1/21 Ideas For The Week Ahead.

What an interesting week we just had, the market had broken down by wednesday afternoon, we had a followthrough on thursday only for it all to reverse friday on the “good news” that Google and Apple had fired employees! What a market! Bad news is good news for the bulls because it means Jay Powell may ease up on the hikes at some point. The bad news for bulls is that stocks tend to bottom months AFTER the fed pivots historically. For now, we remain in no man’s land and this coming week with all the megacap tech companies reporting should finally give us a direction, I think. Let’s look at some charts

As you can see below, the SPY closed it’s week just below the downtrend. What a war that downtrend has waged on bulls for the last 12+ months. It’s interesting how everyone is proclaiming the bull market is back but we’re yet to break that trend to the upside and now with earnings revisions to 225 we’re at 18x earnings on the SPX which would make this the highest priced “recession” multiple in history. Recessions tend to bottom much lower historically but this could be a first. With that said, the data we continue to see does not show a “soft landing” nor does it show any hope of one with the yield curve inverted to its deepest point ever. The people who say such things are obviously not using any sort of historical precedents.

The IWM, below, retested the breakout and continued higher. Small caps remain a beacon of strength and so many of that outperformed this week. SHOP, which I highlighted as a best idea 2 weeks ago closed over $40 yesterday with a huge +6% day.

Oil, below, continues to look strong, a nice double bottom on the chart and this looks set to go much higher. This is an issue for equity bulls as RBOB(gasoline) has been creeping higher, fast and a sharp move up here will not help those inflation numbers.

The dollar remains broken which is bullish for equities It is now firmly entrenched below the downtrend.

Something has to give soon. Equities are against the downtrend, the dollar is below the downtrend, oil looks like it wants to rip higher, and with all that the VIX is near lows. Something is lying and we’re going to find out soon what that is

How Did I Do This Week?

