12/18/25 Recap

First things first, this is my last post of 2025, I barely logged 60 trades today after cpi and we’re done with data events for the year, option volume has completely dried up today. Tomorrow with triple witching you’re going to have some weird moves but overall your year is done after that, nobody is around the next 2 weeks and volumes will be very low. I will still be here updating the database everyday so no it won’t be a full vacation, I may be sporadic with when I do the updating, but the database will still log the trades over the next 2 weeks and I have a link below for you until January 5th which is when I will return. So you still have everything to work with but there’s no point of highlighting trades when there’s so few to pick from now. I hope all of you enjoy the holiday break with your family and friends.

The SPY broke the 50 day yesterday which usually would be a time to move aside but in this brave new world we live in, the next day we immediately gapped back up over the 8 ema. I feel like a dinosaur in this game at this point in life, nothing you ever were taught regarding when to reduce exposure matters, every dip is just the buy of a lifetime and the more bearish a chart looks the more bullish it seems today. I don’t know what to say anymore, we’re told inflation is plunging, but any of you in here who are paying bills knows inflation is nowhere sub 3%, gold is up 60%+ this year which is telling you flat out the inflation numbers we’re getting are nonsense.

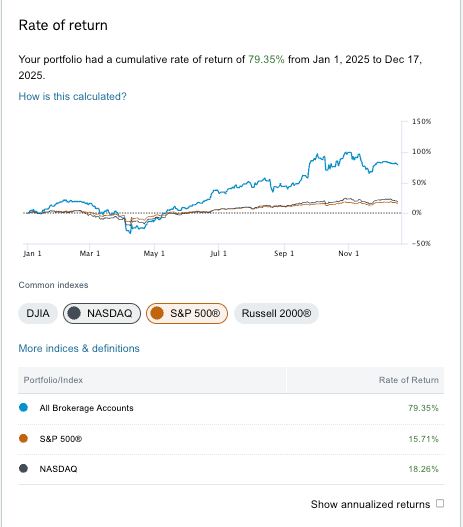

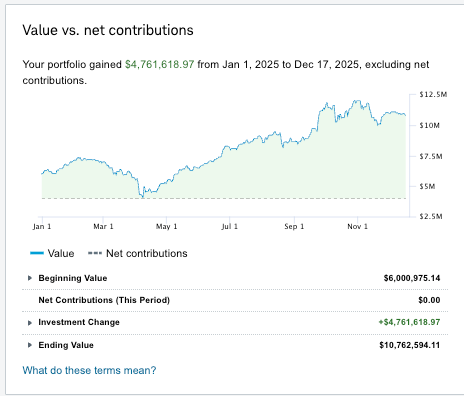

2025 Performance

This has been a an incredible year for me but these last 2-3 months have been some of the most challenging I’ve ever dealt with regarding my discipline being rendered useless as every move down is just a headfake and being cautious was silly on my part. The craziest part about this year is I’m up 80% coming into today and I feel like I failed because I just didn’t push the right buttons the last couple weeks with all the fakeouts.

Also I did not add any money this year

The rant above is just more me saying my style just doesn’t seem to work today because you almost always are going to get stopped out beforehand if you stick to your rules and cutting when key moving averages break. Take CEG, when I flagged that trade monday of the 14,000 weekly 372.50/382.50 calls and I had bought shares but closed them for a loss yesterday because a bearish engulfing candle that loses the 100 day isn’t really where you want to be long. Sure enough, today its up $30 on nothing. Just a market that rewards the reckless and punishes those being technical.

