12/12 Recap

As you all saw with my morning note, I mostly got out of all my longs, a few I couldn’t close because the names were thinly traded and I will go over those down below. The market had a nice rally higher into the close, the exact opposite of what we did last time which was sell into the close and gap higher on the print.

As you will see below, we put in a nice candle on the SPY, closing about the 8 and 10 EMA. The RSI swung up but we’re still stuck below the 200 DMA which doesn’t exactly scream strength and we’re now 6 points away from the top of the downtrend at 405 or so. Tomorrow we could very well get a soft CPI number and run right into that downtrend right before Powell speaks on Wednesday. So even if tomorrow goes well, you still have this looming catalyst where Powell could come in and sink the market AFTER a solid print, hence my decision to just sit this out. I’m not looking to play the guessing game.

Speaking of CPI tomorrow, I just saw this on TV, JP Morgan laying out the scenarios that could unfold at various prints, interestingly, they’re basically giving stocks a 70% chance they go up. Keep that in mind next time someone says “everyone is too bearish”. Interestingly today, we saw the VIX up 10% which stocks were up, that isn’t normal, the VIX is at 25 now up over 20% in less than a week since dipping below 20.

Oil unsurprisingly bounced back hard today after hitting oversold levels during the last session. Anytime any asset reaches oversold levels, that’s probably time to begin picking at it, you see that below in the RSI with 30 being oversold and 70 being overbought.

Today’s Unusual Options Activity & What Stood Out

Pinterest saw 2 large put buys today, one in January $24 puts and one in January 2024 22.50 puts, interesting. Of course Jim Cramer has been fawning over this for the last week and he is the kiss of death, so there is that bearish catalyst.

GFF saw January 41 calls bought, that’s a name I’m in and wasn’t able to close out today because the options are very illiquid, but it’s ok, its an undervalued name and I like it either way.

PFE had a huge call buy in February 52.5 almost 10,000 of these bought

AMZN with a huge put sale in January 2024 75 today. As oversold as Amazon is, if the market goes lower this will too, but overall, $75 should be a solid bottom, last week we saw February $75’s sold

DDOG had a huge call spread bought 12,000x in June for 110/130 with the stock sub $80 today.

Trade Of The Week Update

SPLK exploded 5% higher today, I wasn’t expecting a rip that quickly after my writeup saturday but this morning we saw the takeover of COUPA and people rushed to buy the undervalued growth names with activists in them. Look at Pinterest as well. The activists are going to make deals regardless of what the market does.

What Did I Do?

As I stated earlier, I closed up most everything, this isn’t about being right or wrong, I really don’t care about that, it’s about not getting caught up in some wild moves. By Thursday afternoon we should have a direction. Tomorrow after CPI we could rally all day and then Wed after Powell we could crash all afternoon, the opposite could happen, neither could happen, I don’t know. These datapoints are all absurd this year, we’ve really never cared about these prints anywhere near as much as we do now and that’s understandable. I’m just saying if I miss 6% to the upside I really don’t care, I’ve outperformed the market by a mile and nothing that happens here will change that, but making sure I don’t get slammed being wrong is more important.

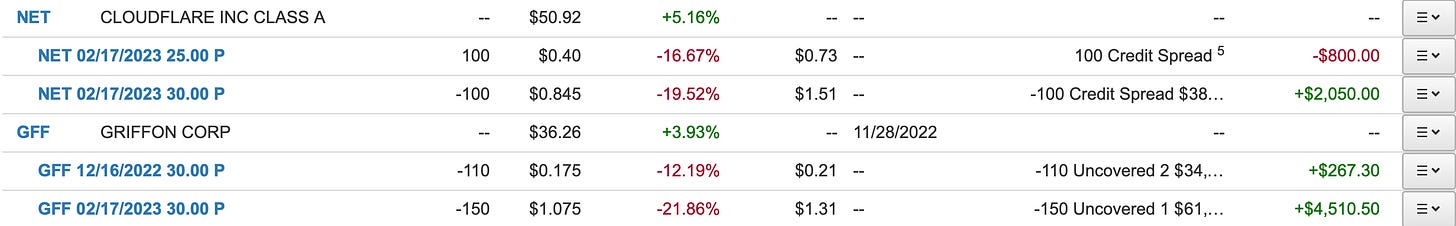

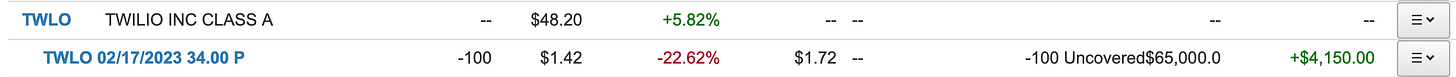

With that said, these are the few positions I kept open

Why? I couldn’t get a nice fill on NET, but that’s ok those short puts are 40% lower, that stock has been on a tear the last week since I entered. GFF was the one I mentioned above in the unusual options, it’s a very illiquid name in the options market and I couldn’t get decent fills so I held on. This name is deeply undervalued and likely wouldn’t be crushed if markets were hit. TWLO as well, I couldn’t get a decent fill so I kept my short puts, this name is dirt cheap and I’m not concerned, it rallied 6% today on the COUP takeover as it’s a name with that type of potential. Lastly the XLV I didn’t close the put spread because that is a defensive trade. If equities dump, XLV will do just fine.

That’s it, I don’t have much to say other than whatever happens in the next 2-3 sessions, we will have a better grasp on direction, will markets breakdown and go lower? Will we breakout and go higher? I don’t really care which happens as long as I can trade the trend going forward. So I hope you all did well today and I hope whatever you chose to do for the next 2 sessions works out.

Me, I will be back tomorrow going over the unusual options and that’s it for the next 2 sessions. I don’t want to waste time with charts until we’re past Powell on Wednesday.

I hope you all had a great day and I will see you tomorrow.