12/11 Recap

I had to head out just a little early today, so you’re getting this 30 minutes earlier, sorry. We had an interesting session with the surprise rebalance that occurred. The megacaps got hit hard and the Nasdaq was up 100 points even with most of the leaders deeply red. We also have tons of datapoints this week with CPI, PPI, Retail sales, and a Fed decision this week. With how great a year we’ve had a lot of people are likely taking their chips of the table too. The SPY is starting to come out of this flag it’s been in after a few 8 ema touches and no breakdown. We are still overbought, but it can stay that way.

The big surprise today was Natural gas which has been horrible for a while, but today seemed like capitulation down over 10% at one point and slowly trying to claw back. This is a very big move for a commodity like this. Something is very wrong when this occurs.

Recent Notable Trades

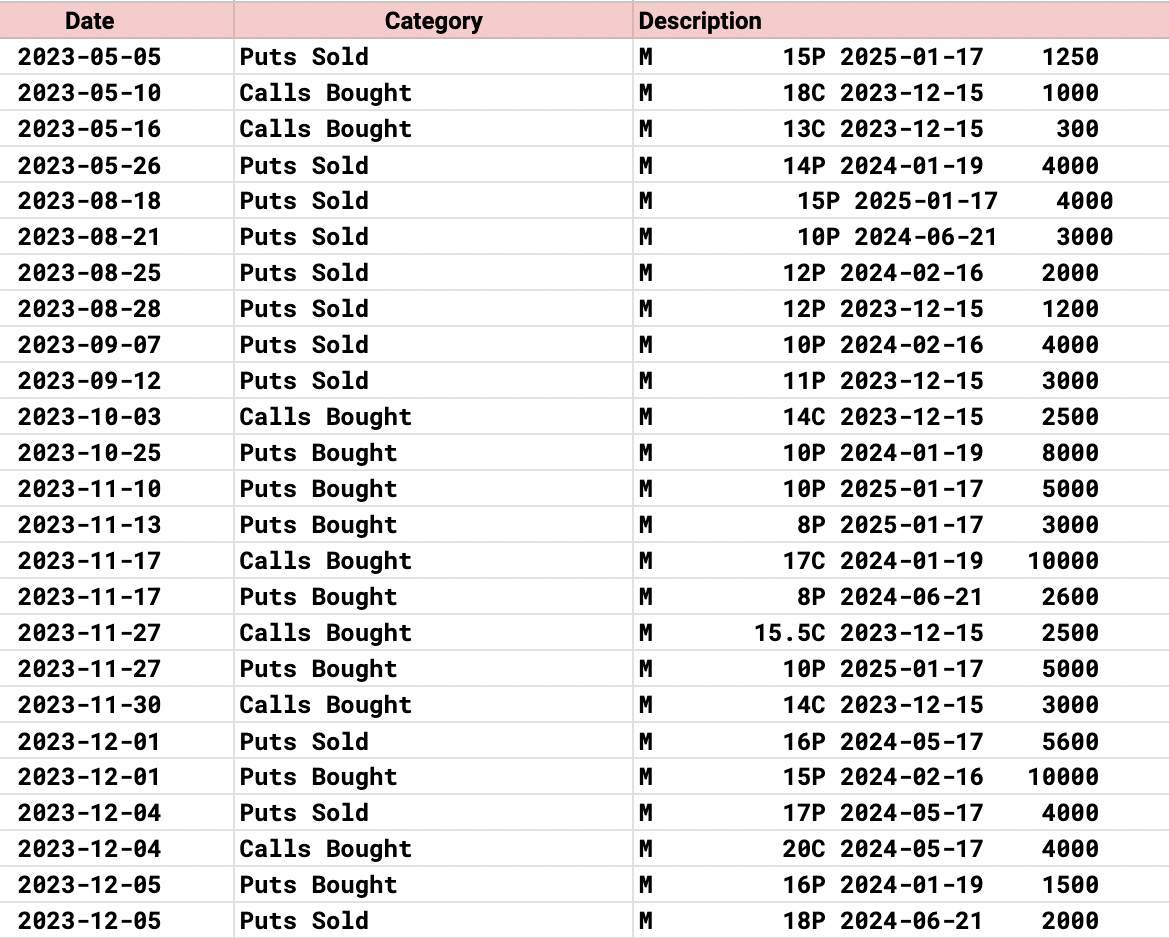

The big one today was M. Macy’s got a takeover offer last night at $21/share. If you look back at friday’s recap and go under the 2 week trends, M was right there as one of the most bullish names with 7 bullish trades and 3 bearish ones in the last 2 weeks, here was all I have in my notes. Something was brewing there, it was up 50% in a month and the culmination was the takeout today, congrats to all of you who played it, I definitely had alot of questions regarding it the last few weeks. I wasn’t a believer, but it worked.

Look at this chart below of Macy’s that huge bullish engulfing on the heaviest weekly volume of the year was followed by a few more green candles before that move today. The charts never lie, they simply show you what is being bought or sold and M was being heavily bought, I wish I paid more attention to it, but this isn’t my cup of tea, small cap retailers that is.

Another one that worked today is HOLI. What is HOLI? I have no clue, it looks like I noted it in the 10-24 recap where someone bought 1000 calls at $20 expiring this week, lucky for them the buyout happened to occur this week and at $26.50. Don’t you love the unusual options?

There were others recently like CRSP Friday which saw 2 large put buys and followed up the next session by going down 10% today and seeing another large put buy added.

Lastly we have BITO which never sees action but saw 2 large put buys last week expiring here this Friday and sure enough bitcoin was decimated today down 7%.

Trends

1 Week

2 Week