11/6 Recap

I have to head out early today so no trades of interest today but where do we begin. The election was a complete landslide, there were no doubts left about who won and the markets reacted very favorably today. I mentioned the trades in yesterday’s recap for each candidate

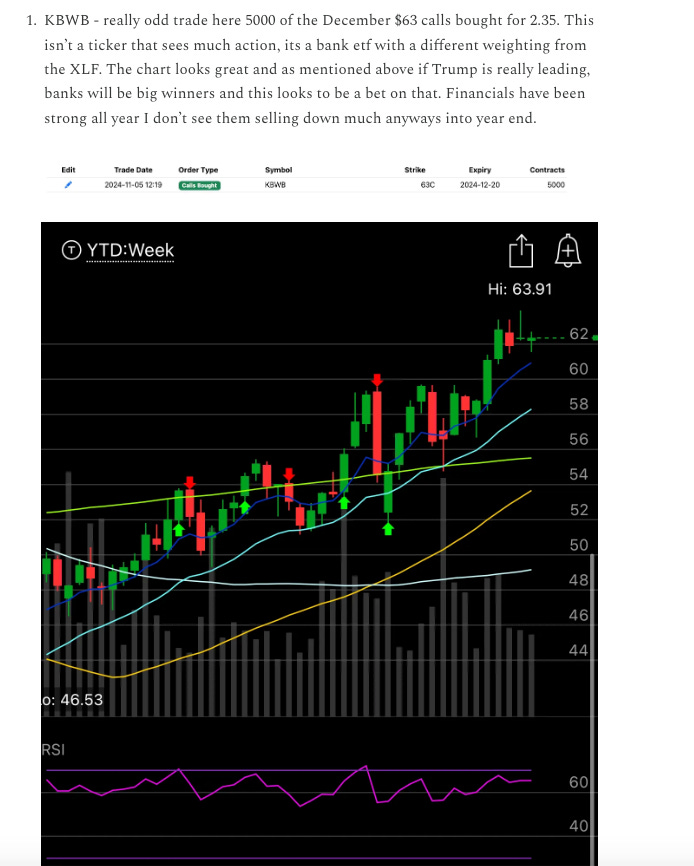

Trump won and BTC is up 7%, remember that obscure financial ETF I highlighted yesterday? KBWB is up just under 10% today vs XLF up 5.5%.

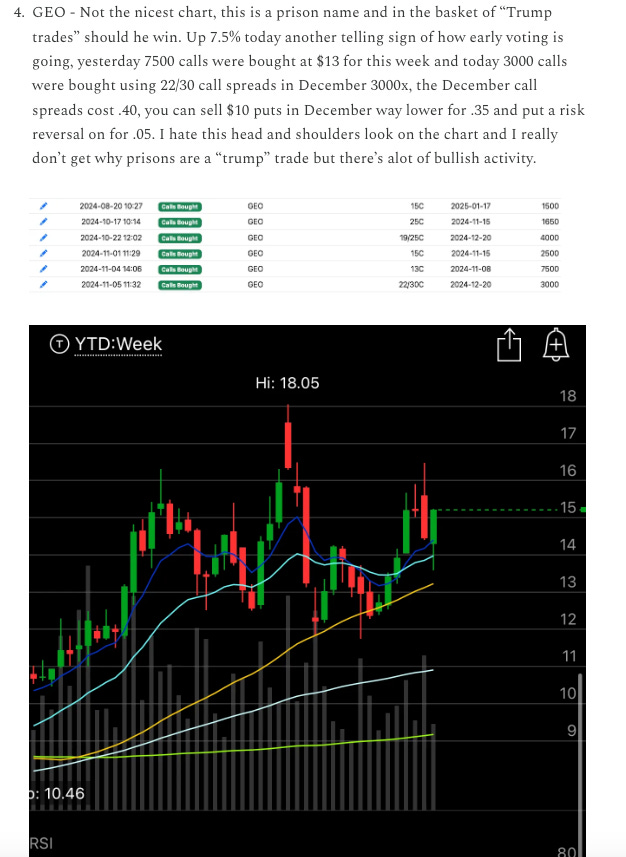

The Kamala trade was decimated. Solar stocks got smoked look at TAN down 11% right now and had you shorted TSLA you would be crying with it up 14% right now. Meanwhile other election trades like prison name GEO which I also highlighted yesterday are up 38% today.

