11/9/25 Recap

The SPY broke to highs today after we got a reprieve on the tariff ruling with it now moved to next Wednesday. We’re not out of the woods yet but we continue to be in a strong uptrend over the 8 ema. We have big rate cuts coming, our own GDP revisions coming in strong, and it just feels like the goal is to just run things hot. As far as equities go, this is a great scenario unfolding. We do have 1 potential roadblock here with a potential government shutdown in the next few weeks which could be a political tool to hurt into midterms, but if we can avoid an iceberg there, the setup is there for a big year.

Top Names From Yesterday’s Flow

I’m going to add a new section here going forward where you can see the top gainers from the previous day’s bullish option flow. All these below had bullish activity in the database yesterday, I may not have specifically highlighted them because I can only highlight 5 a day but they were. Lots of names simply swinging commons can work out relatively quickly. MLTX for instance up 23% today had 500 17.5 calls bought yesterday.

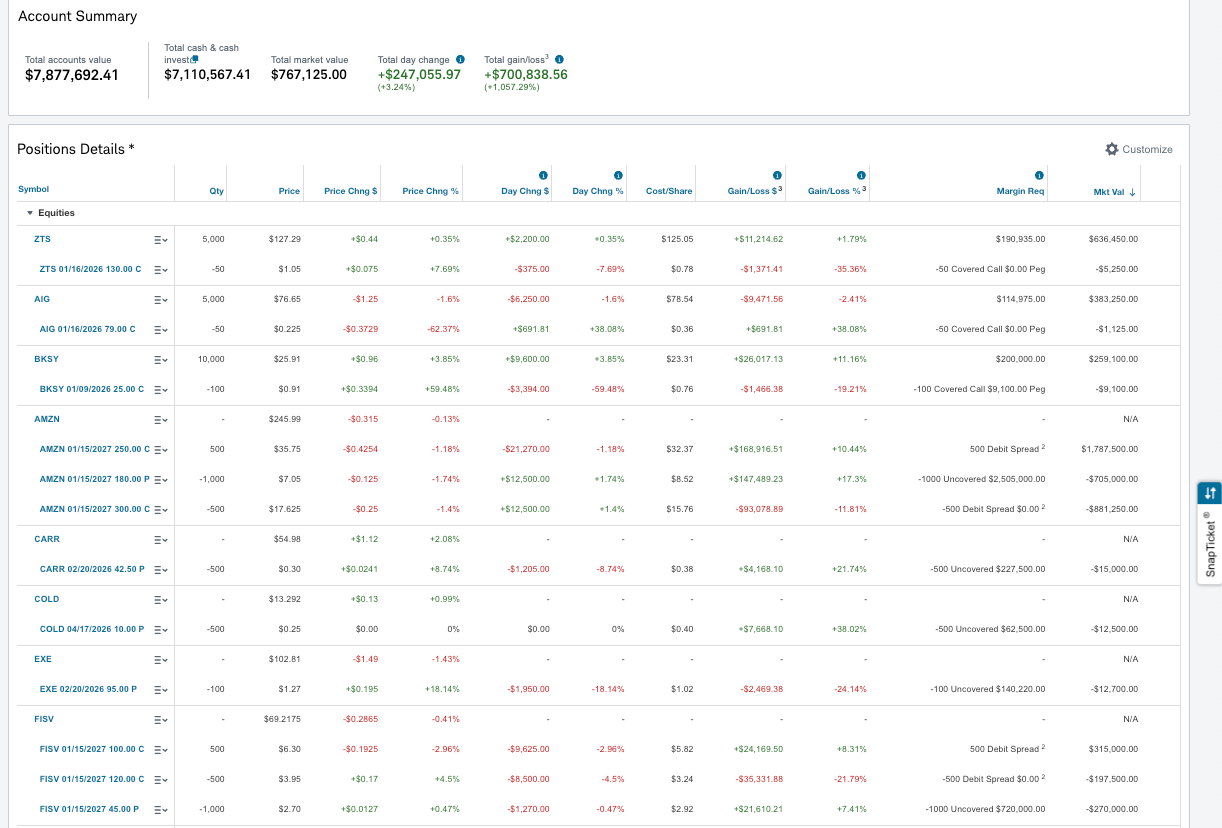

