12/1 Recap.

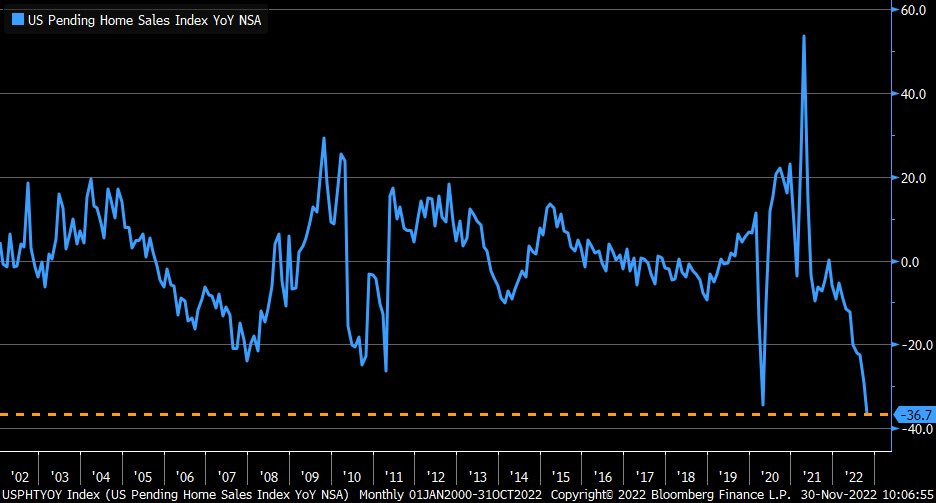

Where to begin. Before we get into the charts, let’s talk about the data we’ve seen emerge the last 2 days. We just had the lowest pending home sales in the last 20 years from when this datapoint began, no big deal just -37%. You guys do know real estate is the biggest sector in our job market right? Do you know how big a percentage of GDP real estate is? I’ll let you have some fun googling that.

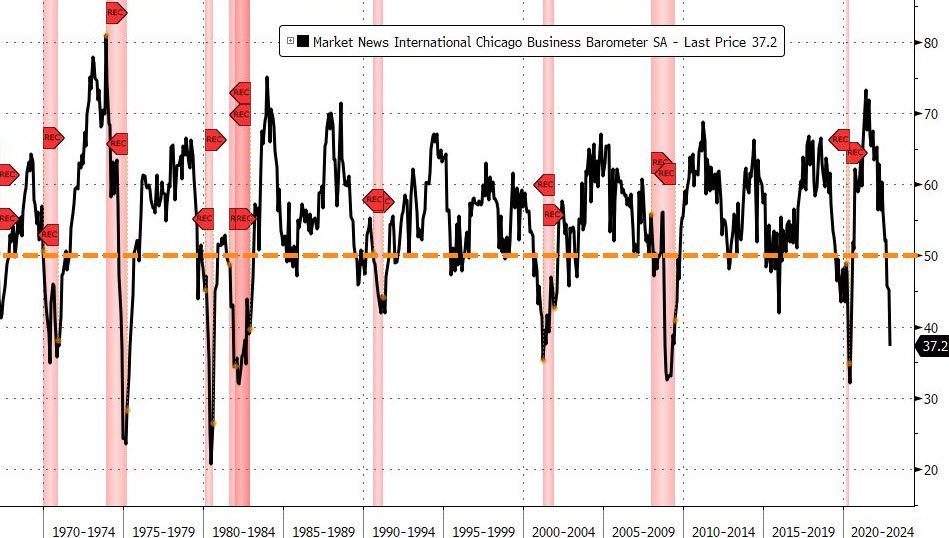

Then yesterday we had an awful PMI reading of 37. Every reading sub 40 has occurred in a recession, see those red highlighted areas, those are recessions, of course now because they’ve changed the definition of recession, we aren’t in one, I’m told.

Then this morning we had personal savings hit their lowest point since 2005 and yet we are told everyday that the consumer is doing fantastic, they’re flush with cash and these are the best of times even though the average american doesn’t have $500 to pay for a medical emergency per CNBC.