There isn’t much to say other than big money was making these bets long before the moves happened in the market. I know when I posted that chart a few days back saying the trump trade was clearly visible in the charts of the market I got a lot of pushback from people telling me that was wrong because the news said it was 50/50. I don’t know what to say other than charts do not lie, they’re simply the flow of money and money was flowing into these trades and the option flow confirmed where the big bets were going. Today was just the end result but like I mentioned in yesterday’s recap, things like Tesla were telling you big money was not remotely scared of holding a stock where the CEO could have gone to jail if Kamala won. Just listen to what you’re seeing and less to the voices you hear in the real world it will make you a better trader.

As for the SPY, below, the 4 day long bear market is over. We gapped up over the 21 ema, around 2% right now. Look did people who sold below the 21 ema miss it? I mean on short term trades yes, I said specifically do not sell long term positions periods of weakness happen, but stocks have gone up since the beginning of time but with short term trades, we could have easily had Kamala win and big gap down this morning, you saw the odds yesterday. So people who made alot today took on a lot of risk, but big deal, the market is up 2%, now you have clarity and you can sell puts on everything into the gap fills and you’re ok because we’re back over the key moving averages.

Recent Trades

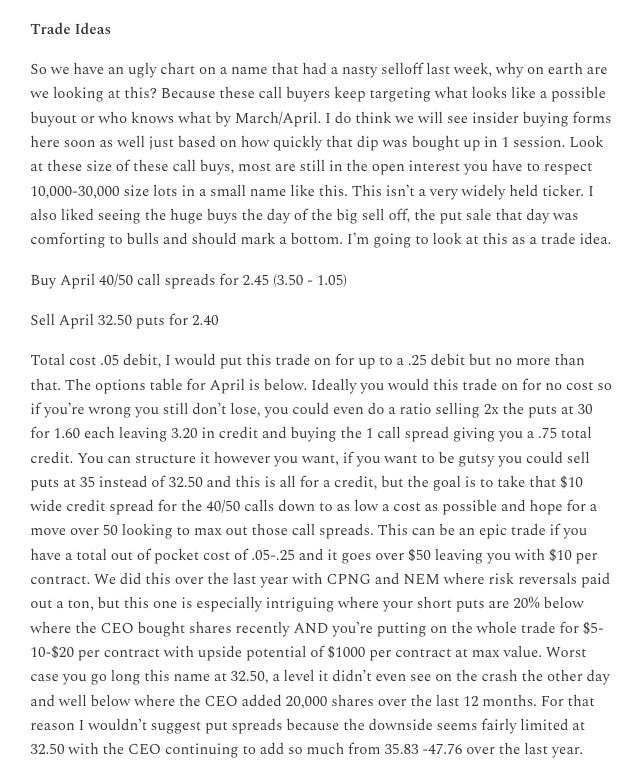

WSC - It took 2 entire sessions from this weekend’s best idea to get an activist involved and another insider buy from the CEO. This played out to perfection as it ripped 8% today on the activist news. The trade I suggested below the call spreads already went from 2.45 to 3.90 and the short puts went from 2.40 to 1.20 up 50%. That was about as quick as things could get with a long term buy like this. The bullish flow was nonstop here. I mean you have to be patient with this stuff, look at CLF, yesterday I got a flurry of emails on how it sold off on earnings, today its up 20% on a Trump win. As I’ve said before, not every trade will work, but we’re analyzing what smart money is doing placing all these bets and looking for repeated call flow in obscure tickers, you will win alot more than you lose over time.

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will be open until the morning and I will have the rest of today’s trades posted by the afternoon. So check back for updated trades and trends.

Hi James, technically speaking, how do you view gap ups, like the one we saw with IWM today? Using IWM as a general example, it’s now firmly above all key moving averages, which alone seems very bullish based on the way you evaluate charts. But it also seems you’ve been hesitant in the past about gaps in general since they often fill.

In terms of viewing charts, should we be bullish on things when they’re above all moving averages, but skeptical if a gap up is what got us there?