1/2 Recap

Happy New Years, the SPY looks terrible. We opened below the 50 day for the third session in a row and today moved up into that 8 ema, rejected, and reversed lower. We’re now nearing that 100 day average right under 580. This isn’t bullish at all. Now if you’re looking at longer term positions, yes there are values to be had, but short term, this isn’t pretty. If we break that 100 day, the next support is that 565.15 level that was our previous breakout and the 200 days right below that just over 550 now. This is a pretty clear head and shoulders bearish formation on the SPY right now. It appears we are now headed for that election night gap fill.

Recent Trades

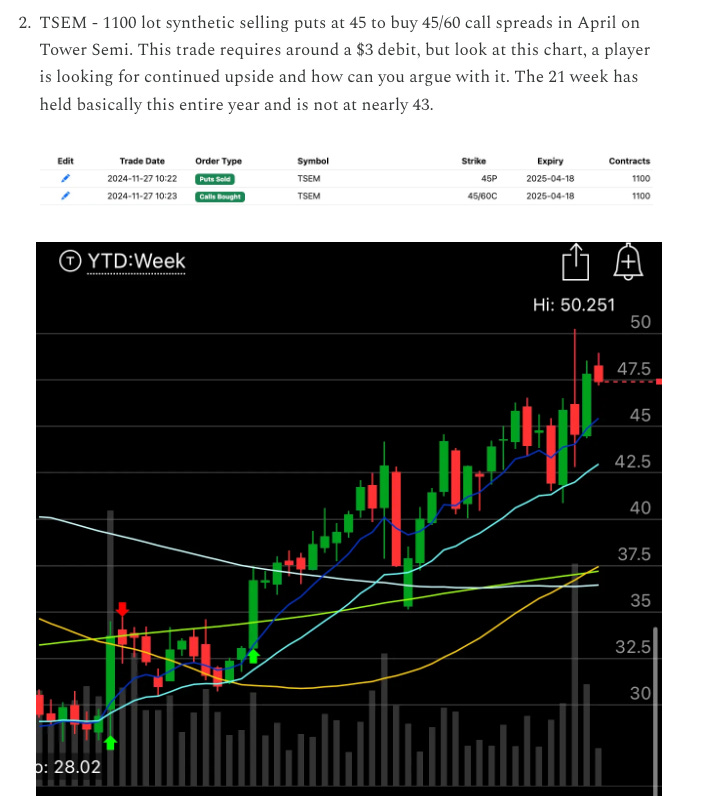

TSEM - In the 11/27 Recap here I noted the risk reversal placed in April and the name has risen 10% since taking that risk reversal up dramatically. This was a very clean trade and right at the money which was a tell it wasn’t overvalued at the time.

My Open Book

So this is going to be a new section in these daily recaps where I post my open book, I use Schwab as my brokerage so those of you with it will be familiar with the platform. I don’t want to discuss every trade I make, I really don’t have time for that, but I will post my book and you can always check the options volume and things will match up. As I said in the year end recap, my book has grown so much the last 2.5 years in here that I will be aggressive but conservative with how I trade but yes I am very aggressive with margin but that’s ok as long as you know what you’re doing and you’re ontop of it.

Also early in the year I like to sell far out leaps on names I think are undervalued and hope that something happens and the shares fall to me at some point so those are the leap puts you see. I stagger my trades to where the margin shouldn’t bite me if I’m assigned anything. Otherwise most of my trades are based off option flow and me trying to scale into names as I see their option data come in. Just remember the purpose of this substack isn’t to copy me, you learn nothing doing that, it’s to see the option data, see what I’m doing, and understand why I’m making the moves that I am so you can improve your trading process. As of right now, I have alot of cash and I’m looking to get assigned some things, but on my terms. As for what happens if things start getting hairy, I just simply roll things out if I don’t want to take assignment, but right now I have plenty of cash and am looking for assignment.