought in unusual size

CBRE had a very odd trade in December 80 calls today, nice chart, breaking out

QQQ had a monster risk reversal put on with 20,000 contracts on each leg selling March 275 puts to buy a 285/320 call spread.

OXY saw an interesting risk reversal selling Feb 65 puts for over $4 and using the proceeds to buy May $90 calls for $3.xx. The trade is basically free and the seller would go long OXY at 65 which is fine. Interesting way to play a potential buyout

FCX saw 2 large put sales in March and May. It was up 8% today!

PDD was an usnual put sale at 80 for next month deep itm. Im not a fan of china stocks but this is a interesting trade.

GNRC saw 2 very large put sales in May and February. This name is down enormously but Generac is a great co and they’re picking a bottom

Trade of the Week Update

Both the OXY trade from last week on 11/18 60 puts and the FCX trade for 11/18 30 puts are going well. If you sold those puts they’ve decayed nicely. FCX ramped 8% today a monster move for this name. The weekly chart is looking very strong now but getting rejected at a big spot for now.

How Did I Do Today?

I outperformed the market by 4% today as impossible as that sounds. WIX exploded 20% on earnings, I had mentioned for a while that I had a decent stake there and even with the conservative covered calls I had sold, the trade was a big winner. PINS also closed up 9% and I mentioned in yesterday’s recap that I had added a huge amount to my holdings. I trimmed a bit today, but I’m going to let the rest get called away next week. Even SIX I had 2 large put spreads sold on that for November and December and that was up 20% on earnings today. Mind you, I’m not really into small caps at all, I was in just those 3 because of the activists and insider buys on Six Flags. I couldn’t believe what I watched today. I really added nothing today, no way was I going to add on such a big up day. I may sell some tech put spreads tomorrow at the gap fills a month out or something, but this was an incredible move and not the day to put longs on even though I think we trend up for a bit.

I hope you all had a great day and I will see you over the weekend when I post my best ideas for next week. Looking back at last weeks best ideas list, look how many names I posted the scans of with the bullish engulfings and crossovers, that was the tell this week was going higher, there was so much buying in all of those the week before. Just an amazing day/week. Have a good one.