12/1 Recap

We got a big reversal today after Powell spoke. Powell said hikes were still on the table but odds of a rate cut early next year have soared north of 50% at this moment. In short, the market doesn’t believe him anymore. The data recently on unemployment was not good and it looks like we could be in the early stages of another recession as we were last year but back then the definition was changed. At this point, my gut tells me they likely would not allow the recession news to be out into an election year as that would devastate the odds of re-election, but we wouldn’t be cutting if a recession wasn’t in the cards.

The SPY bounced off the 8 ema the last 2 sessions and today looks to be putting in the finishing touches on a 5th straight green week. It’s uncanny how markets love to go sideways waiting for that 8 ema to catch up, touch it and go, but we did it again here just like we did in early November. At the moment we remain really extended, but we’ve been that way for over 2 weeks.

Small caps were huge winners today with the IWM up almost 3% as the emerged from this massive inverse head and shoulders pattern. Shockingly, these aren’t as overbought as the SPY, that’s how far they’ve lagged. This is a large breakout as you can see where small caps finally broke out over the last bit of resistance in their way.

Yields continue to plummet as well with the TNX to the lowest point it has seen since September at 42.xx down 3% more today. This has been a complete breakdown for a while now. and it looks like just a hair over 40 is the next stop.

Recent Trades

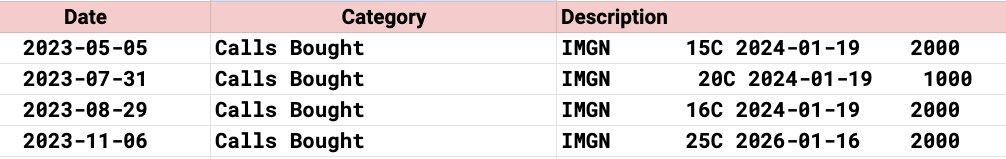

I’m going to add a new section here to go over trades from recent recaps that have really worked out when applicable. I had someone DM me on Twitter this morning about IMGN and I will be honest, I had no idea what that was. It was a biotech that popped 80% yesterday on a takeover.

So I went back into my database and sure enough on 11-6 someone had bought 2000 of the Jan 2026 $25 calls. The stock was $16 then and it was $16 on Wednesday at the close, but it jumped to $29+ yesterday morning on the buyout. There were a few other IMGN trades in my notes expiring in January and all those paid out too, well done whoever took those.

PATH was another one I highlighted earlier this week on 11-28 in one of the recaps. It is up 26% today after earnings. I know there were bearish trades months back on it, but that’s when small caps were in trouble, I don’t know if those are still open or not, because I only log when the trade is placed but putting on that risk reversal right before earnings was very interesting to me. That player made alot of money today.

APLS is up 11% today to $60. This was one where there were a handful of smaller trades for December/January in the past few months that I had logged including a large 3800 block bought in the 11-6 recap. After today’s pop a player stepped in today buying 10,000 of the 75/100 call spreads for next month. Is this a buyout play now?

Lastly, look at the recap from 2 days ago on 11/29, there was a monster buy of weekly UPST calls, 10,000x and that name is up 17% today on the day of expiration! Those short term trades really workout more than they don’t.

That’s the purpose of all logging all these notes to spot where the money is flowing in an odd manner to hopefully capitalize on it. Congrats to whoever did. Just remember in the market the order of what matters is simple:

options flow > charts > fundamentals.

If you stick to that, you will do great at this.

Trends

1 Week