11/8 Recap

The SPY continues the post election breakout hitting new highs today at 598.35. These uptrends are where you have to press things. That 580 level where the 21 ema is now is a spot you can sell puts or put spreads off of into next week. The market seems euphoric but the reality is it isn’t even up 3% off where it was in mid October it just feels like that because of the small sell off we had right before the election. You’re seeing some clear winners and they’re the names we discussed the day of the election: Tesla, Bitcoin, Jails. I have some options down below on these themes. The Kamala themes continue their distribution with names like TAN down all week to new lows below 36. We have 7 weeks left in the year, I’d say you need to be careful trying to be a value hunter here because names will be tax loss sold soon if they’re losers, and there are very few of those this year, if you stick to the winners of the year you’ll fare better as those are less likely to be sold into the close of the year.

Recent Trades

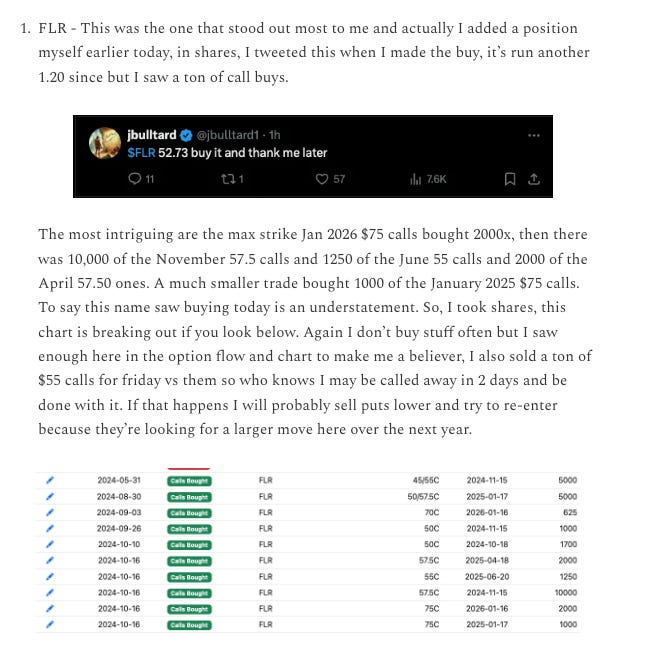

FLR - Let’s talk about this one from the 10/16 recap here. I got a few questions about it today from people who were still in it after it nosedived on earnings today. I did actually take this one and I mentioned it as I do when I take stuff. I had short calls on it at 55 for that week and it closed that week right on 55 and I was called away. The name continued on from 52.73 when I tweeted it all the way up to 59.90 yesterday before plunging to 49.xx at this moment. I never mentioned selling puts again because it just kept going up and they weren’t worthwhile. Look when you follow these flows, greed is something you have to get rid of. When you make a profit, sell it, there’s always another trade. One of the biggest flaws of traders is they hold on too long because they want more and more. Outside of a few megacaps, I think most equities are junk, they’re simply trading instruments. Look at these small caps you miss earnings by a penny or guide wrong and you’re -30%. You buy shares/calls, you make money, you sell, you move on somewhere else. When some obscure name like FLR rips nearly 15% in 3 weeks from it was posted, you shouldn’t hold it into earnings, that just isn’t prudent. So take this as advice from me, have a shorter leash on your trade, money is money, when you have it there for the taking, do so, do not wait for more.

Today’s Unusual Options Activity

Here is today’s link to the database, it will be open until monday morning at the opening bell and the rest of today’s trades will be added by the afternoon.