12/12 Recap

CPI this morning wasn’t a surprise anywhere and we got a small rally in the market. There is still alot of datapoints to come this week. The bigger surprise today was oil which broke to new lows at 68.41 as I type this. While this may be bad for oil bulls, it is good for everyone else. We can only hope this can sustain for a while. While some might say this is a sign something is wrong with the economy, I’m not in that camp.

The VIX also hit it’s lowest point since before the covid panic began today at 11.95, there isn’t much to say here, fear is at record lows for the last few years but in turn that means options are priced as cheap as they’ve been in years. For some that means adding cheap insurance, whatever it is, this isn’t where you want to leverage up.

Overall the SPY continues to look good as it awaits the decision from the fed and whatever Powell has to say this week. It is coming out of a flag and has been green 8 of the last 9 days just oozing up as the vix collapses. I think you can sell puts at that gap below at 440 and just wait for things to calm down if you’re not long already.

Recent Notable Trades

OKTA has been nonstop since I noted it in the recap a week ago on 12/7 after the big 120/130 call spreads was bought 4000x. It was just over $70 then and is up almost 10% in 4 sessions since to 77+. Those last 3 trades from 11-15 on have gone really well in this one.

MDGL was one I noted in friday’s recap with 2 odd lots traded, it popped 4% today up to 218 and those put sales at 210 for January from Friday are looking great for the moment. That 21 ema touch below on Friday seems like the recent local bottom.

Trends

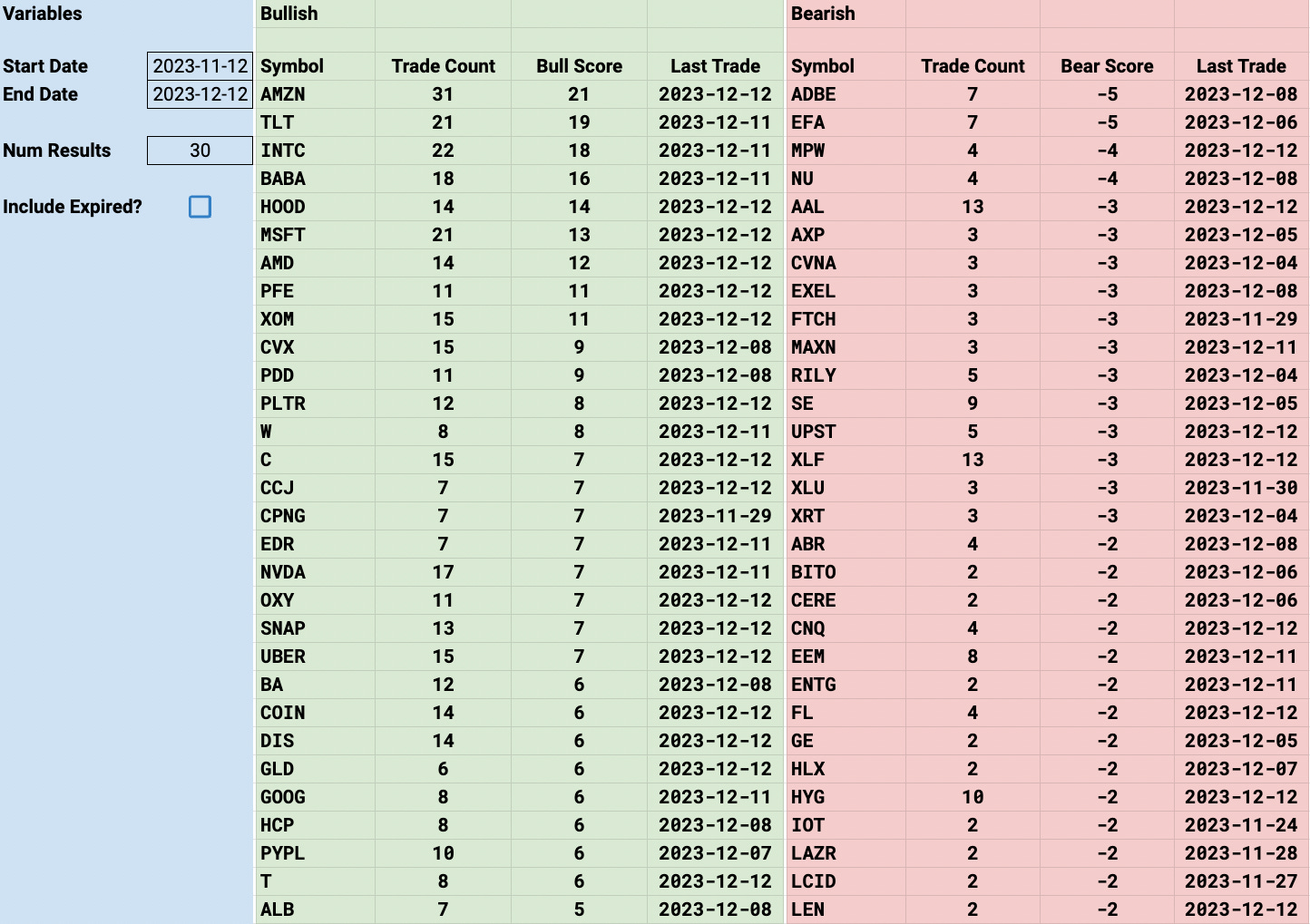

BABA,HOOD, and TLT are the hottest tickers of the past week all without a single bearish trade in that timeframe. BABA, as horrible as it has been, surely has to see a bounce in early 2024 as tax loss selling ends. HOOD has been on a tear up 25% in the last 2 weeks. ADBE reports in the morning and I really have no idea what is going on with all these put buys on the bearish side. Hedges possibly? Risks to photoshop with AI? Issues with the Figma deal? I guess we will have to wait but could be worth some lotto puts if you don’t mind the risk of losing it all but it’s very rare for a megacap name like that to be leading in bearishness on all timeframes in my notes.

1 Week

2 Week

1 Month

Today’s Unusual Options Activity