So aside from these fantastic datapoints, everything is great and you should take every dollar you have right here and buy this rally. Let’s look at charts and see what they say and later on I will explain why I am all in short right now.

The SPY continues to look good technically with all the moving averages sloping up and a close over the 200 DMA and EMA but we’re running into that year long trendline. Hence my short position, my basis on my SPY short is 407.25. I have been pointing at this trendline for weeks in here and my thinking is that if I’m wrong, great, I will lose some money, how much? I don’t know but I know I need to see a close on the other side of this trendline and right here, I look ok for the moment.

On the weekly timeframe you can get another glimpse of what I see. Again I’ve never been a bear from day 1 of this substack, I always sold premium and traded just strength, but right now, there is no basis I can think of for equities to break this downtrend. In fact I am still in the camp we see 3200 at least as earnings go nowhere the 235 estimates people have. This week alone Apple said 6 million less Iphones would be built because of China issues, Apple is the largest component in the SPX, think that won’t hit earnings? Anyways, those are things that take time to play out, as I said the reward of being long here, if we don’t get over that trendline is very small.

In the last 2 months while everyone is cheering stocks going up, they missed the fact the dollar plunged 10%.

I topticked that move perfectly and stocks rallied hard since, I was very bullish that entire time, and the dollar still looks like it is going lower, but I think for once stocks won’t follow it here.

The VIX also closed today sub 20 for the first time in a very long time, another not historically great time to be putting on long term positions, here look for yourself what happened everytime the VIX got to these levels. Maybe tomorrow’s jobs number causes a turnaround, maybe not, but again I have a very tight leash and a weekly close over the downtrend and I close my short. Trading is all about risk and reward, I never thought there was much reward being short, until now, the end.

