1/2 Recap

As the new year begins we got one of the most telegraphed moves imaginable, a big sell in the winners of 2023. Everyone was looking for it and it happened as people took winners off the table and deferred taxes another year into the future. Apple got a big downgrade this morning to $160 and that really wasn’t too shocking considering it has seen 4 quarters in a row of negative growth. As the largest company in our markets it weighed heavily this morning. On the long side we got a sharp bounce in casinos off the Macau numbers this morning and healthcare names bounced back sharply after their vicious 2023, both of those were in the 2024 preview as things I was looking for but I will discuss those below because they had some odd action today.

Overall, I tweeted out a chart of the SPY yesterday on the weekly showing how the last 2 times the RSI was this hot, we sold off hard, that’s just normal action really when things are overheated, they don’t usually stay there long. The reality is we just went up for 9 straight weeks for the first time in forever. I think a little cooling off period is perfectly normal and earnings season starts in 2 weeks and we probably begin a runup into that as we mostly always do.

The daily chart for the first time in months gapped below the 8 ema and looks like it will close below it. That is a decisive trend change, short term, but its notable. Likely we will go through a small period of weakness and the moving averages will turn down, then they need to flatten out and be reclaimed before strength returns. It’s a process, so I would advise you remove leverage and sell upside calls vs your positions short term. Of course we could just turn around and gap up tomorrow and this be a false breakdown, but until that happens, whenever you are below the 8 ema on anything, you proceed with caution with short term positions. Look at the RSI below, its cooling off rapidly as well.

Oil had a big reversal this morning after the big move up overnight. It fell almost $3 before bottoming for the session. Oil continues to be weak and I really do not expect it to stay strong into the election. We’re now on a month of diesel prices sub $4 nationally in the US which will be a big boon for non oil company margins.

Lastly the TNX is perking up and looking to break a downtrend, if yields start ticking higher again, this would not be good for equities as their whole run was the inverse of the move below. So keep an eye on TNX because it seems to want to spoil the party. Equity bulls are hoping it stalls out here and reverses.

Recent Trades

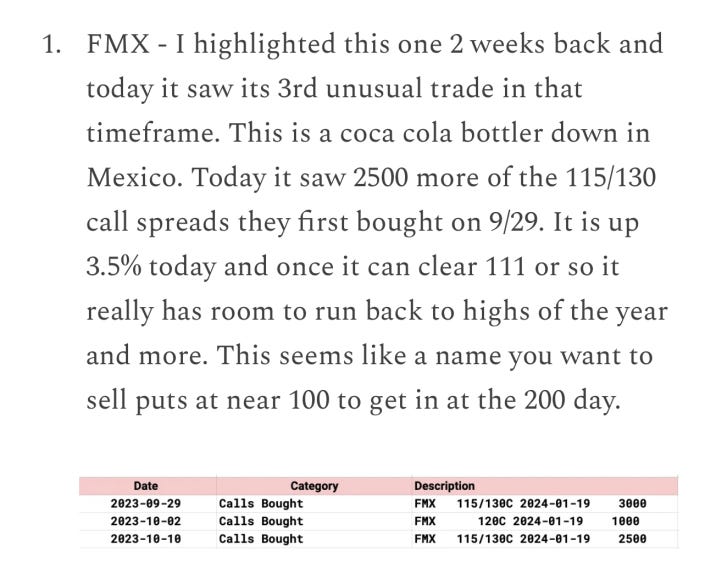

I haven’t posted anything in 2 weeks so its a bit difficult to look at recent trades since there were none but looking a little further back, trades like this FMX I noted back in late September and early October when FMX was just over $100/share worked beautifully as FMX is sitting right at $130 today right before expiration on all those calls. That was as perfect a trade as you could put on in a small name like that.

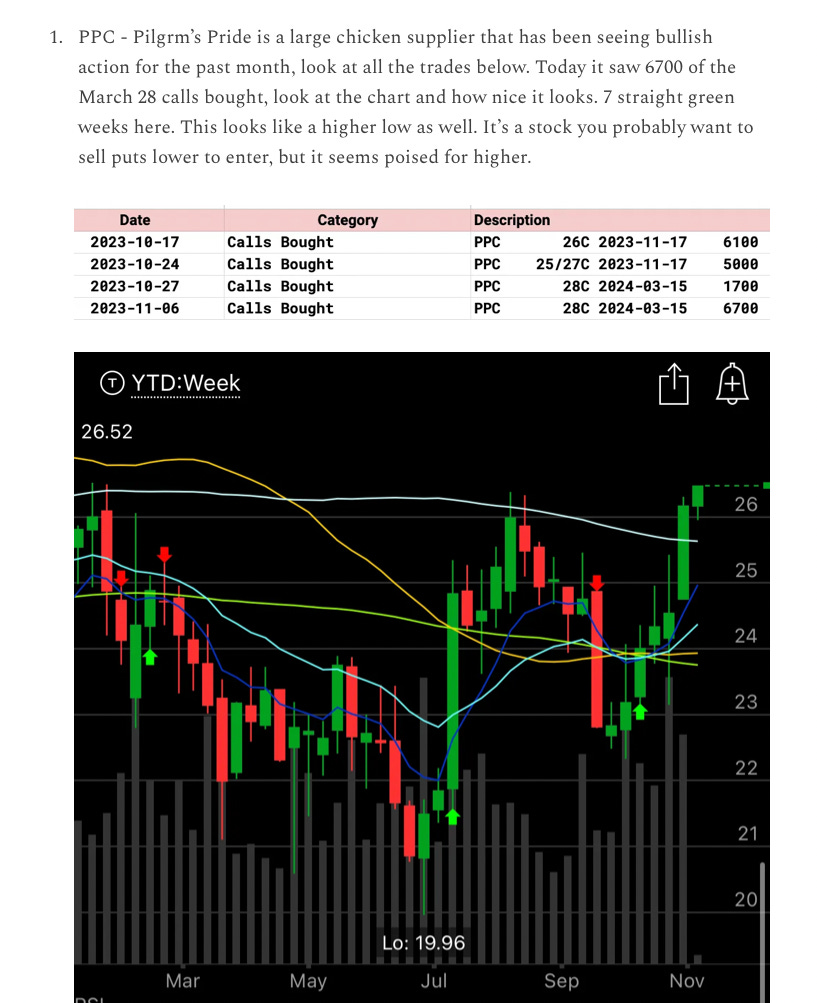

Others like PPC aren’t the most exciting names but all those March calls in early November are now in the money and it doesn’t seem like much but for a name like this to move 10% in 2 months is pretty significant, these aren’t tech stocks and PPC is $28.30 today with 3 months left to go on those calls.

Trends

We’re going to have to wait a little bit on trends because without posting for 2 weeks, I can’t post what I normally do which is 1 week and 2 week trends. This is the list of 1 month trends for now. BABA has turned up into the top spot for now followed by Amazon and Pfizer. CVS is another up 3% today after being a trending name for a while. A name like BSX is rare to see in here, along with CYTK which had that big 80% up day last week. Give this a few sessions before we can start to see trends again, there was no sense in me noting things during all the low volume sessions after December expiry.

Today’s Unusual Options Activity