12/20 Recap

The SPY is bouncing back hard today into quad witching and I will simply say this is nothing significant. Look at the chart below, we were below the 50 day for 2 sessions and even on today’s bullish engulfing candle we still are not near the 21 ema(light blue line). For me, the coast is not clear until we get back over that 21 ema and all these bounces here are opportunities to sell. I expect we will push up into those moving averages and struggle. This is exactly why it is so hard to short things, the last 2 days were about as bearish a close as you could have and sure enough 2 days later they’re instantly buying it up. The liquidity in our markets is ample and every dip is seemingly the opportunity of a lifetime. That is why I think it is just much easier to find names seeing money flow into them and just focusing on what levels I want to play them off of.

Recent Trades

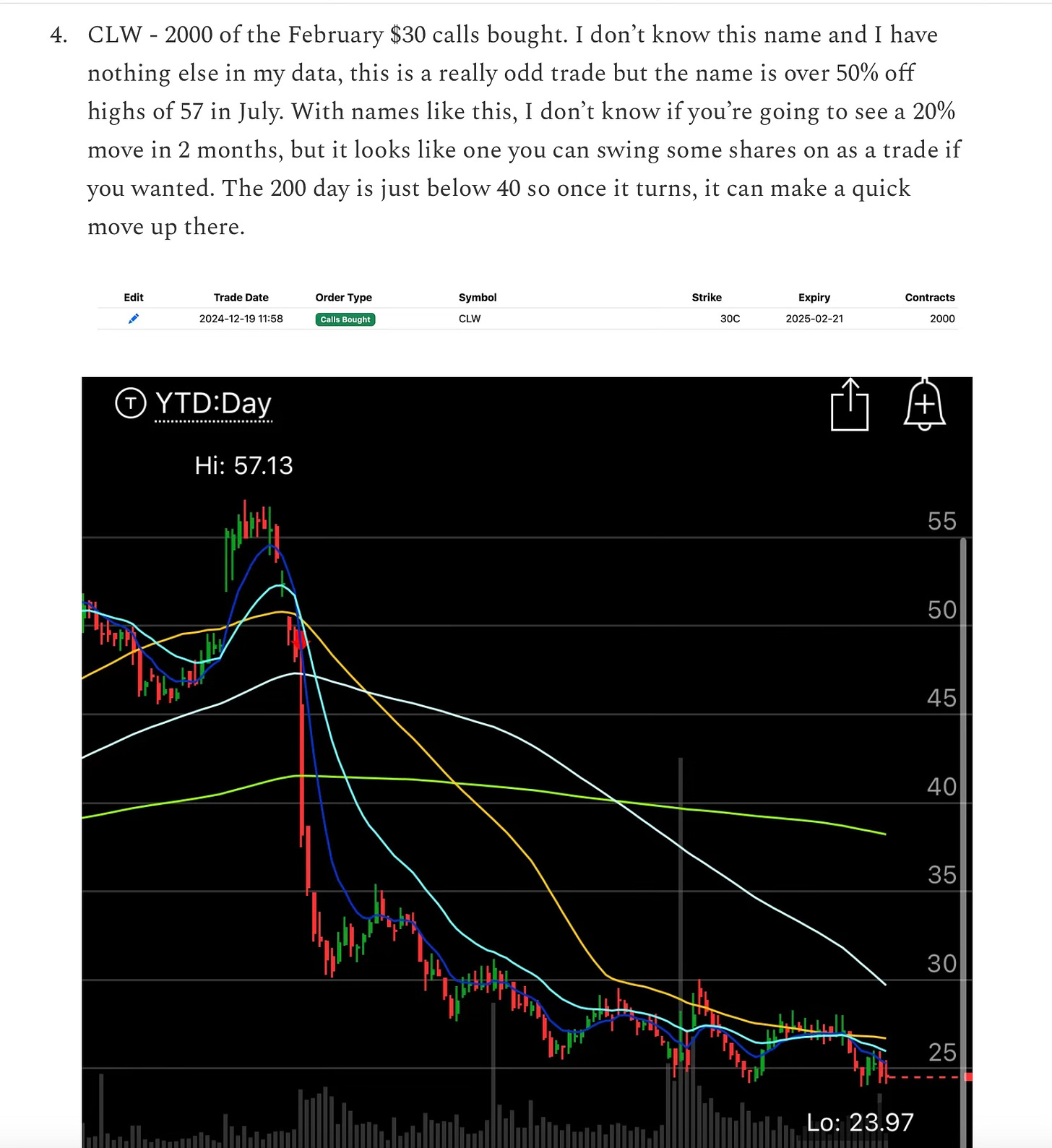

CLW - CLEARWATER PAPER CORPORATION, my absolutely favorite, the 1 day later buyout calls. 2000 calls come out of nowhere yesterday in this obscure name with no activity and here we are less than 24 hours later and the stock is up 22% right now over $30 on news Suzano wants to acquire them. This is just outright insider trading nothing more. I love seeing this stuff unfold and that’s why I try to focus on these obscure tickers when I see money flowing into options on them.

