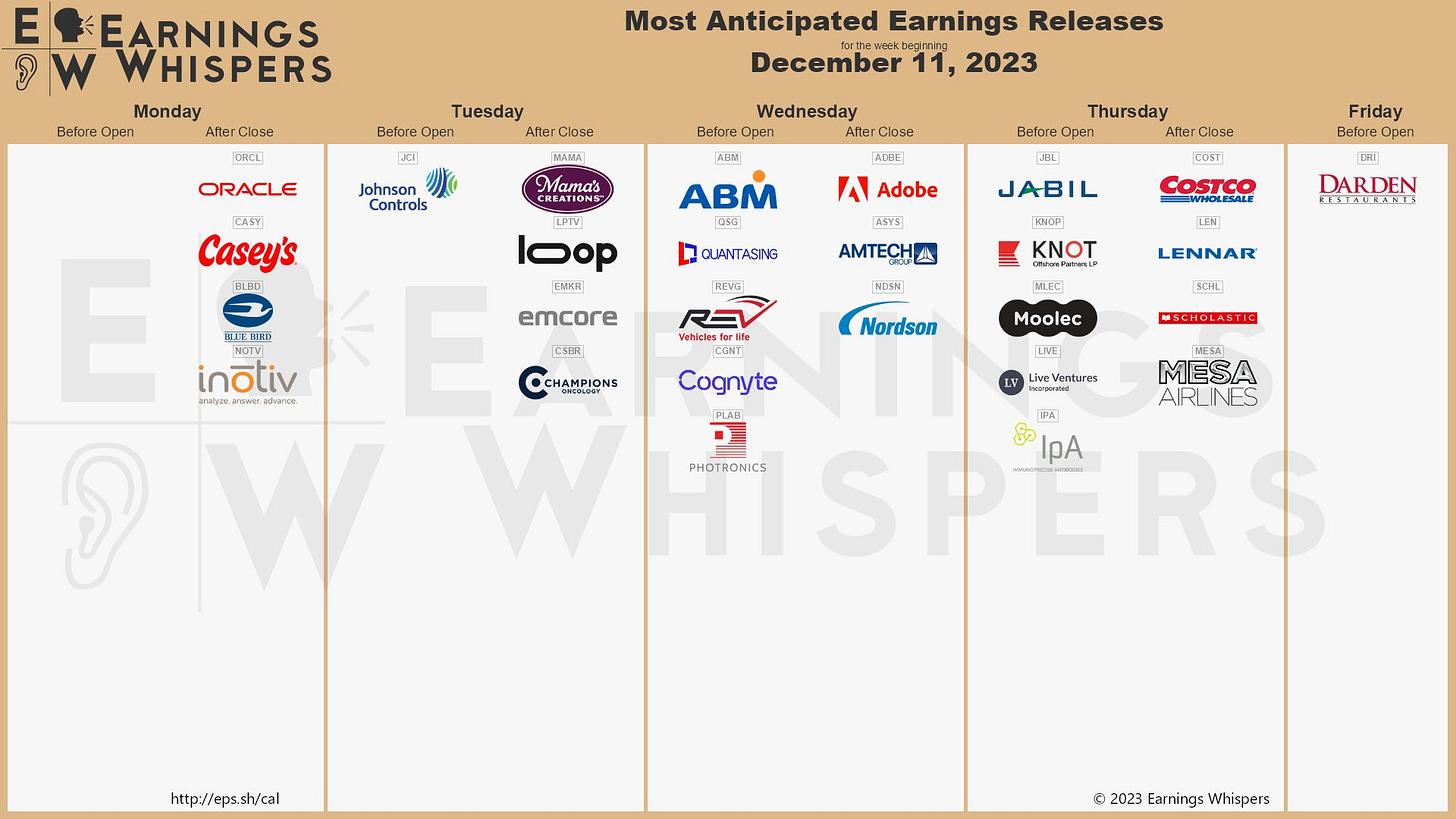

12/10 Earnings Preview For The Week Ahead

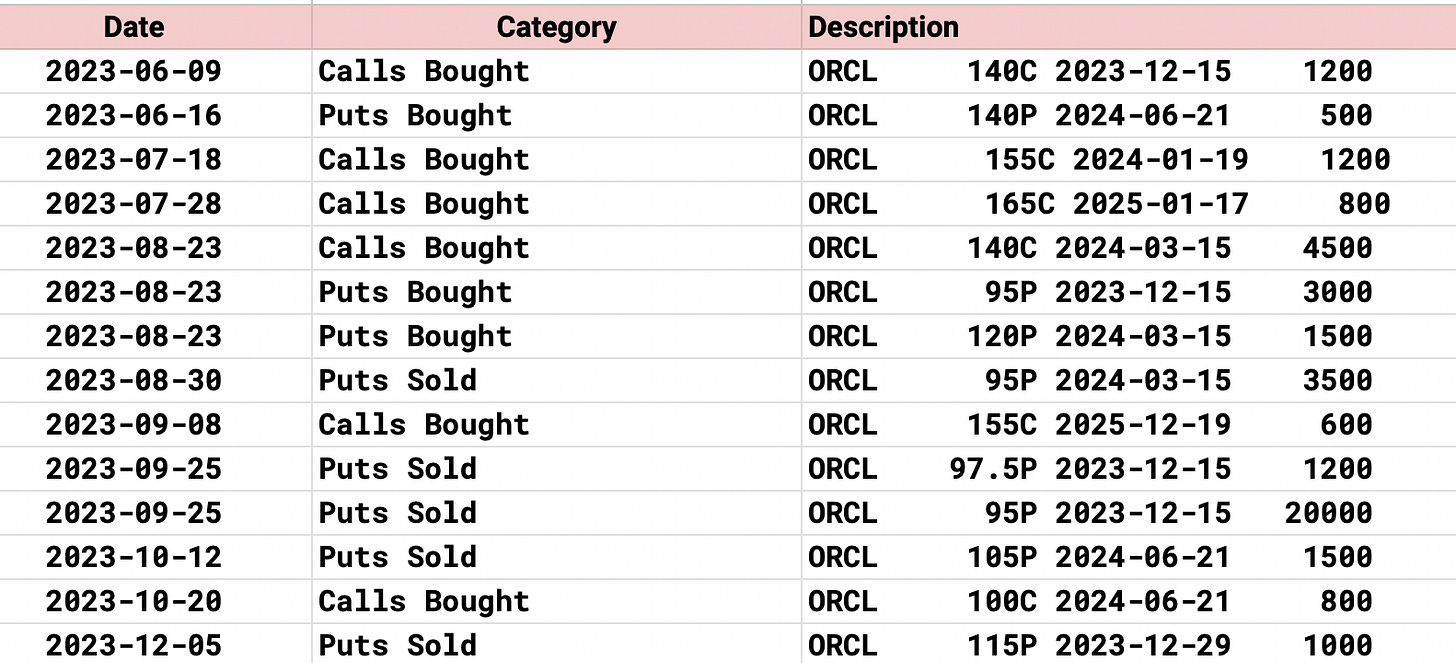

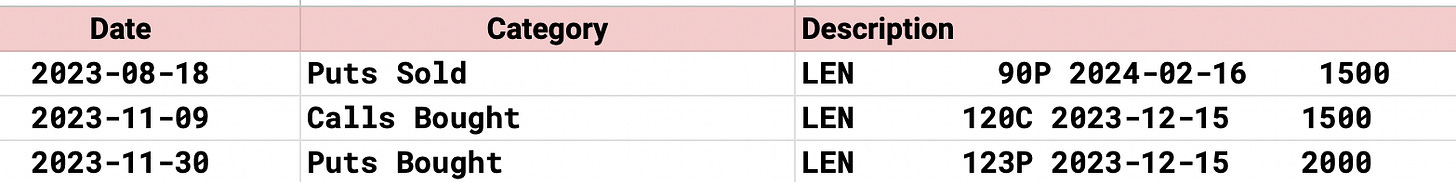

This week doesn’t have many names left to report but there are a few big ones remaining: Oracle, Adobe, Costco lead the way. As always if a name is on this list and I don’t share any options action on it, it just simply means there is none in my dataset.

Monday Afterhours

Tuesday Premarket

Wednesday Afterhours

Thursday Premarket

Thursday Afterhours

Trends

Since there weren’t too many options to go over today, I wanted to share this screenshot below, it is a full year snapshot of my database and the top 30 bullish and bearish names including all the expired trades. Basically every trade I’ve noted this year.

What you will notice is Amazon is by far the most bullish name in terms of large, unusual size and why I’ve been so heavy on it since May and it has not disappointed trading up over 70% on the year. Many in there did not work like PFE, BABA or DIS but others like MSFT, NVDA,META, AMD, CCJ,INTC, PLTR,CCL, and UBER had huge years. Lots of the biggest winners of the year were showing up constantly. CCJ was up almost 100% this year and it wasn’t even a highly discussed name coming into the year but I kept seeing the option flow last year and wrote it up last year in September 2022