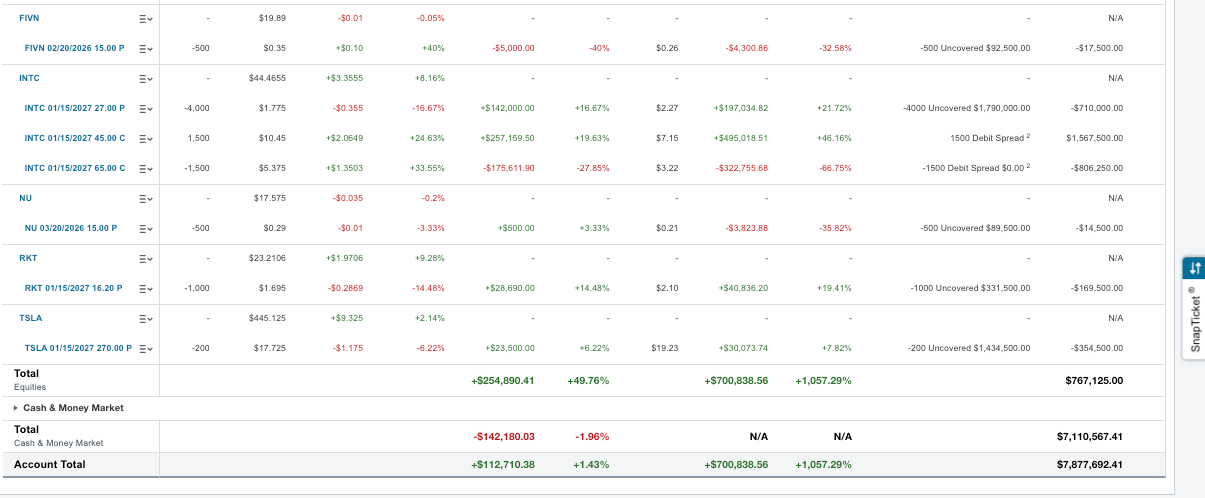

My Open Book

Trades I Made Today

INTC I added 500 more of 45/65 call spreads I am in for January for 4.86 after seeing a huge block of September 65 calls bought at the open. Sure enough minutes later President Trump tweeted about his meeting with the INTC CEO and the stock rocketed up almost 10%. My risk reversal is now 4000 x 1500

RKT - This was up 6% at the open and I closed out my 24.2/34.20 call spread 500x. I like Rocket into the cutting cycle but I don’t have unlimited funds and wanted to deploy more into INTC

AIG - I rolled my short calls at 79 for this week to next week for a .34 credit 50x.

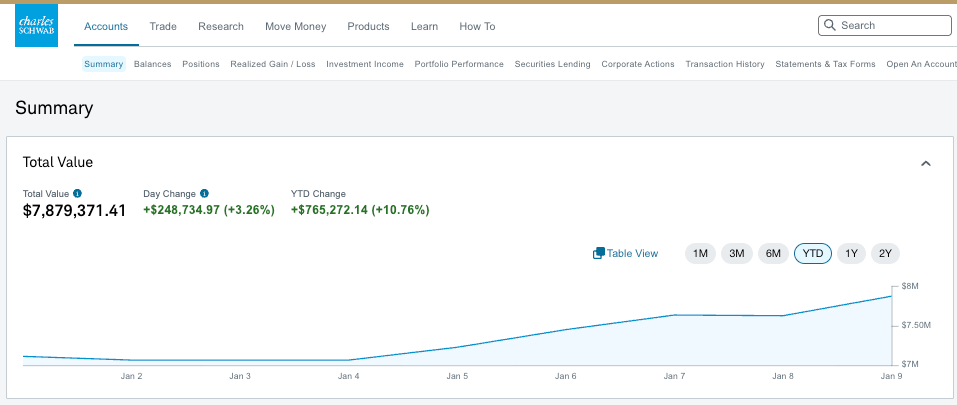

Overall pretty happy with this week, I’m up almost 11% the first week into the year, there is nothing for me to complain about right this was about as good a start as I could have hoped for with my big positions in AMZN,INTC,RKT really carrying the weight as I had risk reversals on all 3 in size.

Trades Of Interest

Here is today’s link to the database it will be up until monday morning at the open