11/16 Recap

We opened the day with some dire earnings commentary from Walmart which is down 8% right now. They said late in October they saw a massive drop-off in spending. I don’t read too much into it because Amazon reported around then and didn’t warn on anything like that. Target had poor earnings yesterday too, I think the segment of the population those stores rely on are hurting more than any other segment as we’ve seen Dollar General decimated this year as well. This isn’t a datapoint to me about the overall economy which is mostly driven by the top 30% of society who for the most part do not shop at Walmart. This isn’t unexpected, we know credit card debt is at record levels, student loan payments have resumed, and overall inflation is hurting people’s spending power but at the same time we’ve seen retailers like Amazon guide to record quarters ahead so it seems like more of a lower end retailer issue more than anything else.

The big story today is oil being taken to the woodshed. As you can see below it is now down over 20% since late September and down 5% today alone to sub $73. This is a very big deal for consumers and companies alike as it really lifts a huge burden. We’ve now been below $80 for 7 sessions and the longer we stay down here the better Q4 numbers will be for everyone.

The SPY is putting in it’s 2nd straight weak candle. That gap below at 440 seems probable to fill, we are just overextended in the short term. Consolidations are totally normal after such an intense run higher in a short period. Lots of catalysts coming up in the short term with NVDA earnings, Black Friday, Cyber Monday, etc.

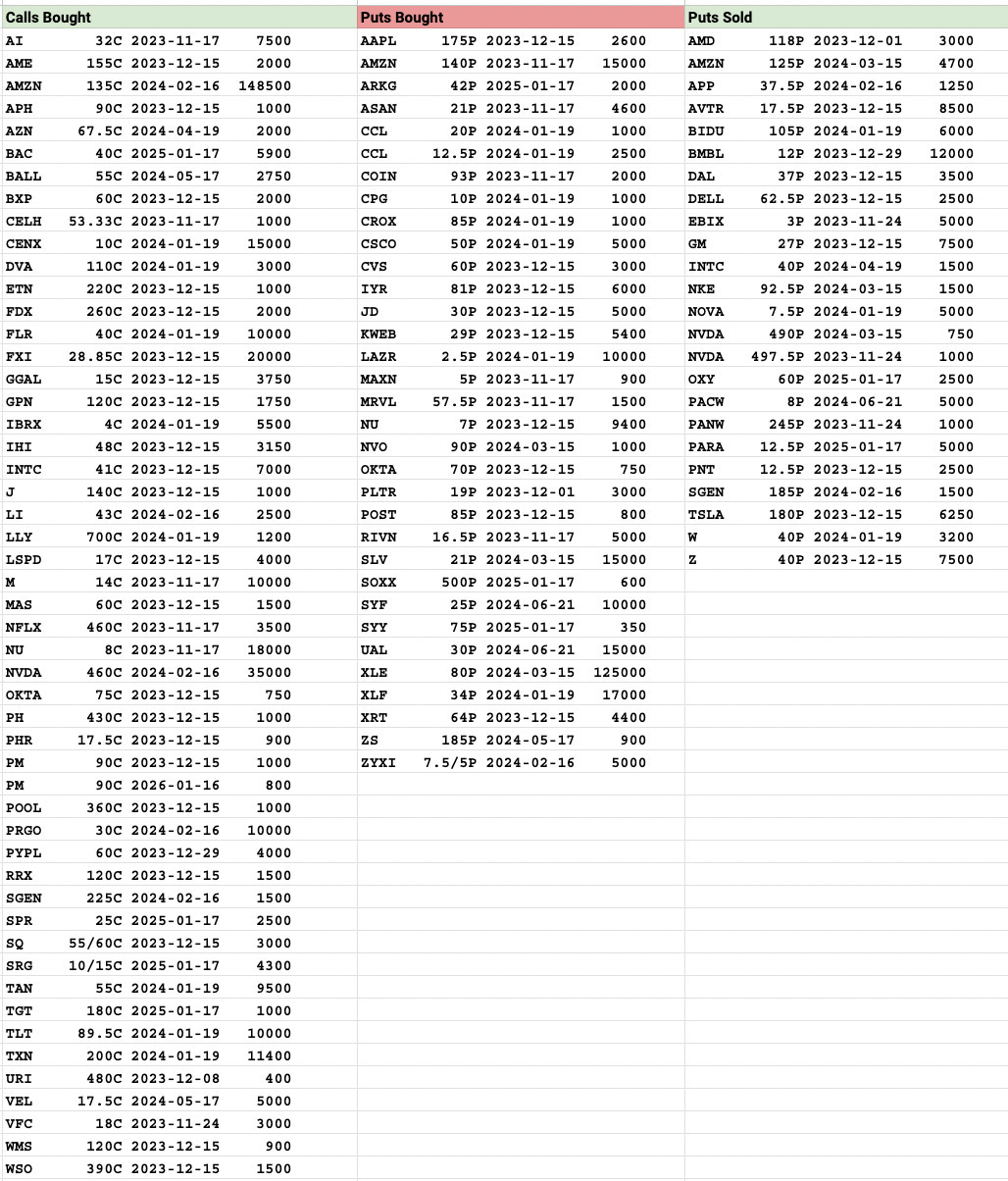

Yesterday’s recap had a lot of gems in it just look at the puts bought. Starting with the monster block of 125,000 puts bought on the XLE one day before the bottom fell out of oil. Then those weekly 140 puts on Amazon bought 15,000x worked great as it flushed below 140 at the open today, the CSCO puts bought were winners too as it was down 12% on a guidance cut that caught everyone by surprise, KWEB was down 5% today, RIVN was down 6% today and XRT, the retail ETF, was hammered with the Walmart earnings. That was one of the better overnight moves I’ve seen out of the put buys in a while. To have so many workout that quickly is very rare.

Trends

1 Week