1/13/26 Recap

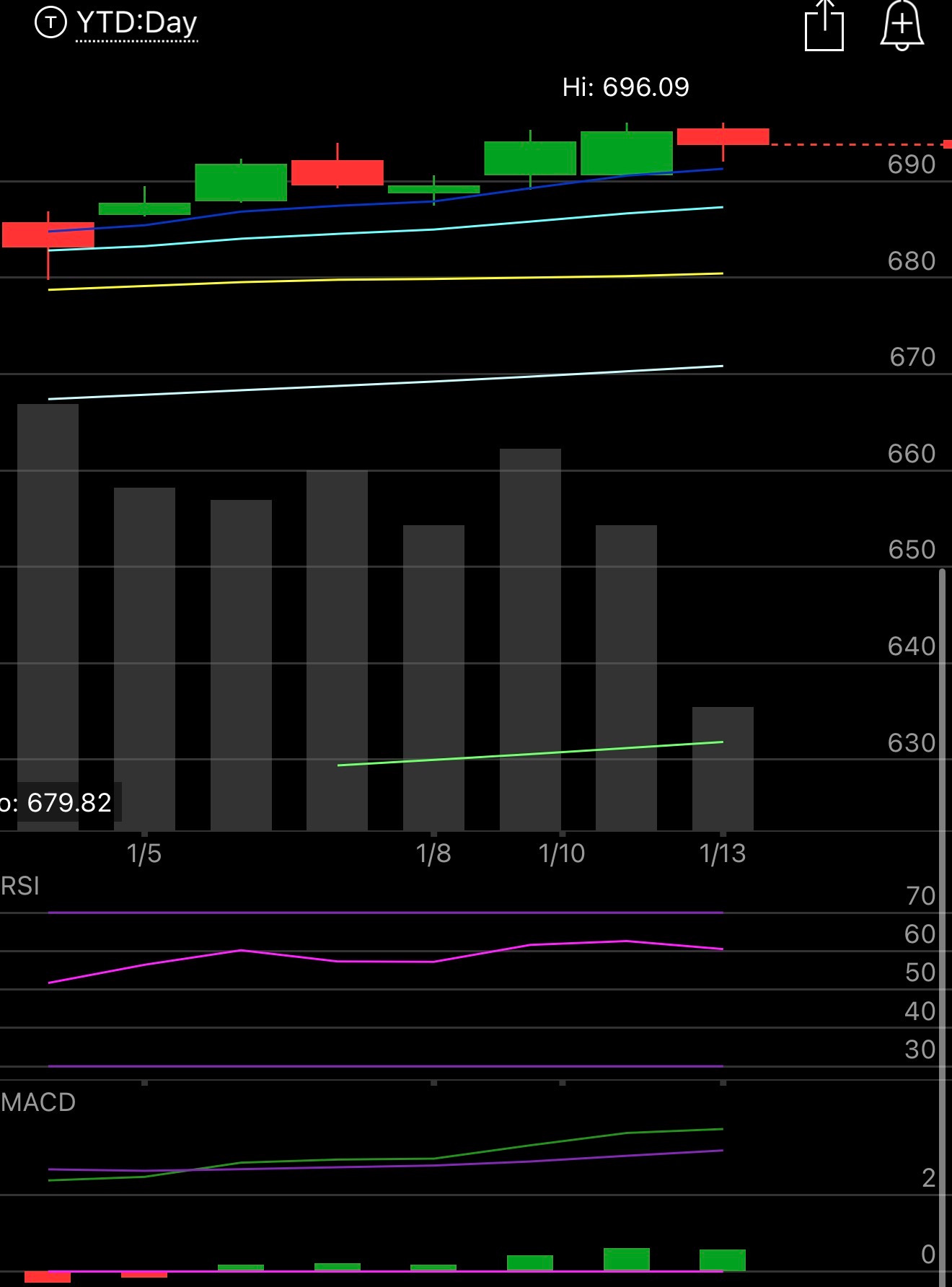

The SPY is in wait and see mode into tomorrow’s Supreme Court ruling. There doesn’t seem to be much fear here the vix is barely elevated. There is not much to discuss here until we see how we react tomorrow if you’re concerned you can definitely take some chips off the table today but as long as we’re just riding above the 8 ema there isn’t much to fear, if/when we lose that 21 ema right below that is when you start to worry.

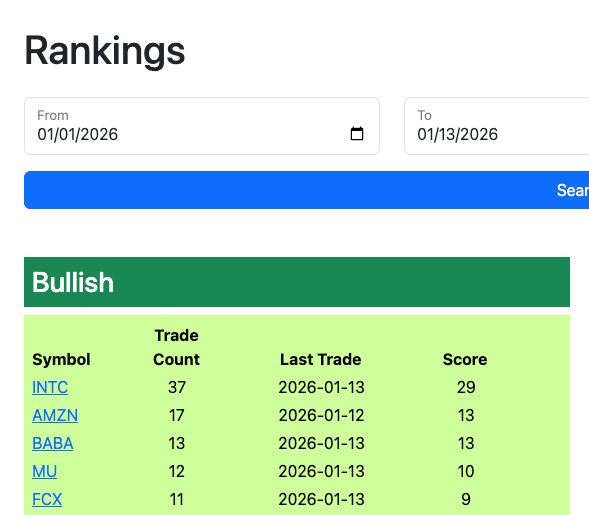

I want to discuss how to best utilize this data. The rankings system in the database was built to emphasize the importance of repeat option flow. Look at the below 5 names leading the rankings YTD with INTC,AMZN,BABA,MU, and FCX. Those are 5 really top notch names so far this year and look how far ahead Intel is and the return it has had so far this year. Even just focusing on the top names via put sales, buying calls or common, the goal is the same, to be in the right names. My belief was always simple, the more action a name has in terms of volume, the higher likelihood it has of going higher which is why I designed this simple tool. Intel has not disappointed so far in 2026.

Top Gainers From Yesterday’s Recap

TTM Technologies was the big gainer with a player buying 1500 of the 95 calls in June yesterday before it popped 19% today. I can’t find any news so I have no clue what this ripped on but this call buyer just happened to time it perfectly and I had nothing else in the database, what impeccable timing.

My Open Book

Trades I Made Today