1/14 Recap

The SPY made a move up this morning and got rejected right at the 8 ema. It reversed lower and is back below the 100 day now. This is what happens in bearish trends, all pops are sold. We have bank earnings this week that should give us some more clues on consumers and the economy, we have CPI tomorrow as well, but without even seeing the CPI tomorrow, sellers are in control right now, so barring some miracle where CPI is so spectacular it completely shocks everyone and we reverse course, we are in for a lot more selling. I wish I had better things to tell you, but I’ve been pretty open with you for a while now that tech is simply not in favor right now, look at all the megacaps, outside of Tesla they’re all being sold off daily. If you’re a long term investor, sure, great buying opportunity, but short term, they are weighing on the overall market and nothing short of earnings surprises the next couple weeks can change that.

The DXY continues to weigh on everything near 110, it is at 2022 levels when we were in a crisis. I mentioned a few weeks back that something had to give, you couldn’t have the dollar at highs and stocks at highs, we got the answer, stocks gave in. Something is just not right with this strong dollar, high yields and the market still 5% off highs.

Recent Trades

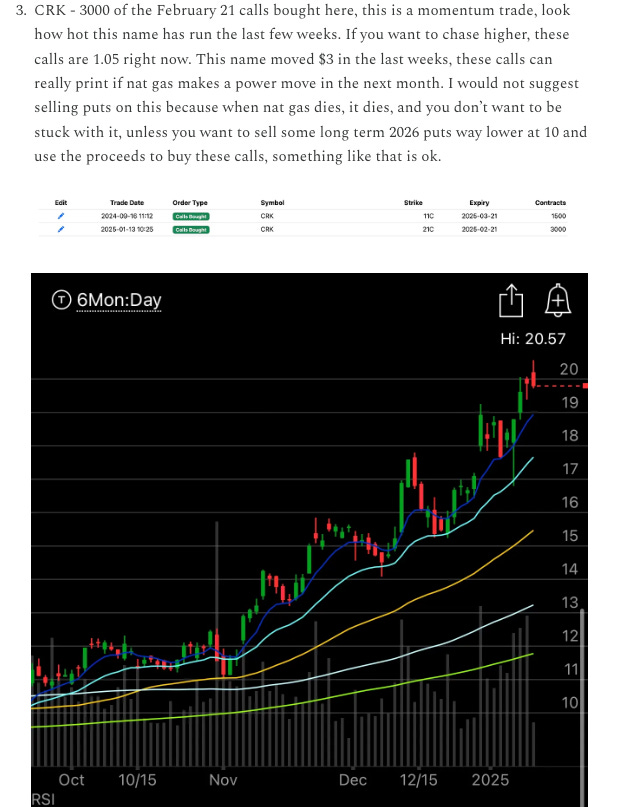

CRK - In yesterday’s recap I highlighted CRK and it instantly took off rising 3% today taking those February calls in yesterday’s recap from 1.05 to a high today of 1.45. This was a quick move up and for a nat gas name, that’s a sharp move. These names don’t usually move like tech stocks but they are doing so right now, look at LNG up 3.5% too. Right now this is the sector that is working and you have to focus on it.

My Open Book