11/6 Recap

A flat overall day so far as the moving averages attempt to catch up to the sharp move we had last week. Look where the SPY is over 435 and the 8 EMA is about $8 lower. These quick moves up are typically followed with some sideways action until things normalize. We don’t have many important earnings this in terms of weighting this week. Overall I’d expect a few more days of either flat or down until that 8 ema can catch up.

Yields bounced back a little today but remain very broken and sitting on the 50 day. If we get another leg down in yields and the dollar it will bode very well for equities.

Back on 7/22 I made NRG my best idea, it was right around $38/share and the purpose of all the best ideas I post weekly is to give you names you can add to your book that have nice upside based on a variety of factors like fundamentals and bullish option flow. Today NRG announced a $950M ASR and the stock is over $46.50 just 14 weeks later for a near 30% gain. So when I post these best ideas they’re not all going to work the next week, just be patient and let these play out, sell some covered calls vs the shares if you’re concerned but in the end more will work than won’t. If you still have those NRG shares I’d strongly considering cashing those in now, that’s a very big move for a utility and it’s less than 10% away from the activists target valuation.

Trends

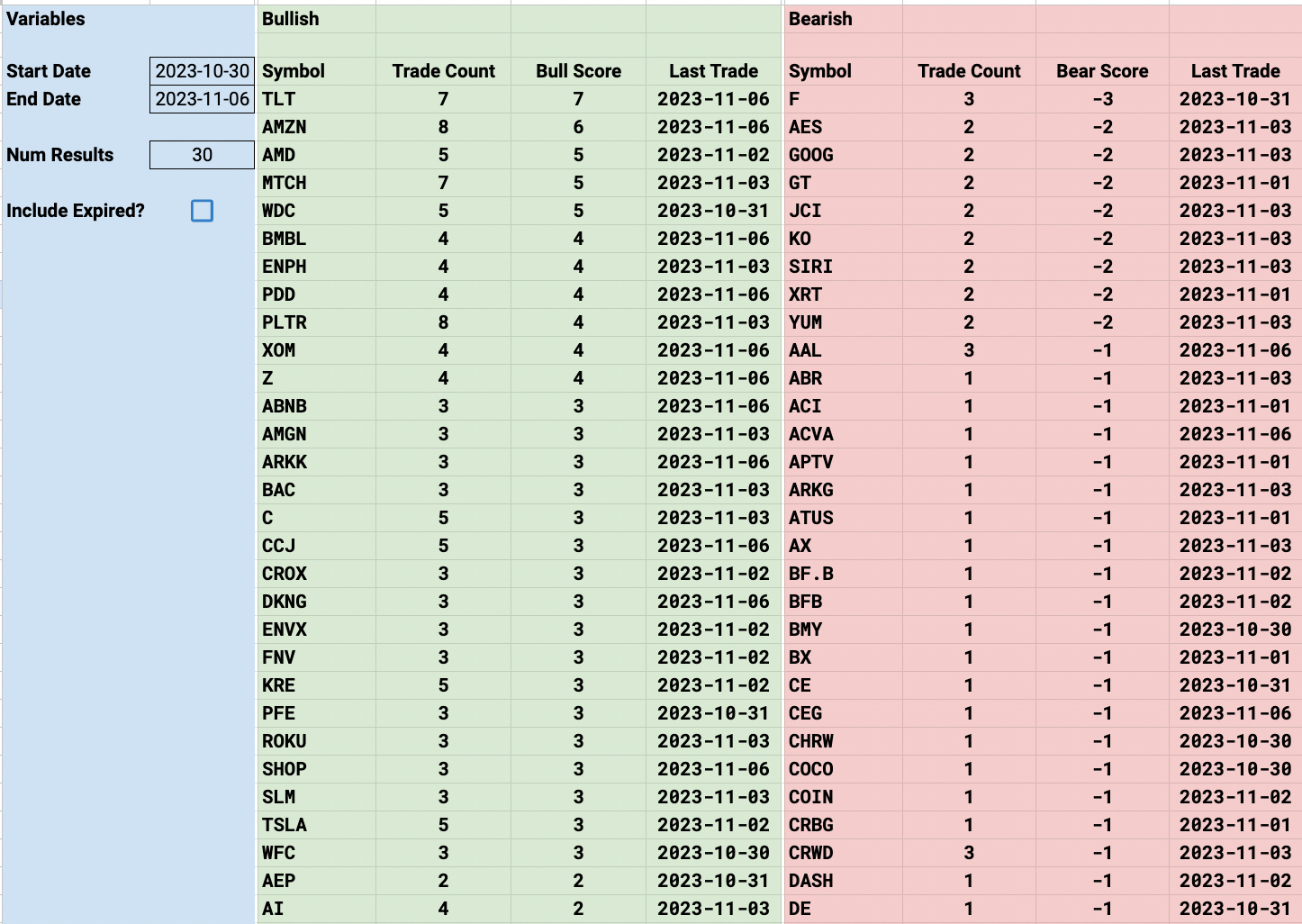

TLT continues to be the top short term and long term trend and if rates really peaked then that would definitely make sense. BMBL today announced a new CEO and it crashed premarket but has made a very large comeback intraday, they have been bullish in that name for a while.

1 Week

2 Week

1 Month

Today’s Unusual Options Activity