12/17 Some Ideas For The Week Ahead

What a week, the market did pretty much everything I expected it to do monday when I wrote my recap saying it was best to be on the sidelines watching. It moved wildly in both directions, crushing short sellers initially on the breakout and then turning around and crushing bulls on the decline. I probably left $250,000 on the table by not holding onto the short position I had tuesday with the June $400 puts on SPY but I’m not a short seller. That day was just different because we were at a do or die spot and we reversed hard there. Being a short a seller is significantly more difficult than being a premium seller because when I sell premium, worst case I’m stuck with a stuck for a little bit until I can sell covered calls to work out of it, if you’re wrong on puts, you’re toast.

What’s fascinating about yesterday is we filled the gap perfectly that I’ve been highlighting for a time at 381.14, we went 10 cents lower and that was it for the day. Textbook really how mechanical the market is at times. The white box I highlighted below is the demand zone where I think we’re headed to. Short term, could we have a deadcat bounce? Sure, with a move big like that last week, we may see a bounce here, but volume will be abysmal the next 2 weeks as most people aren’t in the office for Christmas and New Year’s.

Now, looking at the chart above and below, you can see that when the RSI gets week and the MACD rolls over, it is a prolonged process before the market repairs itself. Every decline is 6+ weeks, and that is why I’ve positioned myself by selling February puts. Someone asked me yesterday in the comments why I was doing so, it’s because the timeframe now is likely a month down, and then a bottoming process, and a move back up, so I want to stay nimble here.