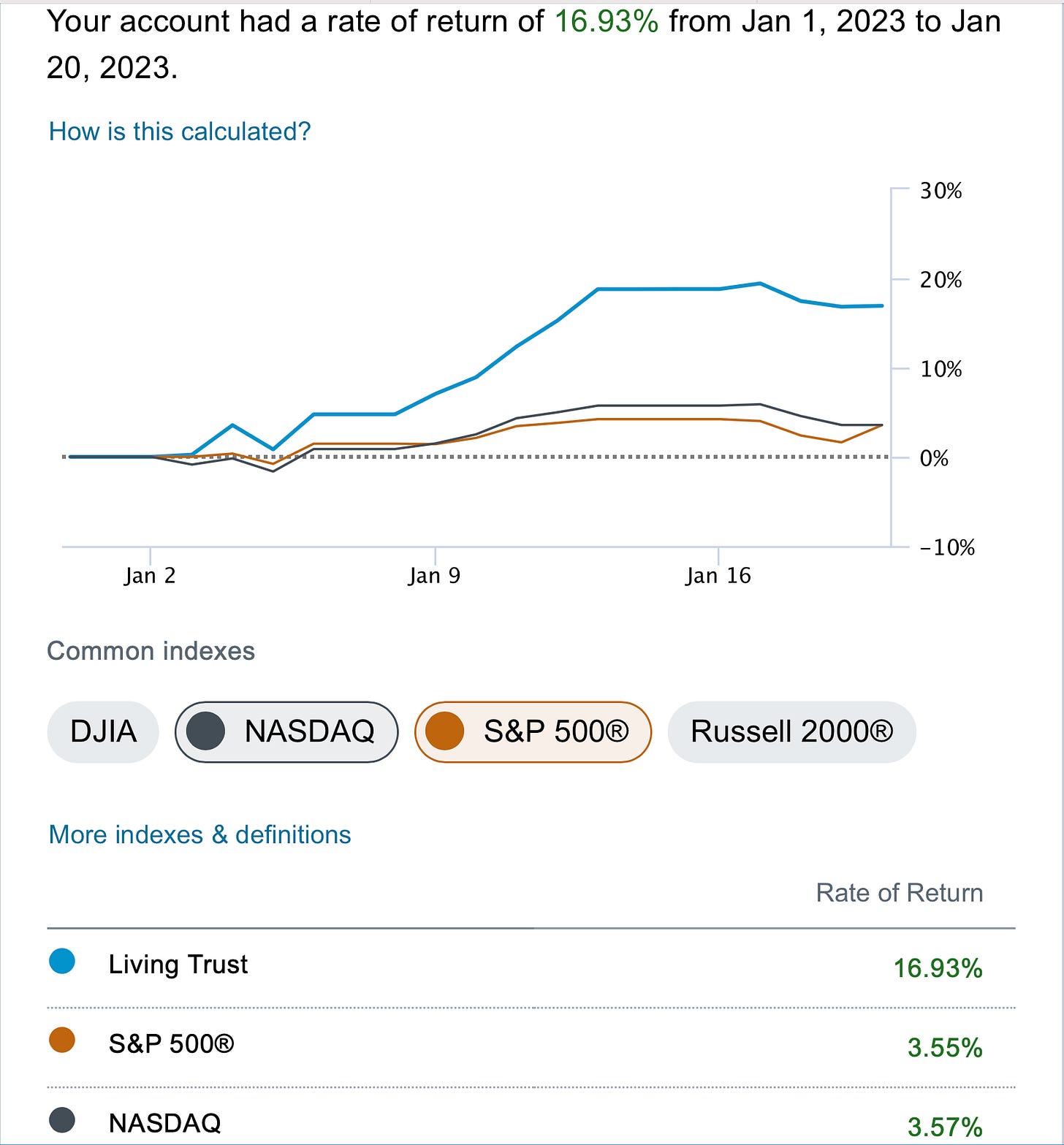

I really missed out on yesterday being hedge to the downside for the first time in forever with the long put spreads. I still think that is the prudent move as you can see the chart above, being long against that downtrend has not worked yet. I am still very long, via short puts lower, but yesterday was a dud for me as I was slightly green vs a market that exploded higher. Schwab had not updated the data to today when I pulled it but I’m still up around 17% for the year vs the Nasdaq up about 6% so I can’t complain thus far, it has been an incredible 3 weeks for me to start the year.

My Best Idea For The Week Ahead

I don’t have one for this week and I don’t mean that in a way of I’m being lazy. I mean it in the sense that this week is going to be full of fireworks, have you seen the earnings calendar? Look at the highlighted names, those don’t even include other critical names like: Johnson & Johnson, Lockheed Martin, Texas Instruments, Union Pacific, ASML,Abbott Labs, and CSX all of which could drop critical hints of where this economy is and where it’s headed. The big ones to me are obviously Microsoft,Telsa,Visa, and Mastercard. They will give us insights to the health of the consumer. Are people still buying $60k ev’s, are people still spending heavily on their credit cards, and how is enterprise spend going? Satya Nadella has already warned tech investors that the next few years will be tough and so far, investors have shrugged it off. We recently saw a downgrade on Microsoft to sell, that never happens, what are those analysts seeing that the rest haven’t. It reminds me of the sell BNP Paribas put on Amazon last year to $2800 and nobody thought it was possible and then the stock fell to $1600(split adjusted).

So for the sake of not gambling, I don’t think the next 2 weeks are a time to put on new trades, ride with what you have, make sure your hedges are in place whether it’s covered calls, puts you’ve bought, whatever, but don’t give back the gains we’ve had this year, for me being up 17% this year, many would kill for that over a year and that’s why I hedged so heavily 2 days ago. We’re almost at a euphoric point where everyone thinks everything is priced in, and all these internals are bullish, yet the simplest downtrend, we have not broken.

A big thing most investors don’t grasp is that there are just a handful of moments a year to really go long, the rest of the year is just sideways or down, for those moments to go long I want to see the RSI bottoming out at oversold levels, I want to see a bullish divergence forming in the MACD, and then I will hammer things long. As of now we aren’t seeing that and actually if you look at the SPY chart above, the RSI is pointing down on the SPY weekly and it’s not even breaking out. So I still remain neutral for the moment, I need confirmation before I get enthusiastic.

Weekly Chart Scans

Weekly Bullish Engulfing

Weekly MACD Bullish Crossover

There’s alot of high quality names in those scans above, but like I said, I would just be patient, the last 3 weeks have been superb, I doubt any of you have not done well, until we get through this minefield of earnings, I think it’s just better to wait and watch. If we breakout, the move will be so powerful being that the downtrend has been a year long. You will catch a long drift. If we breakdown, you will have a chance to reload lower, so while everyone is tripping over themselves to try and catch THE MOVE, it’s best to just let whatever happens unfold in the next 10 sessions and then go from there.

Just my 2 cents, if you want to gamble, gamble but there is absolutely nobody on this planet that can tell you anything with certainty before all these megacaps report because they can and will move the market violently. So sit back, enjoy the fireworks for 2 weeks, there’s many other weeks in the year to attack the market this just is not the time.

Also here is I a short clip I made on how I hedge at the moment