11/9 Recap

We continue this sideways action as the 8 ema scurries to catch up, the market did everything I was looking for it to do this week after that power candle we put in last week. This is healthy action and what bulls want to see, you need some consolidation because going up every day is just not healthy price action. There are still gaps below and OPEX is next week so weird things can happen.

Tech remains unstoppable below is the XLK, the tech etf, now why am I highlighting the XLK? Because the nasdaq includes alot of non tech companies like Tesla, Amazon,etc and those 2 are in the XLY. The XLK below is putting in its 9th straight green candle and leaders in there like Apple are putting in 10 straight. The XLK is all your big tech names Apple, Microsoft,etc and Amazon is dragged down today with Tesla underperforming so much in the XLY. Google and Meta are in the XLC which is the Communications ETF. So keep these moves in mind as people seem to group all tech together, that isn’t the case.

The XLK as you can see below is nearly 50% Apple and Microsoft and those have been unstoppable the last 10 sessions hence the 10% move up.

We actually just got a huge dump in the /NQ now after the auction as yields popped to nearly 4.8%.

13:01 *(US) TREASURY $24B 30-YEAR BOND AUCTION DRAWS 4.769% V 4.189% PRIOR; BID TO COVER 2.24 V 2.42 PRIOR AND 2.38 OVER THE LAST FOUR AUCTIONS - Indirect bidders draw %, direct bidders %, dealers % - 18% allotted at the high

This is the market we’re in now, nothing really matters other than yields, when they decline, stocks will go up, and when they go up, stocks will decline. So you can throw out all the fundamentals, for the moment, they really mean nothing.

We just got mulitiple TICK below 1000 and a TICK of nearly -1500, so you can see the heavy across the board selling after that auction.

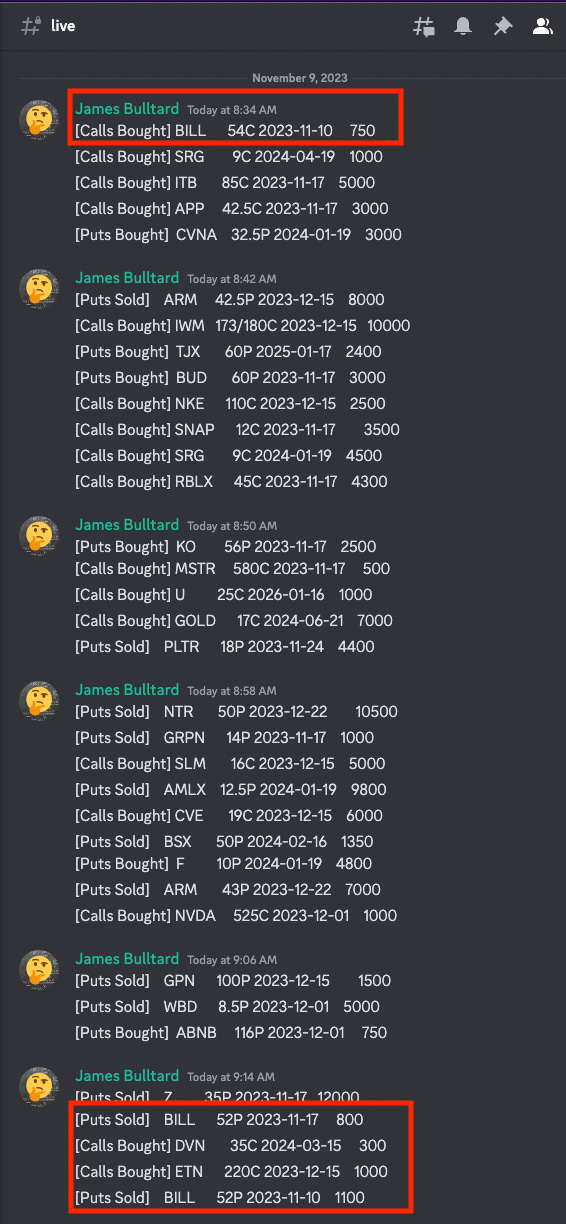

Live

I get questions all the time about what I post in the live portion of what I do everyday from open til 12:30 CST and today was a perfect example of what it is meant for. Right off the open the first trade of the day I noted was a BILL $54 weekly call 750x 4 minutes after the open, then you can see down below 44 minutes after the open another 2 large put sales came in on BILL one for this week and one for next

What happened after? Almost 15 minutes later, BILL dropped a press release that disclosed they were not looking to make the acquisition that was rumored the last 2 days and you can see the big spike just before 9:30 CST. It carried on and the name bounced around 10%.

My point is, I do try to get these recaps out mid day for all the day active traders who want the action intraday, and you’re going to see alot of trades today on BILL in the table, but even by the time I send it mid day, there are some times these have moved quite a bit. This was one of them and there isn’t really anything I can do other than the LIVE portion I offer. If you’re a passive put seller or more of a swing trader obviously this stuff is irrelevant to you, but for those who ask me what the LIVE is for, this is it and what I focus all my mornings on.

Trends

1 Week