11/20 Recap

Pretty slow day overall in the market, especially on the options side, alot slower than usual but that was expected which is why I said I would be taking the next 2 days off. Overall, the market rallied after the Microsoft drama with Open AI and Sam Altman was resolved by Microsoft hiring him directly. As MSFT went up another nearly 2%, the market went up with it. The fate of the market now sits in the hands of NVDA tomorrow afternoon and how they report and guide. Alot of tech names are sitting at critical junctures and that report will make or break them.

The SPY continues to hover at max overbought levels. There is a gap 3% lower just over 440. We have a plethora of data the next week or so with Black Friday and Cyber Monday. The market is looking very strong, but a little cooling off at a 10% move up in one month would be healthy. I’d like to see some sideways action to let the RSI reset for the next leg higher.

The move lower in oil last week has quickly snapped back with a near 10% move on crude in 2 sessions. The OPEC meeting is coming up soon and they are front running probable cuts, but with oil being such a key battleground into the election, I expect alot of whipsaw action here the next few months.

The dollar continues its decline today with the DXY firmly below 103.50. The weakening dollar is the tailwind equities need to continue pushing up as yields continue to fall.

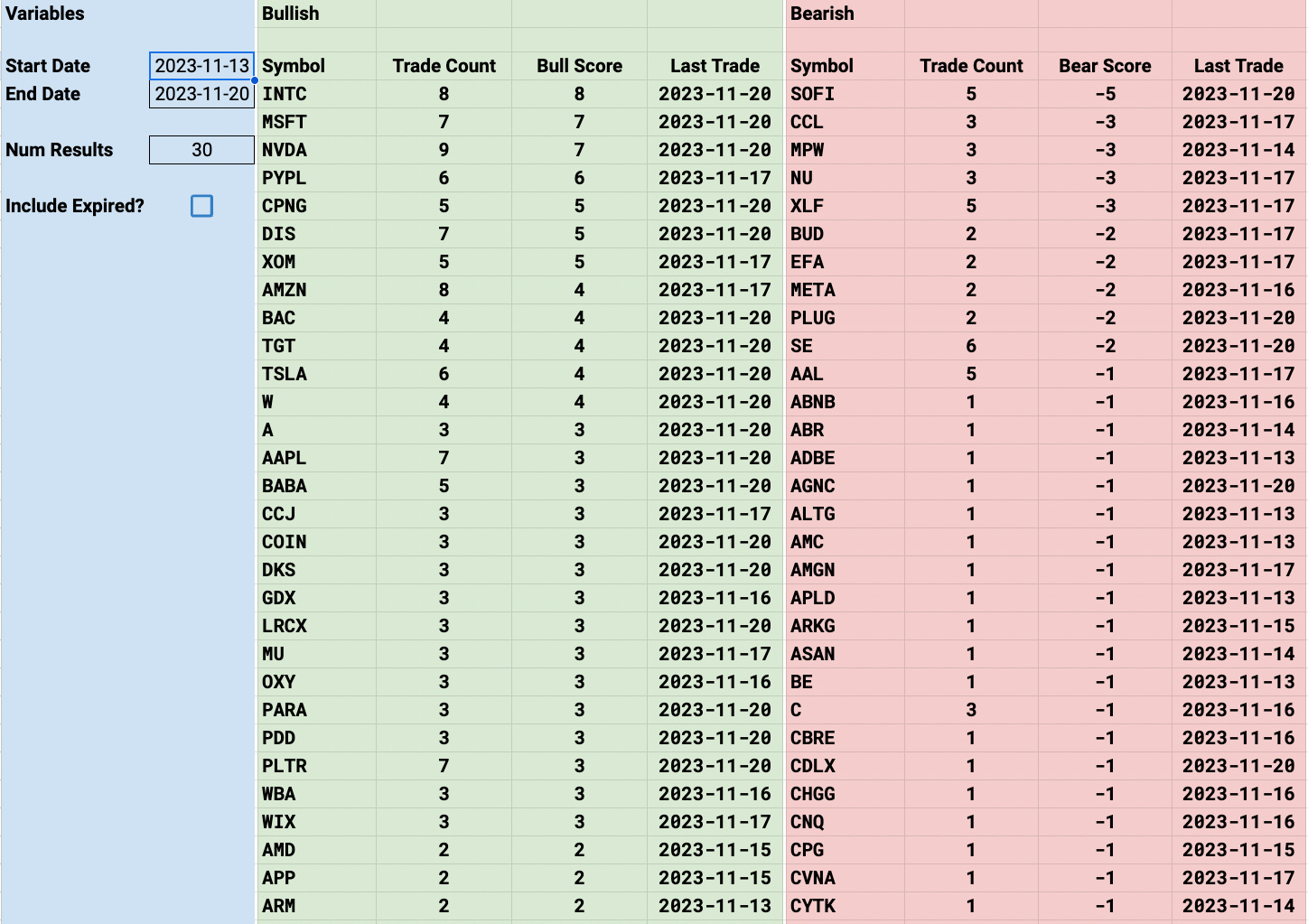

Trends

1 Week

2 Week