11/27 Recap

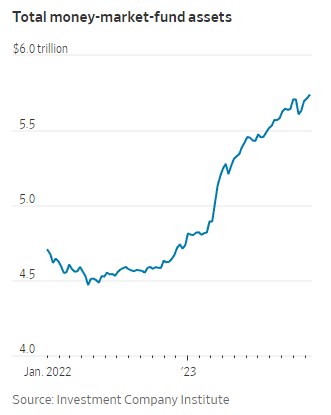

First things first, Amazon broke out last week and we continued higher today, but I will get into that at the end of this recap. As we coast into the end of the year with less than 25 sessions to go, and most major earnings out of the way, we look set for a smooth end to this year. The other day I mentioned that we were at record cash on the sidelines and someone asked me how I gauged that, I meant here below, we have just under $6 trillion dollar on the sidelines in money market funds and if a chunk of this gets some fomo after this run the markets had, we could be looking at a much higher run.

Overall, the SPY is taking a breather letting that 8 ema catch up. I still don’t like that gap below and the healthiest route would be to fill it before proceeding higher, but that doesn’t have to happen here in the short term. The biggest weightings in the market are up so much this year that I don’t see much selling in them until after New Years. Overall we could be set for a pretty uneventful December after that run we just saw as markets consolidate. You can see the bearish divergence below where the macd is in decline as we keep higher.

The IWM continues to form a bull flag stuck below the moving averages above. Small caps have seen a big move recently, but until they get up over these moving averages overhead, they’re going to be stuck in neutral. The setup is there for a nice move higher though.

Oil remains very weak, but the big OPEC meeting is in a few days. Will they come to more production cuts and boost oil? For the moment oil looks terribl but that can change in a flash. I’d like to see over $81 before I begin to get bullish again.

An interesting one from last week was XENE, it is up 16% today on god knows what news, I don’t follow it all, but I noted 3 really odd lots on the name last week as you can see below and it was one of the top trending names on the 1 week trends I post daily, sure enough, the dirty action going on in the options market caught this one.

Like I always tell you, pay extra attention to tickers you don’t know or short term trades you see in my recaps because they can work out nicely.

Trends

1 Week

2 Week