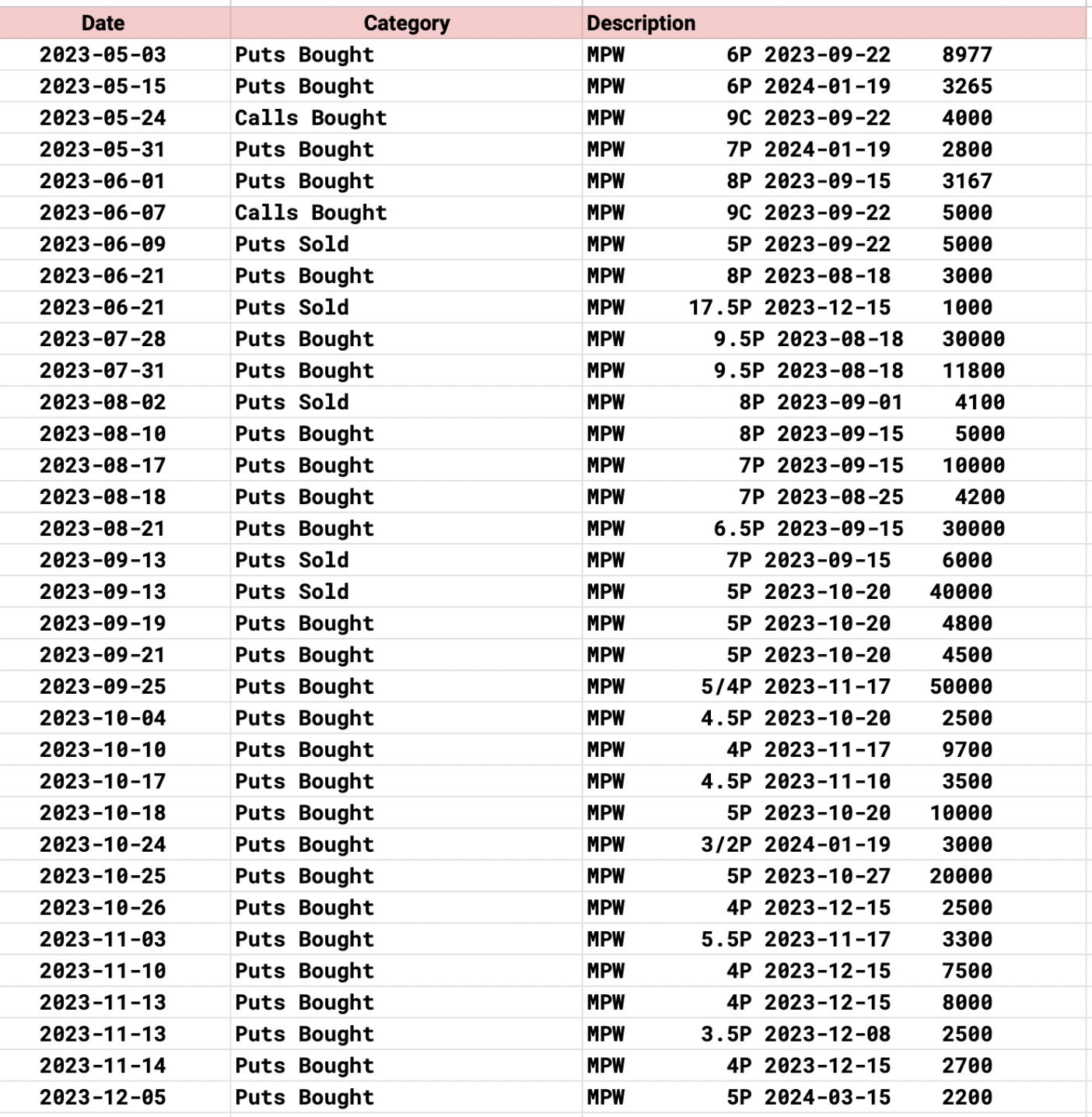

On the bearish side MPW was the most bearish name, here is every trade I noted this year on MPW and they all began in May.

The stock has been in a freefall most of the time since. The majority of those names on the bearish trends underperformed the market this year, so the data is doing its job of trying to help give an edge on direction and names to be in and names to avoid/short.

Remember my number one focus is simply direction. When you have a directional edge, there are many ways to trade things. Stocks don’t have to go up for you to do well. Stocks have 3 potential outcomes: up, down, or sideways. If you’re a put seller you succeed on two of those, up and flat. These option flows are so noteworthy because the big money aligns itself in these trades well before they move more often than not and logging it all daily, looking at the trends in the data is really a tremendous edge on seeing where the money is setting up. I know there’s lots of platforms that give you all the data out there, but most of it is just nothing sharing every single trade with no regard to size or how odd it is historically within a name, filtering for the oddities within all that data is what I think makes what I share so unique. This system of organizing each unusual trade and looking at the totality of it in the trends is just something I always used myself to approach the options market in a different manner when looking for a direction on names.