1/17 Recap

The SPY broke the downtrend today, you can see it opened over the 50 day, it also got over the highs of 7 sessions ago breaking the trend of lower highs. This is back to an uptrend now. You saw my positioning this whole time, I wasn’t too concerned and was pressing the short puts hard, I mentioned a week back I thought we’d run into the inauguration and we have done that now. We also have megacap earnings coming up and we always run into those, the period to worry about is when all earnings are over and we have no catalysts. The pre earnings run up seemingly happens 90% of the time. For now, things look good again, we had those 2 headfakes below the 100 day on monday and tuesday this week, but both days we closed over the 100 day showing buyers were waiting there and they stepped up where they had to.

Recent Trades

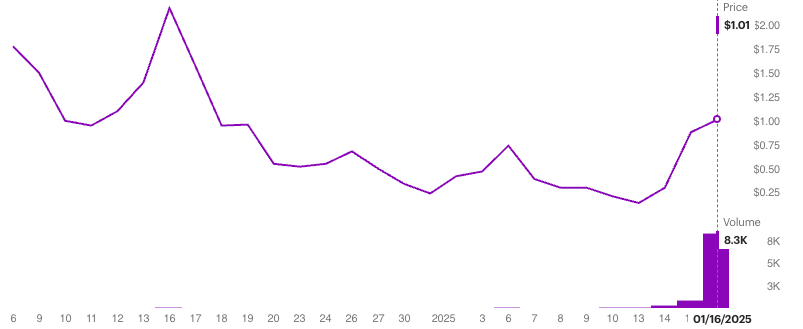

HOOD - In yesterday’s recap I flagged some calls on HOOD for next week bought 3000x along with a few other bullish trades recently. This morning Morgan stanley gave it a huge upgrade which sent the stock up 4%.

Those calls were bought for 1.01 those calls are $1.67 right now with HOOD at 47.95 today. That was a quick $200,000 profit for the player who bought 3000 of them yesterday.

My Open Book

Alot of you email me asking me what I’m doing with my book, and I’ll answer this here 1 time because I really don’t want to discuss my holdings, I post them to be honest with you but it is just too many trades to discuss. I have my 1 massive AMZN call spread the 170/250 call spread I bought last year, it is up huge, but it is at $45 today and it maxes out at $80 over $250 by June 2026. So I don’t need much for this trade to gain another near 100% just 12% or so on AMZN in 18 months, nothing crazy. The rest of my book I am lining up short puts using leverage at levels I think would be great buys. Most won’t get assigned, very few will, if any. I’m trying to keep raising the cash levels of my portfolio with fairly conservative trades on margin while I await AMZN. So far it is working as planned, not counting today, because Schwab doesn’t update in real time, 3 weeks into the year, the Nasdaq is up .14%, the SPY is up 1% and I’m up 3.5%. The leverage is doing its thing as we’re mostly flat and the short puts are eroding slowly. As I’ve said before, I would not try to copy what I’m doing because I have a very good cushion to fall back on where my AMZN leaps are at a long term capital gain now and I can trim them if need be to free up even more cash. I’m in a unique spot with my book now.