1/20/26 Recap

The SPY gapped down big overnight on a myriad of things from an escalation in the Tariff war with Europe to Japanese rates rising. So far the they bought the dip right off the 50 day and we need to make a sharp move back higher before we get a bearish 8/21 ema cross down. The market has been trading heavy, we’ve gone sideways for a few months mostly and now this could be the beginning of something more. On one hand you always have to worry with Trump in office as Greenland is warning residents to prepare for invasion now, but on the other hand Trump is in a pickle where he has built his entire persona on the stock market being representative of his economy and every serious move down he backs off his initial plan and saves stocks. So while we could have a small bumpy period here as who knows what is coming with this Greenland takeover, at the end of the day as we’ve seen over the years, Trump chooses to make stocks go up over anything else and with midterms 10 months away, the last thing he wants is his market to suffer for a prolonged period.

On a longer timeframe you can see below we opened below the 8 week for only the 2nd time since the uptrend began last May. The last one was saved within 1 week, will we do it again? I don’t know but until we lose that light blue line, the 21 week, I wouldn’t worry too much because this is still one big uptrend going back 8 months. Under that 21 week is where you want to start closing up things.

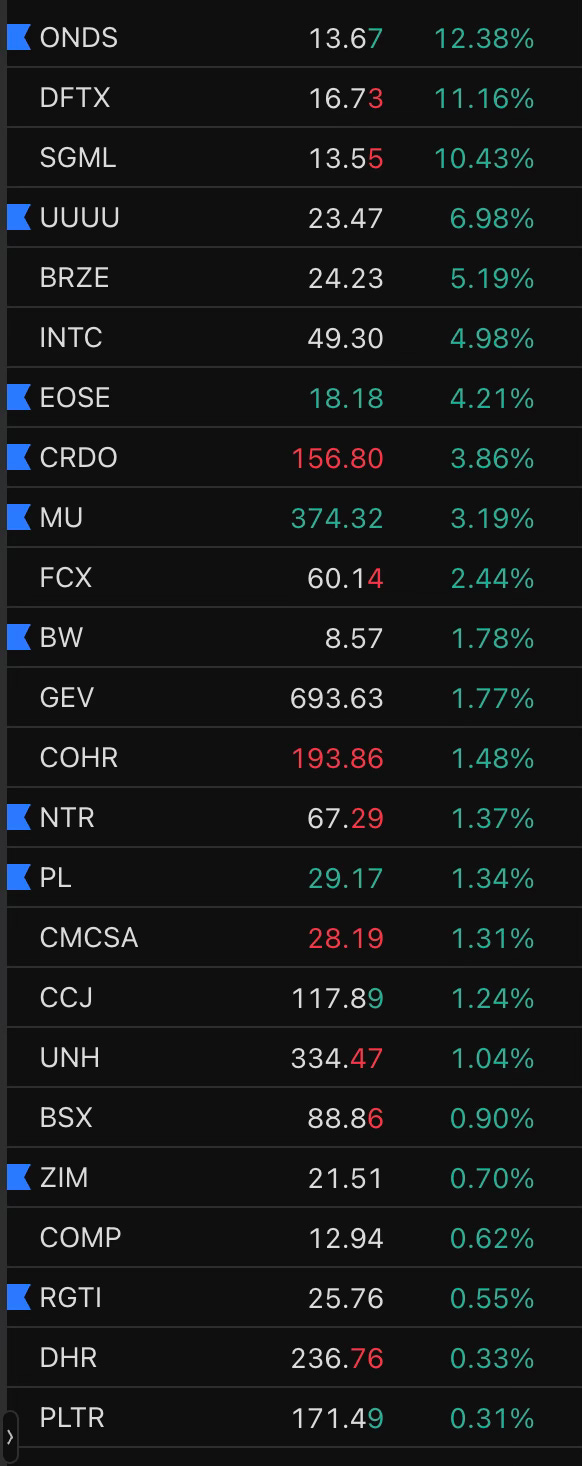

Top Gainers From Friday’s Recap

My Open Book

Trades I Made Today

UUUU - I sold to open another 1000 of the 15 puts in March for .52 adding to my position, I love how this one is acting right now and I was big on it last year but Trump and Bessent have made it clear this is going to be a critical focus for us in 2026.

INTC - rolled my March 40 short puts up to 45 in January 2027 1500x. The January 45 puts were sold for 7.89 giving me a basis near 37 if I’m assigned. The call flow is so strong here and I closed my big trade last week hoping for a pullback, while it did pullback 6% last week, its so strong today in this weak tape and shows insane relative strength so I just decided to press it. If I have to close all my open positions and go all in long 150,000 shares of this next January I would, this is the trade the rest of Trump’s term and it remains a fraction of the valuation of Taiwan Semi.

BA - sold to open 100 of the Boeing 237.50 weekly puts for .66, just like this name right here with the flow it’s been seeing, and I want to buy any pullbacks. This nets me $6600 this week.

GPN - bought 5000 shares of this at 74.12 following a call buy I saw today at 90, this has some insider action recently as well.

MBLY - bought 30,000 shares at 10.86 following a couple large call buys I saw today that I will discuss below.

FOUR - added 5000 commons 63.96 following the payments theme with GPN and the FISV trade I already had on.

DVN - closed my Jan 32.50 short puts 500x, kept my March ones, I hated today’s price action with nat gas up almost 30%. I took a small loss, nothing notable.

This was a weird session I was expecting to be deeply red, surprisingly I was green, just a combination of being in the right names with the flow recently like INTC,BA,FCX in size as they’re all green. I’m happy, things could have been worse, but I’m ok for now and considering the leverage I’m using, I will take it.