1/12 Recap. Premium Sellers Won Today.

Coming into today, options prices were through the roof, and why not everybody was expecting a huge move in either direction. I tweeted out this morning that something was off, the VIX was still so low and the VIX usually gives a gauge of how much the market is going to move in any given session. There was nothing there saying a big move was coming.

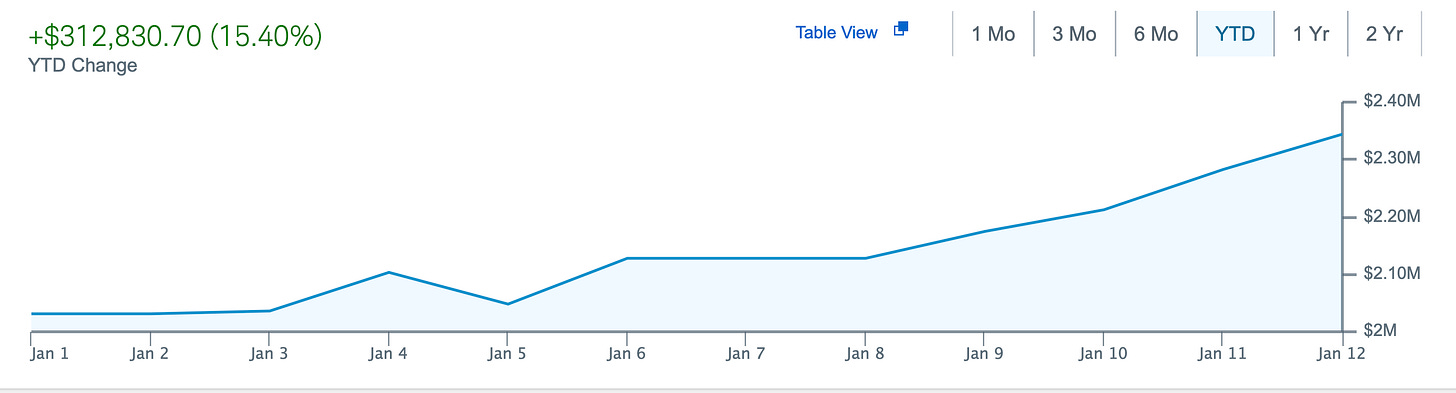

So what happened? CPI came inline and stocks did nothing, just another slightly up day, as we continue to trend towards that downtrend line. People who bought calls or bought puts got smashed as the IV drained and those who sold premium won the battle as the options decayed. I happened to have a fantastic day, and I will go over that below. This year has been crazy so far I haven’t been long 1 equity in my trading account and I’m up 15.4% in 8 sessions? That just shows you how juiced those options were late in 2022 and how quickly they’re decaying in this environment.

The SPY continues its upward move towards that yearlong downtrend and today’s candle showed how much interest there was in being long with that long wick lower showing it tested much lower yet closing up near the highs and over all the key moving averages. How tomorrow’s weekly candle closes is critical, we still have not broken out, yet.

The dollar just broke down on the weekly chart today, look at that white line. Look at the RSI and MACD, a weaker dollar is good for stocks. The close on this weekly candle tomorrow is very big in telling us if this breakdown is for real.

The one that caught my eye is the IWM, below, as that shows a clear breakout on small cap names. If IWM is breaking out, ARKK is going to run, as are all those small cap names. Again, it all hinges on the close of the candle tomorrow.

Today’s Unusual Activity & What Stood Out