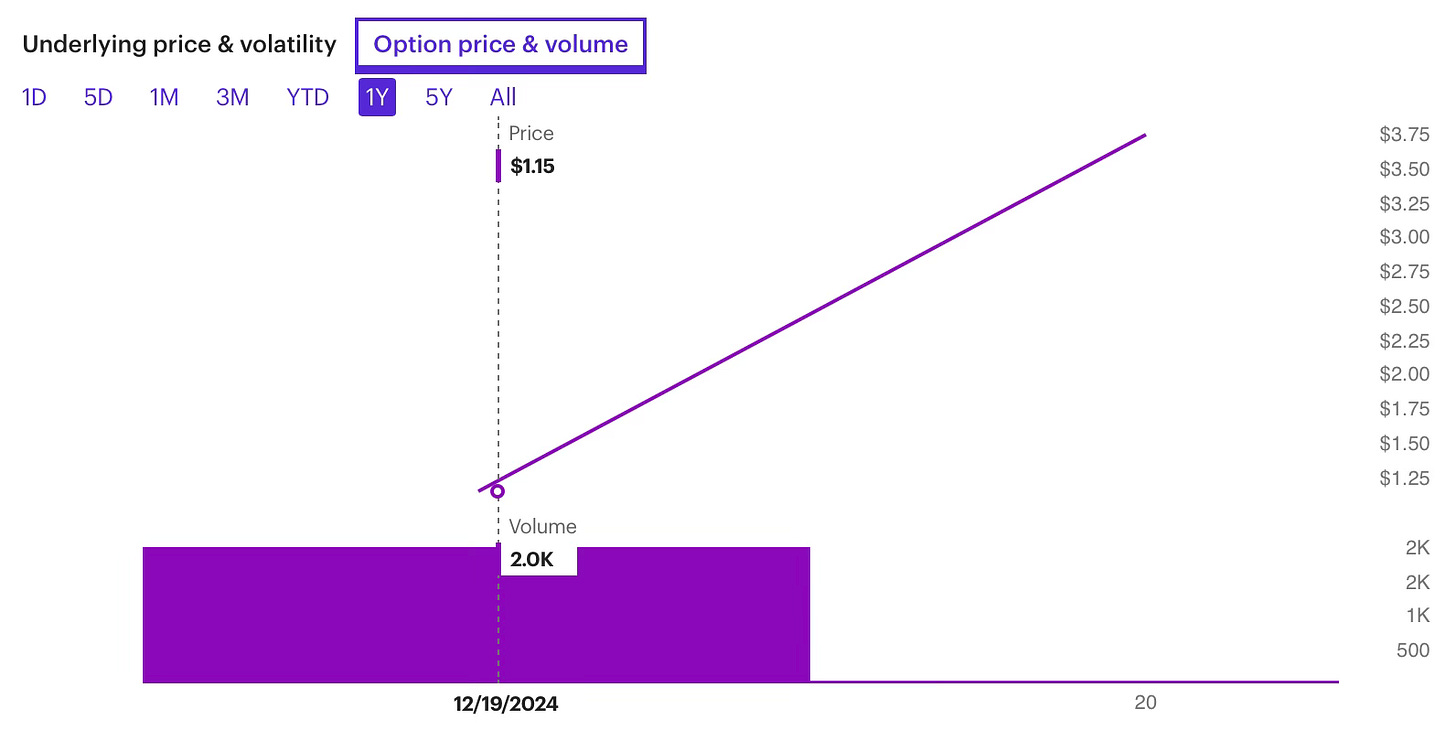

The calls were bought for $1.15 and are $3.75 today as you can see below. It’s always interesting to me why they stop at say 2000 calls when they clearly knew what was coming, why not 20,000? Is there a number they know would set off the SEC and they try to stay small to not set off the alarms? I don’t know but I would love to see what the buyer of these calls would say to the SEC if they ever investigated and asked why this trade was placed on that specific day, a day before the news, when nothing else had traded ever in anywhere near that size.

Today’s Unusual Options Activity

Pretty slow session so far only 77 trades today, this is just how it is going to be into year end, the volumes are just not there anymore. Here is today’s link to the database, it will be open until Monday morning and the opening bell. Im flying back home today so I won’t be updating the database in the afternoon today.