12/15 Recap

We are closing in on a 7th straight green week in the SPY, we haven’t done this in forever. The euphoria of the fed this week may be just that, we had one fed speaker this morning say rate cuts were absolutely not on the table and sure enough the IWM is down almost 1% today. If rate cuts aren’t on the table then the large caps that led all this year would still be the trade into next year as they are the winners of a high rate environment. So that weakness we saw recently may be been a buying opportunity and all those small caps than ran so hard may be the sells. It’s so hard to get a gauge on anything when it’s all a back and forth over what may or may not happen with rates.

On a daily timeframe, yesterday’s candle on the SPY really looked like a short term top, we are still above the 8 ema but this RSI hasn’t hit levels like this in a long time and we just need to cool off. If bulls can hold this up for 2 weeks and sell into early January that would be the most tax efficient thing all investors hope for.

Recent Trades

At the top of yesterday’s recap in the table was a buy of AA $35 calls in February 2000x. It’s up 7% today.

How about RUN? In the recap on Tuesday someone put on a risk reversal selling the puts at 5 and buying a 12.5/30 call spread for 2025.

Look what RUN has done in the 3 sessions since, its up 50% in 3 sessions, yes, that’s not a typo, that player nailed that trade about as perfectly as you could.

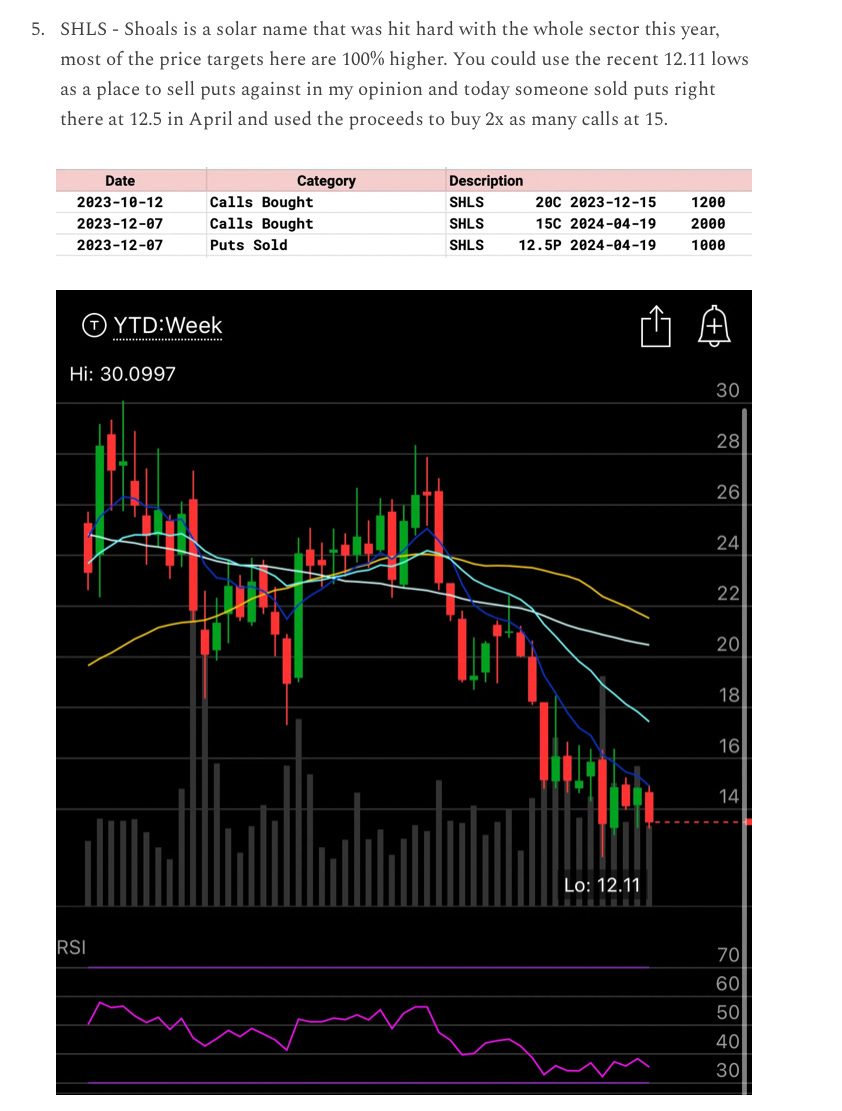

I had highlighted another solar name recently seeing an odd risk reversal, SHLS, on 12/7 a week back, it is up over 20% in a week since to 15.73 now.

OKTA was up another 2.5% today to $83, this is up almost 15% in the past week from $72 last friday and those 82.5 calls bought on 11-29 when it was 67.5 are up a few hundred percent. It was a great time last week to put on those 2025 call spreads 4000x

Are you seeing what I mean by you’re going to see the moves in the options flow before they happen? People constantly send me emails saying they want more deep dives. If you’re actively trading, all that’s important is knowing what is being bought and focusing on being in those names, the how or why is meaningless. You could spend 100 hours reading financials, that’s not what’s going to move a stock, it will move when players with bigger money finally move it.

Trends

AMZN continues to be the top trend on all timeframes,it will be featured in Barron’s this weekend with an emphasis on their FCF generation going forward alot of what I’ve pitched all year on my thesis. BABA worked out today, they’ve been loading it up in the past week as one of the top trends for 2 weeks really and today we got a 3.5% move up on the stimulus news out of China. US Steel, X, had a flurry of trades this week, I think a deal gets done over the weekend, we’ve already heard about multiple bids over 40, and there was an odd lot of CLF puts in yesterday’s recap for next week, could they be the buyer? My guess is yes as the acquirer usually takes a hit in such deals and those put buys for next Friday were a bet on that.

1 Week

2 Week