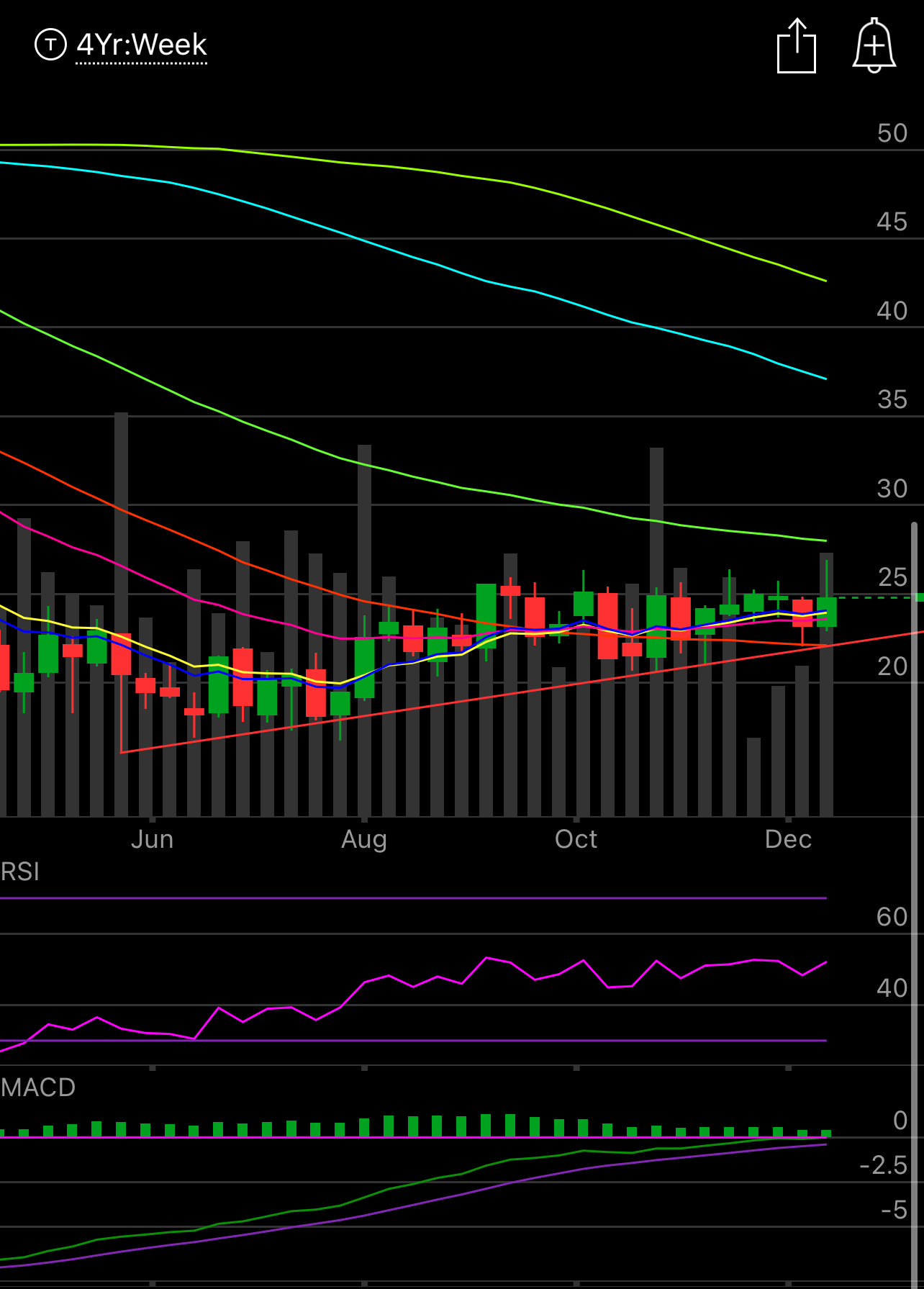

What you will notice with me is my trades are prolonged. When a chart is strong and option flows are bullish in the name, the move is extended. Take my favorite name of the last few months, look at this uptrend Pinterest has been in. It’s clear as day what your risk/rward is here as it has never closed below that trendline on a weekly basis. It is a smooth sailing uptrend. Even this past week it put in a GREEN candle, almost no name did that, everything had a red candle this week, but relative strength in PINS came through when it was needed most and the name closed higher than it opened in a complete bloodbath for equities, especially tech.

Look at the daily chart of PINS, you will note how even yesterday, it ended up closing over all the moving averages. That is a sign of strength, almost no name in tech has a chart setup like this. Now that isn’t to say if the market declines Pinterest won’t go with it, but, it will likely be the first to recover and maintain strength throughout whatever we see going forward. Relative strength is probably the single most important thing that you can focus on to ensure you’re trading the right names.

My Best Idea For This Week

Nothing, do nothing. Going back to when I started posting these I lost count of how many I posted but only 2 of the 30+ I posted did not work out. We did very well and right now the market looks horrible, the volume is not going to be there as there’s just 2 weeks left in the year and you have probably done very well this year alongside me so there is nothing to do short term. I also believe Binance could go bust at anytime and the implications that would have on crypto would reverberate to equities as chaos ensues amongst traders.

With that said, I have some short puts that could be assigned this week, I’m not closing them, but I would not be putting on longs here. You want to see the market stabilize and reclaim some moving averages first before getting bullish. I think the first few months of next year won’t be great, I think if/when the bull market returns ie we finally break that sloping downtrend line which will continue to go lower, the tech names won’t lead us out of it. While those names are great, new bull markets have new leaders, we won’t know what those are yet, but my guess is probably something energy related as I personally believe we’re in a multi year energy bull market now and this China re-opening is going to massively hurt us by pushing oil prices higher and sustaining our inflation issues that everyone thinks are going to just disappear by next year. I think realistically we’re facing a situation where stocks are sideways or down for some time but that’s ok with me as that is the perfect environment for doing what I do, selling premium.

Some Charts Of Interest

Apple is finally breaking down. This has mostly avoided it unlike the rest of the megacaps. While Amazon is down over 50% off highs this is down closer to 30%. The problem is, if it’s really breaking down, and that appears true, this is a huge negative for the market as this is the largest component in the S&P and Nasdaq. This could be a prolonged move that will weigh on markets for a long time.

Look at this daily chart where you can see the confirmed breakdown. Look where all the moving averages are, those are all beginning to slope down, the MACD and RSI are weak, this could be a multi week/multi month move down for Apple unless it proves this was a fakeout and reverses higher immediately next week. So keep your eye on this as the implications are enormous.

Costco looks awful, this is another like Apple yet to breakdown. Look at the uptrend(red line) going back a few years, now we’re about $40 away and it looks like destiny for this name. The stock still trades at a nosebleed valuation for a retailer.

The daily as you can see is oversold, so it could put in a short term bounce but this isn’t a healthy chart with a series of lower RSI readings, money is clearly exiting COST.

Another chart that’s breaking down is ARKK, now you’ll say, James, why do I care about ARKK, I’m not in it or any of its components. You should care about ARKK because it has been a barometer of small caps. When it goes, they all go in this market. The weekly and daily look awful and this thing isn’t going to get better anytime soon which should weigh on small cap tech for the time being.

Scans

Weekly Bullish Engulfing Candles

Not many here, no names that excite me, hence my decision to do nothing this week

Weekly MACD Bullish Crossover

Another list with nothing really interesting. DDOG is a fantastic company posting fantastic margins, you can sell puts on it lower, but otherwise another ho hum list.

There just isn’t alot of bullish setups out there today. I wish I could tell you otherwise. I think the next couple weeks markets will be all over the place, but on low volume, be sure to make the tax adjustments you need, sell losers to offset your winners, make sure you do whatever is necessary to pay as little as possible in taxes. Otherwise, yesterday was basically the end of the year. I will continue to post my unusual option flows but overall I’m done unless a few positions get assigned to me in the next 2 weeks. I hope you all have a great rest of your weekend and I will see you monday.

I like the idea of no trade of the week at this time. I'm only in PINS and OXY right now, but if we get a good deadcat bounce I'd like to resell the SPY 415 call spread. I do think the short side is more challenging to pull off but it feels more rewarding when it works. By the end of January I should have my trading accounts fully funded and ready to go so that I can attack the market fully which I hadn't been able to do quite yet. Cheers to the good year and many more!

Don't forget about SJIM!!!!