11/29 Recap

We had a large reversal intraday on the sPY today as you can see below. I mentioned in yesterday’s recap that we were overheated and the RSI needed to cool off, it looks like that is slowly happening. The VIX is still below 13, this is an insanely calm market right now. It’s perfectly normal after the run we’ve had to just take a little break, stocks can’t go up everyday.

Oil is rallying again into the OPEC meeting here in a couple days. These events typically end up being a sell the news event but we will see. Oil below 80 is a great thing for everyone who isn’t bullish oil stocks. It would be ideal if it could sustain down here.

Note

People keep joining in here and I keep getting emails with tons of questions. I do have some things pinned at the top but just a quick primer, this is how you should be looking at things.

The monday recap, 3 of the 5 trades I highlighted have worked out really quickly. The DIS put buying I noted has seen DIS dump $4 since.

Then the LMND calls worked nicely as the stock was up over 5% at one point today over $19/share

and then the RILY puts bought were actually in the money at one point yesterday but it bounced back a tad today and it is down like 12% since those were posted at 20.50+

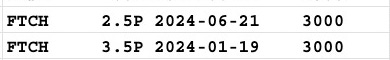

Whether you buy shares/calls/sell puts that’s all on you, I am just trying to highlight oddities out of the millions of trades placed daily. While I do post a big table with all the unusual action I’ve noted in a session, those 5 that I highlight are the ones that stand out most to me. You can do what you want with that data, but the specific names I note those are the ones I think deserve the most attention. If you look at monday’s recap there were 2 large put buys on FTCH that I didn’t flag because I try not to highlight what I deem junk but FTCH is down 50% today. FIFTY PERCENT. Those puts paid out a fortune for whoever followed.

So while I try my hardest to curate the best list possible out of the millions of options trades placed daily, I just can’t highlight every single one I see. If you take the time and scan the tables I share daily there are countless gems hidden in there. Again if you’re not sure what to do with all this data, the discord is perfect for that, there’s 500+ people in there and channels for everyone to ask questions on different things. The invite is in your welcome email you got when you signed up. The current trades channel has alot of great traders in there who can help you with whatever questions you might have and you can see how they’re all playing these trades around all this data. It’s really become and incredible resource and you should be using it.

As for technical analysis I always get emails from people here or tweets on Twitter about how it’s a self fulfilling prophecy or voodoo or whatever. I think for those who’ve been here long enough you’ll see alot of these levels I note just end up being so key. You have to remember 90% of the market is algos trading programmed to these same levels we discuss here, I know this because I worked on this stuff. When you look at something like Amazon where I’ve noted the 146.57 level being key for so long you can see in the daily price action and why that level is so key.

Here is a tweet from 15 days ago where I noted that level.

Since then you can see here on the 4 hour chart below, from the time we broke out over it, every dip below it, is immediately bought up. That is what happens when former resistance turns into support and the algos flip from sellers to buyers. You can see below, not a single close on the 4 hour chart below it, until we get a close below, this is a breakout. This is all the proof you need regarding why these moving averages are so important to understand. Combining an understanding of charts and moving averages with the options flow and trends I share daily to determine what name and where one wants to enter that name is about as powerful a tool as a trader at any level can have when it comes to being in the right name and not being in weakness.

Trends

1 Week

2 Week