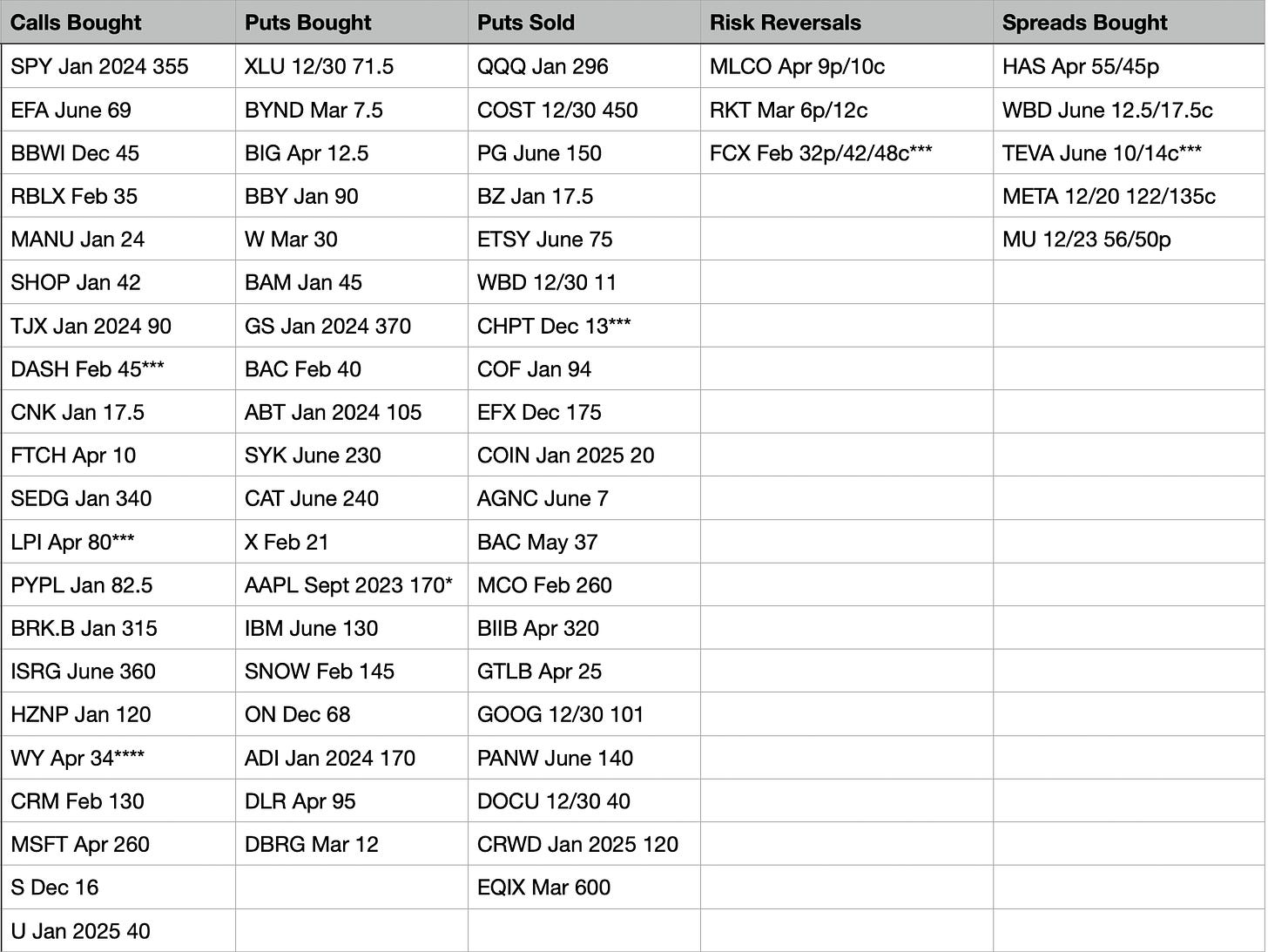

Today’s Unusual Options Flow & What Stood Out

DASH had huge call buying today in Feb 45, 35,000 of these calls were bought, huge dollars being through around.

WY saw over 13000 of these April 34 calls bought in a name that doesn’t see much

LPI was another odd one, a small energy name with very unusual volume on April $80 calls, could be a buyout name.

FCX saw a large risk reversal today selling Feb 32 puts to buy a large 42/48 call spread, interesting trade because commodities weaken in a recession.

TEVA with a lage call buy next June with the 10/14 call spread bought in huge volumes.

Apple had an odd Sept 2023 put buy of deep itm 170 puts almost 10,000x. Someone getting levered short.

What Did I Do Today?

I was slightly green today, my heavy SPLK exposure probably helped alot because the market was slightly red and I had put on some short positions yesterday but added more today over 409 taking my average up to 407.25. Right here, for a few days of course, I’m going to give this short position a go. I’m all in. I have my conviction, I waited patiently to get my spot and I’m going to give it a whirl. I added more of the 430/435 bearish call spreads I had for 12/30 today at .48 and .49. I now have 1000 of these.

When I say all in short, here you go. I have my short DIA call spreads, that’s the dow jones, I have 5600 shares short of the SPY and that’s only because the rest didn’t fill at my limit price near 410. I have short puts at 390 next week covering those short shares like a covered call would on the long side. Then I have my 1000/1000 bearish call spread. So you want proof of my conviction, there it is. I’ve had a tremendous year and the risk is worth it for me. If I’m wrong, great the government will get a few less tax dollars, if I’m right, great I make a few bucks. Either way, you have to admit with multiple rejections at this trendline, with earnings in decline, if ever there was a time to be short, this is a good one.

Anyways, that’s my positioning, hope you all had a great day and I will see you over the weekend with all my best ideas for next week.

Thanks for that. Makes complete sense.

Where would you take profits from these shorts ?

How much room are you giving yourself in case the market breaks the trendline as a fake breakout like it did in august on the same trendline on the qqq?

Loving your insights!

Agreed this is the time to go short. This rally has been lead by industrials, materials, and financials, all the "value" stocks. Seems like everyone has been searching for safety in these value names but the prices are getting crazy. New bull markets should be lead by growth names and the Nasdaq to show an appetite for risk, with valuing following, not the opposite that is happening right now. With 4%, soon to be 4.5% rates a 38 PE on COST, 35 PE on MCD is crazy.

I have a little out of the money puts for March, April and May in MCD, COST, GS, CAT, BLK, and APPL as well as VIX calls that I have been scaling into the past 2 weeks.