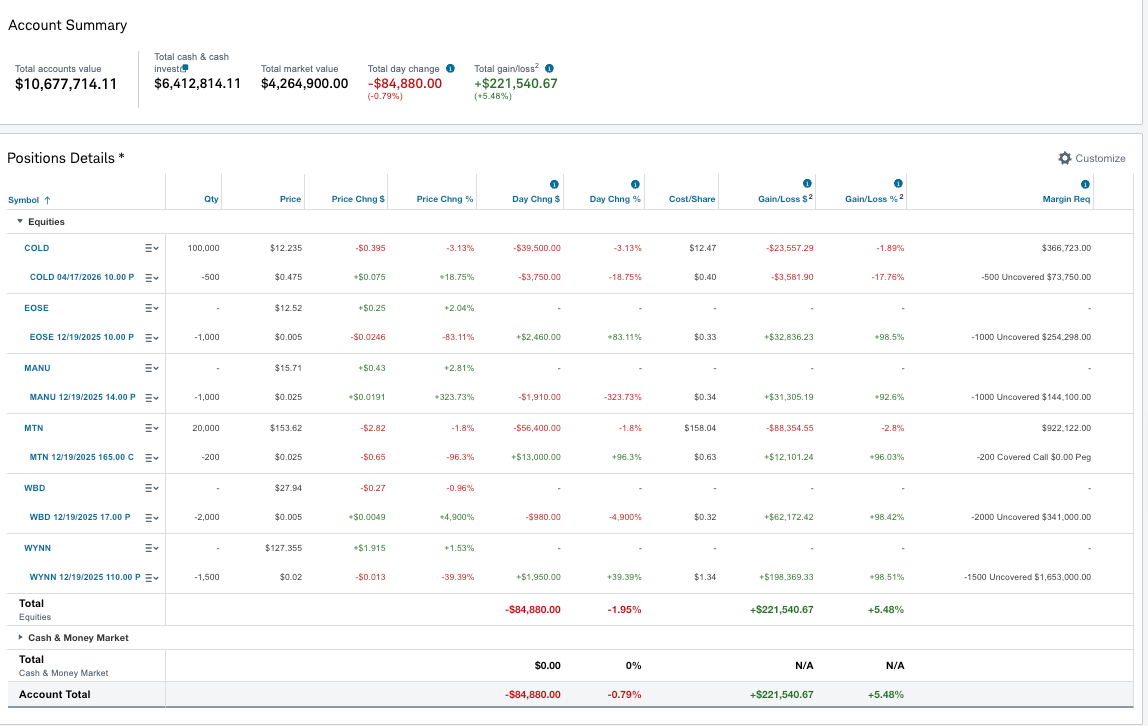

My Open Book

I made zero changes today, lots of stuff expires tomorrow and my year is over. As we get late in the year if COLD and MTN are still red for me I may harvest those losses, but I do like those two names into 2026.

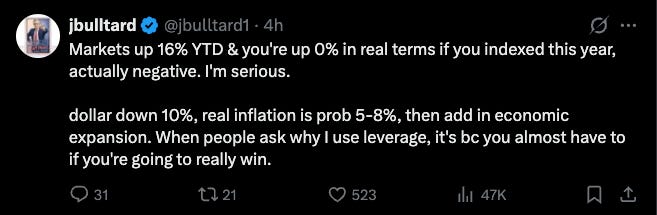

I think next year is going to be a year for these high yielding names as we cut rates. These names with these huge yields are gifts in this environment if you’re a long term investor. As we start to cut rates, I think you’re going to see the demand for 6-8% yielding names go up alot and Trump has made it very clear he basically wants rates at 0, now that won’t happen but you get my point, he wants materially lower. As for the tech names, I don’t know how I feel, I feel there will be a reckoning with all this capex and investors wanting returns, but I also think some names like Amazon that lagged for so long will do well as they catch up. Overall we’re coming off 3 straight years of 20% returns basically on tech stocks, and year 2 of a presidency is historically the worst. I don’t make long term predictions but we do go up 90% of years, so up wouldn’t shock me, but up in real terms is what interests me and that means up factoring in inflation and economic expansion, like I tweeted this morning, I think if you performed inline with the market you’re actually negative this year if we want to be honest about things. When some of you ask me why I use so much leverage, this is why, I’m trying to outperform the market while also being in high quality names. Think about this post below as you approach next year.

Today’s Unusual Options Activity

Here is today’s link to the database it will expire January 5th which is when I will return to writing these recaps everyday.

So congrats on the great year, I’m thankful for all of you who think enough of me to be here. I sometimes can’t even believe this is my life. I get to do what I love, I get all the great emails from you all on how well you’re doing and improving and I get to work from home and spend time with my kids which was something that would have never happened if I was still working. I really couldn’t imagine what this place has become when it all started 3 years ago but its been a fun journey watching the community grow. Enjoy the holidays, I will see you all next year.

Happy holidays James, and keep up the great analysis and commentary heading into 2026! Cheers from up here in Canada.

James, I have tremendous respect, admiration and gratitute for your read of the market, trading discipline and risk management. That you share them and your insights is a great service to your readership. Enjoy your time with your family over the holidays.